In the ever-turbulent seas of forex trading, candlestick patterns stand as ancient lighthouses guiding traders through the storm. These time-tested formations, originating from 18th century Japanese rice markets, are more than just pretty pictures on a chart. They are the whispers of market sentiment, the subtle hints of potential reversals, and the keys to unlocking profitable strategies. As we delve into the world of candlestick reversal patterns and strategies, prepare to uncover the art and science behind these luminous signals. Whether you’re a seasoned trader or a curious novice, understanding these patterns could be the game-changer in your trading arsenal. So, set your sails and join us on this enlightening journey through the flickering world of candlestick reversal patterns.

Understanding the Basics of Candlestick Reversal Patterns in Forex Trading

Engulfing patterns are a staple in the arsenal of any forex trader. The bullish engulfing pattern, for instance, is composed of a small bearish candle followed by a larger bullish candle that completely “engulfs” the prior candle’s body, suggesting a potential upward reversal. Conversely, a bearish engulfing pattern features a small bullish candle followed by a larger bearish candle, hinting at a downward reversal. The significance of these patterns lies in their ability to signal a shift in market sentiment. When these patterns appear at the end of a trend, they often indicate a strong reversal, making them valuable for traders looking to capitalize on trend changes.

Another essential candlestick formation is the morning star pattern, a reliable indicator of a bullish reversal. This three-candle pattern starts with a long bearish candle, followed by a small-bodied candle that gaps down, and concludes with a long bullish candle that closes well into the body of the first bearish candle. The morning star pattern signifies that the selling pressure of the first candle is waning, and the buying pressure of the third candle is taking over, suggesting the dawn of a new uptrend. Its counterpart, the evening star pattern, signals a bearish reversal and is equally important for traders to recognize, as it can help them anticipate and react to market downturns effectively.

The Most Common Candlestick Reversal Patterns and How to Identify Them

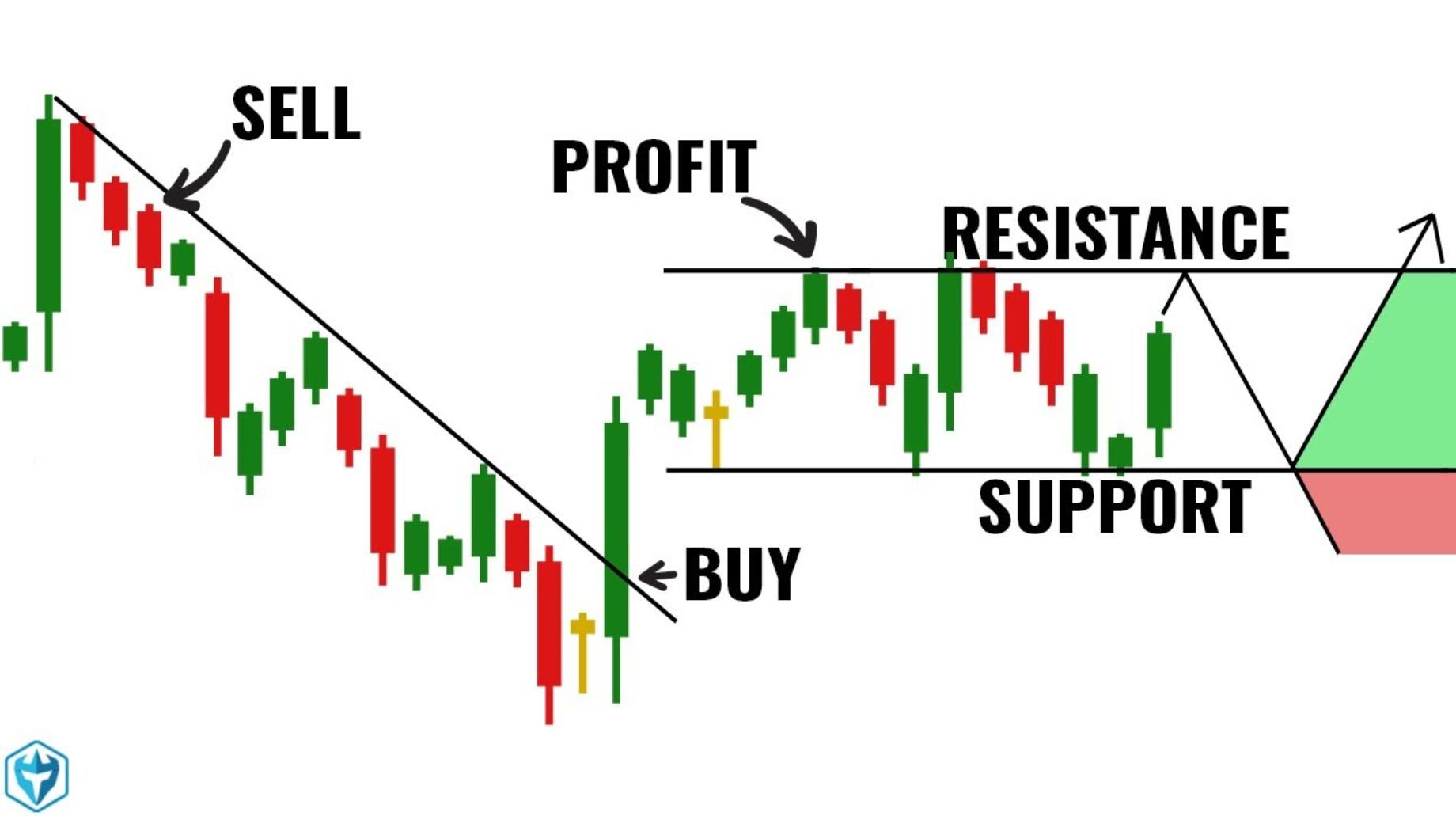

One of the most common reversal patterns in forex trading is the Double Top and Double Bottom. Picture the Double Top as the market trying to climb a mountain, reaching the peak, and then failing to ascend higher on the second attempt. This pattern resembles the letter “M” and signals a bearish reversal, hinting that the market is likely to head downward. Conversely, the Double Bottom is like a resilient climber who, after two failed attempts to descend deeper, finally finds the strength to rise. It forms a “W” shape and indicates a bullish reversal, suggesting the market is poised to go up.

Another notable pattern is the Engulfing Pattern, which is a two-candle formation that can signal powerful market reversals. A bullish engulfing pattern occurs when a small bearish candle is followed by a large bullish candle that completely engulfs the previous candle’s body. This suggests that the buyers have overpowered the sellers, and the market may reverse to an uptrend. On the flip side, a bearish engulfing pattern happens when a small bullish candle is overtaken by a larger bearish candle, indicating that sellers have seized control and a downtrend could be imminent. These patterns are highly regarded for their predictive power and are a staple in the toolkit of many forex traders.

Effective Strategies for Trading Forex Using Candlestick Reversal Patterns

In the dynamic world of forex trading, candlestick reversal patterns serve as invaluable tools for traders to anticipate market shifts. One prominent strategy involves leveraging the Engulfing Pattern, which comprises two candlesticks where the second fully engulfs the first. When a bullish engulfing pattern appears at the end of a downtrend, it signals a potential upward reversal, indicating that buyers have taken control. Conversely, a bearish engulfing pattern at the end of an uptrend suggests a possible downward reversal, hinting that sellers are overpowering buyers. The strength of the signal is often proportional to the size of the engulfing candle’s body, making it a reliable indicator for traders looking to capitalize on market reversals.

Another effective strategy is the Morning Star Pattern, a three-candle formation that signals a bullish reversal. This pattern starts with a bearish candlestick, followed by a small-bodied candle that indicates indecision, and concludes with a larger bullish candle. The Morning Star suggests that the selling pressure is waning and buyers are starting to take over, making it a strong indicator of an impending upward move. Traders often look for this pattern at the bottom of a downtrend as a cue to enter long positions, anticipating a shift in market sentiment from bearish to bullish.

Comparing Popular Forex Trading Robots: Which Ones Excel at Candlestick Reversal Patterns?

When it comes to trading robots that excel at identifying and trading candlestick reversal patterns, the M W Scanner is a standout. This tool is designed to detect the Double Top and Double Bottom patterns, which are classic indicators of potential trend reversals. The Double Top pattern, resembling an ‘M’, signals a bearish reversal, while the Double Bottom, forming a ‘W’, indicates a bullish reversal. The M W Scanner goes beyond mere identification; it incorporates Fibonacci levels and candlestick analysis to pinpoint optimal entry and exit points. This ensures traders are not just entering trades based on patterns but are doing so at the most opportune moments, enhancing the likelihood of successful trades.

Another noteworthy contender is the CandleBot, a versatile tool that identifies a range of candlestick patterns, including bullish and bearish engulfing, morning and evening stars, and hammers. These patterns are essential for traders looking to capitalize on potential market reversals. CandleBot’s strength lies in its customization options, allowing traders to tailor the pattern recognition to their specific strategies. Moreover, it offers automated trading features, enabling trades to be executed based on identified patterns, combined with robust risk management settings like customizable lot sizes, take profit, and stop loss levels. This blend of pattern recognition and automated execution makes CandleBot a powerful ally for traders focused on candlestick reversals.

Case Study: How CandleBot Utilizes Morning and Evening Star Patterns for Forex Trading

CandleBot, an advanced tool for Forex traders, leverages the Morning and Evening Star patterns to predict potential market reversals. The Morning Star consists of three candles: a bearish candle, a small indecisive candle, and a bullish candle. This pattern signals a potential bullish reversal after a downtrend. Conversely, the Evening Star, also a three-candle pattern, includes a bullish candle, a small indecisive candle, and a bearish candle, indicating a potential bearish reversal after an uptrend. CandleBot enhances these patterns with customizable parameters like maxMiddleCandleRatio1, allowing traders to fine-tune their strategies for greater precision.

In practical application, CandleBot scans for these patterns across multiple timeframes and instruments, providing real-time alerts and automated trading options. Traders can set parameters for take profit, stop loss, and lot sizes, ensuring effective risk management. The tool’s user-friendly interface makes it accessible for both novice and experienced traders, while its free availability adds significant value. By integrating these powerful candlestick patterns into their trading strategies, users can capitalize on potential market reversals with greater confidence and efficiency.

Risk Management Techniques When Using Candlestick Reversal Patterns in Forex Trading

One crucial risk management technique involves the use of stop-loss orders. By placing a stop-loss order just below the recent swing low for long trades or above the recent swing high for short trades, traders can efficiently limit their potential losses. This is particularly useful when trading candlestick reversal patterns, as these patterns can sometimes signal false reversals. For example, imagine entering a long trade based on a bullish engulfing pattern. If the price unexpectedly reverses and hits your stop-loss, the loss is minimized, allowing you to exit the trade without significant damage to your trading account.

Another effective strategy is the use of position sizing. This involves determining the appropriate amount of capital to risk on each trade, which is often calculated as a percentage of your total trading account. For instance, risking 2% of your account on a single trade ensures that even a series of losses won’t drastically deplete your capital. By combining position sizing with candlestick reversal patterns, traders can maximize their potential for profit while keeping risk under control. Additionally, tools like the Risk to Reward Ratio Manager can automate these calculations, helping traders to visualize and manage their trades more efficiently.

Q&A

What are candlestick reversal patterns in forex trading?

Candlestick reversal patterns are formations on a candlestick chart that indicate a potential change in the direction of the prevailing trend. These patterns are used by traders to predict possible reversals in the market, aiding in making informed trading decisions.

Can you describe some common candlestick reversal patterns?

Sure, here are a few:

-

Hammer Pattern: This single candlestick pattern has a small body near the top and a long lower wick, resembling a hammer. It indicates potential reversal after a downtrend, showing buyer intervention.

-

Inverted Hammer: Similar to the hammer but with the long wick above the body. It also suggests a potential upward reversal after a downtrend.

-

Engulfing Pattern: Comprising two candlesticks, where the second completely engulfs the first. A bullish engulfing pattern at the end of a downtrend signals a potential uptrend reversal, while a bearish engulfing pattern at the end of an uptrend suggests a possible downtrend reversal.

-

Morning Star: A three-candle pattern indicating a potential bullish reversal. It starts with a bearish candle, followed by a small indecisive candle, and ends with a larger bullish candle.

-

Evening Star: The bearish counterpart to the morning star, indicating a potential downward reversal.

How reliable are these patterns in forex trading?

While candlestick reversal patterns can be quite useful, they are not foolproof. Their reliability increases when used in conjunction with other technical analysis tools such as support and resistance levels, trend lines, and other indicators. Always consider the broader market context and avoid relying solely on candlestick patterns for trading decisions.

What strategies can be employed using candlestick reversal patterns?

Traders often use these patterns as entry or exit signals in their trading strategies. For instance:

-

Confirmation Strategy: Wait for confirmation of the pattern by subsequent price action before entering a trade. For example, after identifying a hammer, wait for a bullish candle following it to confirm the reversal.

-

Support and Resistance: Use candlestick patterns in conjunction with support and resistance levels. A reversal pattern forming at a key support or resistance level can be a strong signal.

-

Trend Analysis: Combine candlestick patterns with trend analysis. In an uptrend, look for bullish reversal patterns to enter long positions, and in a downtrend, look for bearish reversal patterns to enter short positions.

Are there any automated tools to identify these patterns?

Yes, there are several automated tools and indicators available that can help traders identify candlestick reversal patterns. These tools can scan multiple charts and timeframes, providing alerts when a pattern is detected, thus saving time and reducing the chances of missing potential trading opportunities.

What are the risks associated with trading based on candlestick patterns?

The main risk is the potential for false signals. Not all patterns lead to a reversal; sometimes, they may just be a temporary pause in the trend. Additionally, market conditions, such as low liquidity or high volatility, can affect the reliability of these patterns. Therefore, it is crucial to use proper risk management techniques, such as setting stop-loss orders and not over-leveraging positions.

Final Thoughts

As we draw the curtains on our exploration of candlestick reversal patterns and strategies in Forex, it’s clear that these techniques offer traders a visual and analytical edge. By interpreting the market’s emotional undertones and identifying potential reversals, traders can make more informed decisions. Yet, remember, while candlestick patterns are powerful, they shine brightest when used in conjunction with other analytical tools. So, whether you’re spotting a morning star or a hammer, keep your toolkit versatile and your mind sharp. Happy trading!