In the bustling bazaar of forex trading, where currencies dance in a perpetual waltz of value, traders are constantly on the hunt for tools that can give them an edge. Enter the currency strength meter, a seemingly humble yet potent instrument designed to gauge the relative strength of currencies. But with a plethora of options available, how does one discern the wheat from the chaff? This article embarks on a journey to help you identify the best currency strength meter for your trading needs, ensuring that you are well-equipped to navigate the dynamic world of forex with confidence and precision.

Identifying the Best Currency Strength Meter for Your Trading Needs

Choosing the right currency strength meter can make or break your trading strategy, and it’s essential to understand the features that cater to your specific needs. For instance, the Currency Strength Meter Pro for MT5 is a powerhouse, offering advanced features like a comprehensive dashboard that displays the strength of currencies across various timeframes. This tool provides a visual representation through graphic lines and labels, making it straightforward to spot strong and weak currencies. Additionally, it includes a robust notification manager that alerts you based on predefined criteria, ensuring you never miss a potential trade opportunity.

On the other hand, the SL Currency Strength Meter 28 Pair Indicator takes a different approach by focusing on the overall strength across the market for individual currencies at any given moment. This indicator is particularly useful for spotting trend continuations and potential reversals with its visual cues like diverging lines and trend arrows. It also provides various notification options, from pop-ups to mobile alerts, ensuring you stay updated regardless of where you are. Both tools offer unique advantages, and the choice ultimately depends on your trading style and the level of detail you require.

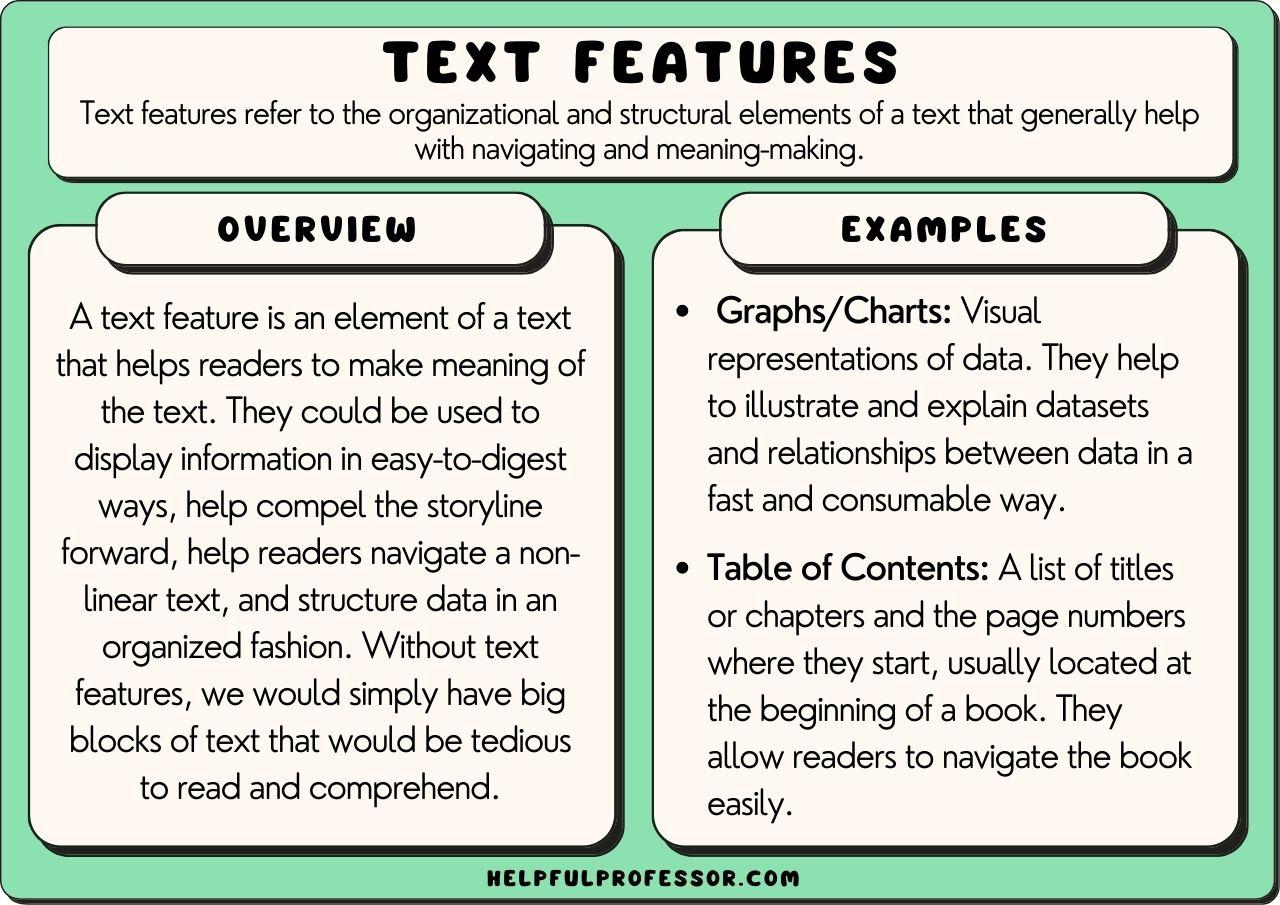

Understanding Currency Strength Meters: The Basics and Beyond

The SL Currency Strength Meter 28 Pair Indicator is a powerhouse when it comes to measuring the strength of currencies across the forex market. This tool calculates the strength of all 28 major currency pairs, offering a comprehensive view of individual currencies’ performance at any given moment. For instance, if the index line of a currency climbs above +15, it signals an upward trend, indicating that the currency is gaining strength. Conversely, a line pointing downward past -15 suggests weakening. The indicator also highlights flat or nearly flat lines, which represent currencies maintaining their current strength. This nuanced understanding allows traders to identify strong and weak currencies, helping them make informed decisions such as buying strong currencies and selling weak ones.

Moreover, the SL Currency Strength Meter is versatile, accommodating various trading strategies from short-term scalping to long-term trends. It includes features like dynamic alerts, which notify traders of potential BUY or SELL signals based on the strength indices. This is particularly useful for spotting trend continuations or reversals. The tool’s user-friendly interface, combined with its powerful analytical capabilities, makes it an invaluable asset for any trader looking to navigate the complexities of the forex market effectively. With the ability to filter and rank the best currency pairs to trade, the SL Currency Strength Meter ensures that you are always trading in the direction of the market’s momentum.

Top Features to Look for in a Currency Strength Meter

One of the standout features to look for in a currency strength meter is its ability to provide comprehensive data across multiple timeframes. This multi-timeframe analysis allows traders to get a holistic view of the market, identifying both short-term movements and long-term trends. For instance, the Currency Strength Meter Pro for MT5 supports calculations for all 28 major currency pairs and across nine different timeframes, offering a detailed snapshot of market dynamics. This feature is crucial for traders who need to make informed decisions quickly, as it eliminates the need for manual cross-referencing of different charts.

Another essential feature is the inclusion of various algorithms for calculating currency strength. Advanced meters, such as the one mentioned, utilize multiple indicators like MACD, RSI, CCI, and Momentum to provide a robust analysis. This multi-algorithm approach ensures that traders get a more accurate and reliable measure of currency strength. Moreover, features like a powerful notification manager, which alerts traders to significant market movements, and customizable graph lines for better visualization, make these tools indispensable for both novice and experienced traders. These features not only enhance trading efficiency but also help in minimizing risks by providing timely and precise market insights.

A Deep Dive into the AI Currency Strength Meter and Its Capabilities

Imagine a tool that can compute the strength of any currency pair, be it a major pair, metal, CFD, commodity, or even cryptocurrencies like Bitcoin and Ethereum. This AI Currency Strength Meter does exactly that, and it does so in real-time. It’s not just limited to the usual suspects; it can handle the rare and exotic currencies as well. All you need to do is name the currency you’re interested in, and the meter will scan all the pairs on your MetaTrader 4 platform to find the best pair that fits your criteria. If your chosen currency is strong, the meter will look for the weakest currency to pair it with, and if it’s weak, it will find the strongest counterpart. This level of automation not only saves time but also enhances accuracy in identifying profitable trades.

The capabilities of this meter don’t stop there. It breaks down all 28 forex currency pairs and calculates the strength of individual currencies across all timeframes, giving you a comprehensive view of the forex market in just one window. It’s designed to reveal the true movements of the market by analyzing the performance of individual currencies and their respective economies on a daily, weekly, or monthly basis. This tool is particularly useful during news events, as it calculates the currency strength for you, ensuring you’re always trading the best currencies at any given moment. The strategy of pairing a strong currency against a weak one is even employed by banks to maximize profits, making this meter an indispensable tool for both novice and expert traders.

Comparing Currency Strength Meters: Analytico vs. AW Double Grids EA

The Analytico EA is engineered with a focus on three core principles: market direction, trading volume, and the speed of price movements. This trifecta ensures that your market entries are precise and timely, aiming to maximize your trading success. What sets Analytico apart is its martingale-free position recovery system. Instead of doubling down when the market moves against you, it employs a smart approach to mitigate losses and regain control, all while keeping an eagle eye on daily drawdown. This makes it a robust choice for traders who prioritize capital preservation alongside profit generation.

On the other hand, the AW Double Grids EA offers a different flavor of automation with its unique approach to risk management and market engagement. It leverages a grid-based trading strategy that can adapt to various market conditions, opening buy and sell limit orders to take advantage of market spikes. This method aims to harness positive slippage and protect against adverse price movements. However, it requires a more hands-on approach to configuration, especially for those looking to optimize it for specific trading pairs or market scenarios. While it offers promising returns, it demands a certain level of expertise to fully capitalize on its potential.

Real-World Performance: Case Studies of Trading Robots Using Currency Strength Meters

In the realm of automated trading, the Currency Strength Matrix stands out by reading price action across 28 currency pairs in real-time. This tool provides traders with a clear view of the strongest and weakest currencies, allowing for strategic pairings that align with current trends. For instance, if the matrix shows the USD in a consistent uptrend against other major currencies, pairing it with a significantly weaker currency like the JPY can yield profitable results. This strength-based approach not only simplifies the decision-making process but also enhances the probability of successful trades by ensuring that traders are always in sync with prevailing market trends.

On the other hand, the FX Power indicator offers a historical perspective on currency strength across various time frames, ensuring that traders have a comprehensive view of market dynamics. By comparing short-term and long-term analysis, traders can identify efficient combinations and trade ‘crossings’ of currency histogram lines. For example, if EUR crosses above USD in both the 1-hour and 8-hour charts, this dual confirmation can signal a robust buying opportunity. The ability to customize analysis periods and receive real-time alerts further empowers traders to make informed decisions, minimizing risks and maximizing potential returns.

Q&A

Question: What is a Currency Strength Meter and why is it important for traders?

Answer: A Currency Strength Meter is a tool used to identify the relative strength and weakness of various currencies against each other. It is crucial for traders as it helps them make informed decisions by showing which currencies are strong and which are weak, allowing them to pair strong currencies with weak ones for potential trades. This can enhance the accuracy of trades and improve profitability by aligning trades with the current market sentiment.

Question: How does the Currency Strength Meter calculate the strength of currencies?

Answer: The Currency Strength Meter calculates the strength of currencies using various algorithms and indicators. These may include MACD, RSI, CCI, RVI, MFI, Stochastic, DeMarker, Momentum, and others. The meter typically requires data from multiple currency pairs and timeframes to provide a comprehensive analysis of the market. The strength values are often normalized to a range, such as 0 to 100, where values above a certain threshold indicate strength and values below indicate weakness.

Question: What features should I look for in a good Currency Strength Meter?

Answer: A good Currency Strength Meter should have the following features:

– A user-friendly dashboard that shows the strength of currencies for any timeframe.

– Graphical representation of currency strength with lines and labels.

– Notifications for crossing strength levels and finding new tradable pairs.

– Support for various calculation algorithms and smoothing techniques.

– The ability to backtest trading strategies using historical data.

– High-resolution screen support and customizable settings for individual preferences.

Question: Can a Currency Strength Meter be used for all types of trading strategies?

Answer: Yes, a Currency Strength Meter can be used for various trading strategies, including trend trading, scalping, and swing trading. By identifying strong and weak currencies, traders can align their strategies with the prevailing market conditions. For example, trend traders can use the meter to confirm trend continuation, while scalpers can use it to find short-term trading opportunities based on diverging currency strengths.

Question: Are there any advanced features available in modern Currency Strength Meters?

Answer: Modern Currency Strength Meters come with several advanced features, such as:

– Real-time analysis using artificial intelligence and machine learning.

– Recommendations for the top tradable currency pairs.

– Integration with notifications via email, mobile app, or popup alerts.

– Detailed historical analysis and backtesting capabilities.

– Customizable analysis periods and multi-instance settings for comprehensive market views.

– Support for a wide range of financial instruments, including metals, commodities, and cryptocurrencies.

Question: How can a Currency Strength Meter improve my trading performance?

Answer: A Currency Strength Meter can improve trading performance by providing insights into which currencies are strong and which are weak, allowing traders to make more informed decisions. This can help in identifying high-probability trades, reducing the time spent on market analysis, and increasing overall trading efficiency. By aligning trades with the strength and weakness of currencies, traders can enhance their chances of success and profitability.

Final Thoughts

As we wrap up our exploration of currency strength meters, it’s clear that the right tool can make a significant difference in your trading strategy. Whether you’re drawn to the sleek interface of the latest AI-powered indicators or the tried-and-true reliability of established metrics, the choice ultimately depends on your specific needs and trading style. Remember, in the fast-paced world of Forex, knowledge is power, and the right currency strength meter is your compass. Happy trading, and may your pips always be in the green!