At this time, purchasing EASY Bot items is not available to all members. Read more - how to get access to purchase

FAQ

In the world of forex trading, it’s no secret that automating processes can significantly enhance trading results. The EASY Scalperology Bot is presented as a powerful tool designed to help traders identify and seize market opportunities with maximum efficiency. With its help, you can simplify your trading process while maintaining a high level of accuracy in executed trades.

The core concept behind EASY Scalperology lies in leveraging advanced algorithms and strategies to minimize risks and maximize profits. This system is specifically designed to execute one trade at a time for each currency pair, effectively avoiding unnecessary risk. In this context, the bot serves as an excellent ally for both newcomers and seasoned traders looking to optimize their trading strategies.

Key Features of EASY Scalperology Bot

EASY Scalperology Bot is built on the innovative EASY Trading AI strategy, which empowers it to make informed and strategic trading decisions. One of the standout features of this bot is its ability to pinpoint the optimal times to enter and exit trades based on comprehensive data analysis. By utilizing historical data in conjunction with real-time market conditions, the bot can identify profitable opportunities while minimizing risks. This precision ensures that traders can capture market movements effectively, enhancing their potential for success.

Another crucial aspect of the EASY Scalperology Bot is its unique trading approach. Unlike many other systems that rely on high-risk methods such as martingale, this bot executes only one precise trade at a time per currency pair. This strategy not only conserves capital but also allows for a more focused trading approach. Additionally, the bot incorporates customizable parameters allowing users to adjust settings based on individual trading styles and risk tolerance. This level of customization is essential for adapting to varying market conditions and maximizing profitability across different trading instruments.

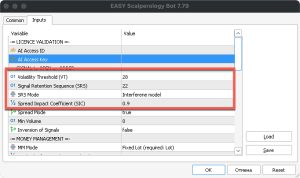

Understanding the Volatility Threshold (VT) Parameter

One of the key parameters in the EASY Scalperology Bot is the Volatility Threshold, commonly referred to as VT. This parameter plays a critical role in determining when the bot should initiate a trade based on prevailing market conditions. The VT setting analyzes both historical and real-time data to identify levels of market volatility that indicate potential trading opportunities. Essentially, it acts as a filter: if the market volatility exceeds the predetermined VT level, the bot is activated to search for viable trade setups. This capability is particularly valuable because it helps traders avoid entering the market during low-volatility periods, which can lead to missed opportunities or unsuccessful trades.

Setting the Volatility Threshold correctly is crucial for optimizing trading performance. The recommended range for VT is typically between 5 and 50, depending on the trading instrument and its historical volatility patterns. For high-volatility assets such as cryptocurrencies, a higher VT value is often necessary, while more stable instruments like major currency pairs can operate effectively with lower ranges. By fine-tuning this parameter, traders can effectively manage risk and enhance the bot’s ability to execute profitable trades. Ultimately, the Volatility Threshold serves as the first line of defense in the decision-making process of the EASY Scalperology Bot, ensuring trades are conducted in conditions that favor success.

Exploring the Signal Retention Sequence (SRS) Parameter

Another essential parameter of the EASY Scalperology Bot is the Signal Retention Sequence, abbreviated as SRS. This parameter is vital for ensuring that only the most reliable trading signals lead to actual trades. The SRS works by assessing recent price movements following the generation of a signal, confirming its validity before the bot executes the trade. In essence, SRS acts as a safeguard, filtering out signals that are weak or potentially misleading, thereby enhancing the overall efficiency and accuracy of the trading strategy.

The way the Signal Retention Sequence operates is straightforward yet powerful. When a trading signal is generated, the bot evaluates the last specified number of pips to see if the market is supporting the anticipated direction of the trade. For example, if the SRS is set to a value of 10, the bot will require that the signal remains valid for at least 10 subsequent pip movements before taking action. This helps mitigate the chances of entering a trade based on a signal that doesn’t have sufficient market backing. In this way, the SRS contributes not only to minimizing false entries but also to maximizing the likelihood of successful outcomes by ensuring that only the strongest signals are acted upon.

By understanding and utilizing the SRS parameter, traders can significantly improve their decision-making process. It allows for a more disciplined approach to trading, where each signal is thoroughly vetted before execution. This parameter, combined with others like the Volatility Threshold, creates a comprehensive trading framework that empowers users to navigate the markets with greater confidence and effectiveness.

Unpacking the Spread Impact Coefficient (SIC) Parameter

The Spread Impact Coefficient, known as SIC, is a crucial parameter in the EASY Scalperology Bot that directly affects the bot’s cost management and trade execution efficiency. In trading, the spread—the difference between the buying and selling price—can significantly impact profitability. Therefore, the SIC is designed to dynamically adjust your trading decisions based on the current spread levels, ensuring that trades are executed under optimal conditions.

The SIC parameter is typically set within a range from 0.1 to 2. A lower setting, such as 0.1, indicates minimal consideration for the spread, meaning the bot will execute trades relatively freely, regardless of spread conditions. Conversely, a higher setting, like 2, ensures that the bot is more cautious and only executes trades when the spread is at more favorable levels. This adjustment helps protect traders from entering positions that could lead to increased costs and reduced overall profitability.

Implementing the SIC effectively means that the bot not only focuses on identifying profitable trades but also takes into account the cost of executing those trades. This dual focus is particularly beneficial in fast-moving markets where spreads can widen quickly, impacting trade execution. By monitoring and adjusting for spread fluctuations, the SIC allows traders to ensure that they are not just capturing profits but also preserving them.

Moreover, for traders using brokers that might have variable spreads or commissions, the SIC setting becomes even more important. By adjusting this parameter, users can tailor their trading strategies to maximize efficiency and minimize unnecessary costs associated with trading. In conjunction with other parameters like the Volatility Threshold and Signal Retention Sequence, the Spread Impact Coefficient is an essential tool for maintaining overall trading health and profitability. Understanding and calibrating this parameter can help traders make well-informed decisions, leading to a more successful trading experience overall.

Detailed Money Management Options in EASY Scalperology

One of the standout features of the EASY Scalperology Bot is its robust money management framework, which is designed to give traders enhanced control over their capital during trading activities. This framework offers several modes, allowing users to align their trading strategies with their individual risk tolerance and trading style. The available MM Modes include Fixed Lot, Fixed Risk, Fixed Margin, and Fixed Margin Optimized. Each of these options provides a unique approach to managing your trading capital effectively.

With the Fixed Lot mode, you can specify a predetermined lot size for each trade. This approach brings simplicity and predictability, making it easy to manage how much capital you will risk per trade. In contrast, the Fixed Risk option allows you to set a percentage of your total account balance as the risk for each trade. This dynamic method ensures that your risk is proportionate to the current size of your account, which can be especially beneficial for adapting to gaining or losing periods in your trading.

The Fixed Margin mode further refines your risk management strategy by determining trade sizes based on a fixed percentage of your margin. This is particularly useful for traders who want to leverage their capital while maintaining a defined risk profile. Meanwhile, the Fixed Margin Optimized mode takes this a step further—it not only sets the percentage related to margin usage but also utilizes a Decrease Factor to intelligently adapt trade sizes based on changing market conditions. This means the bot can optimize your capital allocation to minimize risk exposure even during times of high volatility.

In addition to these modes, EASY Scalperology incorporates comprehensive Balance Protection settings to further safeguard your trading account. The Max Profit Day (%) parameter allows you to lock in your daily gains by halting trading once a specified profit target is reached. On the flip side, the Max Loss Day (%) parameter acts as a safety net, preventing significant drawdowns by ceasing trading if losses exceed a defined threshold. Together, these settings work to maintain a stable and sustainable trading portfolio, protecting your capital and enhancing your overall trading success.

With such a detailed and flexible money management system in place, traders using EASY Scalperology can confidently tailor their approaches to suit their specific needs and goals. Whether you prefer a conservative strategy or a more aggressive approach, the bot’s customizable settings empower you to navigate the complexities of the market effectively and profitably.

Individual Settings for Each Currency Pair

One of the key advantages of the EASY Scalperology Bot is its ability to provide tailored settings for each currency pair, enhancing the effectiveness of your trading strategy. Each trading instrument comes with its own unique characteristics and market behavior, which is why customizing settings is essential for achieving optimal performance. The bot allows traders to fine-tune parameters based on the specific attributes of different currency pairs, ensuring that you’re always operating under the most conducive conditions.

When setting up EASY Scalperology, users have the option to optimize their configurations through the strategy tester. This powerful tool records historical price movements and simulates various scenarios, allowing traders to identify the ideal settings for parameters like Volatility Threshold (VT), Signal Retention Sequence (SRS), and Spread Impact Coefficient (SIC) specific to the chosen currency pair. For example, the behavior of EURUSD will often differ from that of AUDJPY or GBPUSD, meaning the parameters that work well for one pair may not perform as effectively for another.

Furthermore, by continuously analyzing trade outcomes and refining the parameters, traders can achieve a more precise approach that maximizes their chances of success. The bot’s adaptability allows it to respond to changing market dynamics, adjusting its performance based on the historical effectiveness of the settings for each particular currency pair. By taking the time to optimize and customize these settings, you can significantly improve how the bot operates in live market scenarios.

Ultimately, the ability to apply individual settings for each currency pair makes EASY Scalperology an even more powerful tool in a trader’s arsenal. By addressing the unique aspects of each pair, traders are better positioned to capitalize on market movements, ensuring that they remain competitive and successful in their trading endeavors. This personalized approach not only boosts the bot’s performance but also enhances your overall trading experience.