Forex scalping robots are the mercenaries of the trading world, executing rapid-fire trades with machine precision. In this article, we will delve into the techniques and tools that make these automated systems tick. From algorithmic strategies to the latest software innovations, we’ll explore how these robots aim to profit from small price movements in the Forex market. Whether you’re a seasoned trader or a curious newcomer, understanding the mechanics behind these high-frequency marvels could be the key to enhancing your trading arsenal. And no, these robots won’t take over the world—just the Forex market, one pip at a time.

Forex Scalping Robots: Mastering the GBP/JPY Pair with Yen Wave 🚀

Navigating the tempestuous waters of the GBP/JPY pair requires a scalping robot with nerves of steel and a method to its madness. Enter the Yen Wave, a meticulously crafted Expert Advisor designed to thrive on the H1 timeframe, capitalizing on the heightened volatility during the overlapping European and Asian sessions. Utilizing advanced scalping techniques, it deftly maneuvers through rapid price movements, while volatility channels pinpoint range boundaries and breakout opportunities. The integration of Heiken Ashi candles smooths out tumultuous price action, making trends as clear as a sunny day at the beach. 🌊💹

Risk management is where the Yen Wave truly shines. Equipped with automatic stop-loss orders and dynamic position sizing, it’s like having a vigilant lifeguard on duty, ensuring that the high waves of volatility don’t wipe out your trading account. This EA has undergone rigorous backtesting and forward testing, proving its mettle across various market conditions. Whether you’re a budget-conscious trader or a seasoned veteran, the Yen Wave offers a user-friendly interface, regular updates, and dedicated support to help you ride the Forex waves with confidence and precision. 🌐📈

Trend Screener vs. AtlantisMu: Scalping Strategies Compared 🥊

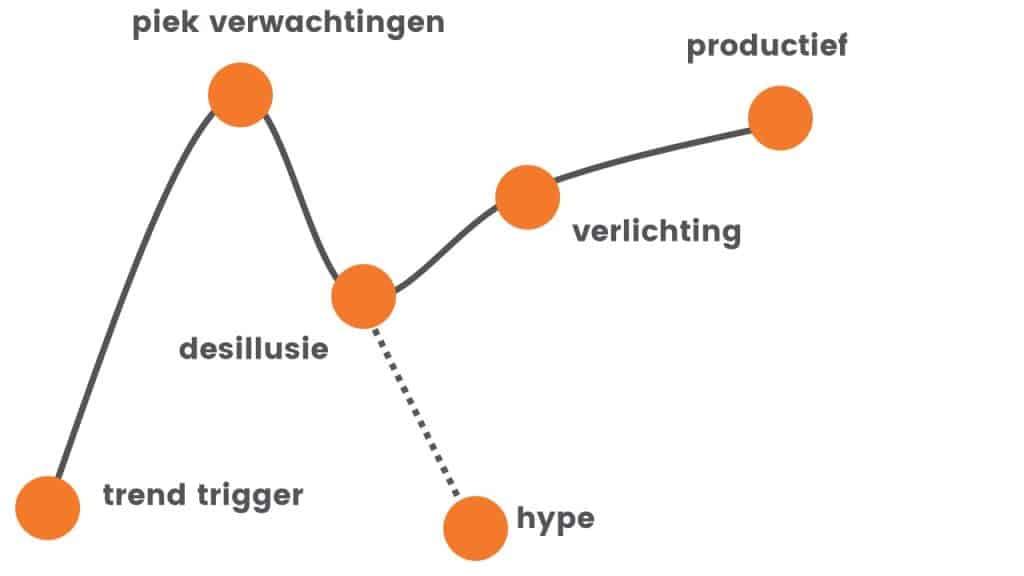

When it comes to scalping strategies, Trend Screener and AtlantisMu offer distinct approaches that cater to different trading styles. Trend Screener is a comprehensive suite that includes a scalping strategy designed for fast-paced day trading. It capitalizes on small price movements within a single trading day, making it ideal for traders who thrive on quick decision-making and rapid execution. The system’s dynamic tools like the trend line map and reversal dots make it a versatile choice for those looking to exploit short-term market inefficiencies. With features such as multi-currency and multi-timeframe analysis, Trend Screener provides a robust framework for identifying profitable scalping opportunities across various markets 🌍📈.

On the other hand, AtlantisMu focuses on a more specialized scalping strategy, primarily targeting pairs like GBPUSD and EURCHF on the M5 timeframe. This robot ensures consistency by employing strict risk management protocols, including fixed stop loss and take profit levels for every trade. Unlike many other EAs, AtlantisMu steers clear of risky strategies like martingale or grid trading, adhering instead to a disciplined approach that relies on pending orders and precise execution. This makes it a reliable tool for traders who prefer a more conservative and rule-based scalping strategy. With its fully automatic mode and adjustable inputs, AtlantisMu offers a straightforward yet effective solution for those aiming to make consistent profits in the forex market 🚀💰.

Unlocking High-Frequency Trading: The Power of Heiken Ashi Candles 🔥

Experience the magic of Heiken Ashi candles, a technique that transforms traditional candlestick charts into a trader’s dream. Imagine a world where erratic price movements are smoothed out, revealing a clearer representation of market trends. This is not just a fantasy; it’s the reality with the Heiken Ashi OHLC Indicator. Designed to filter out market noise, it provides crystal-clear signals, making your trading decisions sharper and more precise. Whether you’re navigating Forex, stocks, or cryptocurrencies, this versatile tool adapts to any market, guiding you through the chaos with the calm of an experienced trader by your side. 🚀📈

Unlock the potential of your trading strategy with the Quantum Heiken Ashi PRO. By smoothing out price fluctuations, these candles offer enhanced clarity and reduced noise, allowing you to spot favorable trading opportunities with ease. The innovative formula transforms traditional candlestick data into easy-to-read colored bars, highlighting bearish and bullish trends with remarkable precision. Say goodbye to false signals and hello to seamless integration into your MetaTrader platform. Whether you’re a seasoned trader or a beginner, harness the power of Heiken Ashi to elevate your trading performance and uncover hidden opportunities. 🌟📊

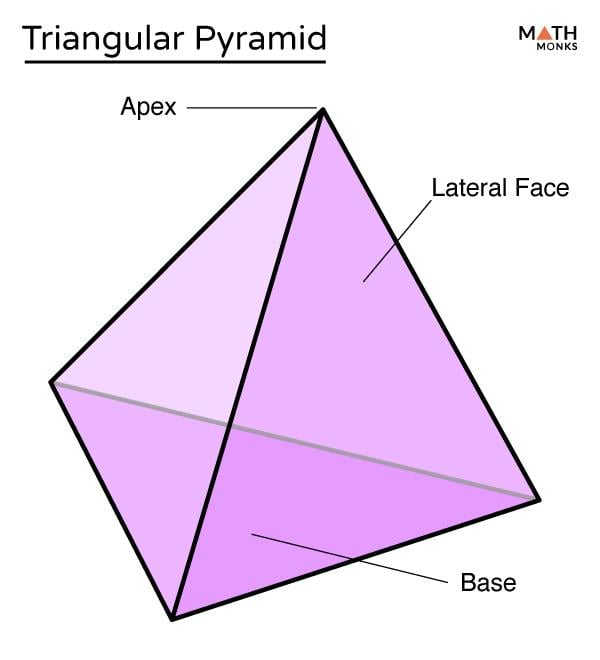

Triangular Arbitrage and Scalping: A Dynamic Duo for Forex Traders ⚡

Triangular arbitrage and scalping form an electrifying combination for the Forex market. Triangular arbitrage, also known as cross currency arbitrage, exploits inefficiencies between three related currency pairs by placing offsetting transactions. This strategy takes advantage of discrepancies in the market, ensuring a zero-risk profit when the cross exchange rate deviates from the implicit rate. Imagine using a permutations calculator to identify all possible valid arbitrage pair triangles from your market watch list! This method leverages intricate logic to open trades in a group of three, dynamically managing them for optimal profit. It’s like having a financial wizard in your trading terminal!

On the other hand, scalping is the art of capturing small price gaps created by order flows or spreads. Scalping robots, like the ones using advanced machine learning and genetic algorithms, can execute trades faster than a caffeine-fueled trader. These bots utilize price action patterns and standard trading indicators, filtering out market noise and avoiding stop-loss hunting. With features like dynamic take profit, profit closing, and intricate hedge logic, scalping robots ensure that every trade is optimized for the best possible outcome. When combined with triangular arbitrage, the precision of scalping can exploit even the smallest market imperfections, making this duo a formidable force in the Forex trading arena. 🚀📈

Maximizing Returns with US30 Scalping: A Practical Guide 💡

When it comes to scalping the US30, precision and speed are the name of the game. The Diamond Titan FX EA, specifically designed for the US30 index, offers a robust solution for traders looking to capitalize on the rapid price movements of this dynamic market. This expert advisor has been rigorously tested on both demo and live accounts, ensuring reliability and performance. It avoids risky strategies like grid, martingale, or funding, instead protecting each trade with a Stop Loss and Take Profit level. The built-in automatic lot bidding function makes it user-friendly, while the recommendation to use a VPS ensures that the EA operates seamlessly 24/7. For the best results, it’s crucial to use low spread accounts, as even a slight increase in spread can significantly affect profitability. 🌟📈

For a more hands-on approach, the US30 Scalper EA is another excellent choice. This expert advisor is optimized for the M15 timeframe and is designed to work with raw accounts to minimize spread costs. Each trade is safeguarded with a Stop Loss, and the EA does not employ multiple open trades, grid, or hedge strategies, making it a safer option for conservative traders. The EA’s simplicity means you can start trading with minimal setup, and its compatibility with various brokers ensures flexibility. However, always remember to test on a demo account for at least 12 weeks to ensure compatibility with your broker before going live. Using a VPS is highly recommended to keep the EA running smoothly around the clock. 🚀🕒

The Intricacies of Volatility Channels in Scalping Robots 🌊

Volatility channels are the bread and butter of scalping robots, especially when navigating the tempestuous waters of the forex market. 🏄♂️ These channels, like the Keltner or Donchian channels, provide the much-needed boundaries within which price movements are analyzed. The idea is simple yet powerful: identify the upper and lower limits of price fluctuations and leverage these to make informed scalping decisions. For instance, the Keltner Channels Breakout strategy zeroes in on moments when the price breaches these predefined limits, signaling potential buy or sell opportunities. This method ensures that trades are executed only when the volatility conditions are just right, avoiding the pitfalls of low liquidity or excessive turbulence.

One shining example is the GBP/JPY scalping robot, which thrives on the pair’s inherent volatility during the overlapping European and Asian trading sessions. By employing techniques such as Heiken Ashi candles to smooth out the price action, the robot can discern underlying trends more clearly. It doesn’t just stop there; the robot incorporates risk management features like automatic stop-loss orders and dynamic position sizing to handle the pair’s notorious volatility. This meticulous approach, combined with extensive backtesting, ensures that the robot remains robust across various market conditions. Indeed, volatility channels are not just lines on a chart—they are the very framework upon which profitable scalping strategies are built. 📈✨

Risk Management Essentials in Forex Scalping with Antarctic Scalping 🛡️

Risk management is the cornerstone of successful Forex scalping, especially when utilizing robots like Antarctic Scalping. This expert advisor, designed for the M5 timeframe, integrates price action analysis with indicators to ensure precise entry points. By maintaining fixed stop-loss and take-profit levels, it safeguards against unexpected market moves while trading pairs like GBPUSD and EURUSD. The recommended settings include a maximum spread of 5 pips and slippage of 3 pips, ensuring tight control over trade execution. With a minimum balance of $500 and a risk setting of 5%, traders can optimize their scalping strategy without overexposing their capital. 🛡️📊

To illustrate, Antarctic Scalping’s risk parameters are meticulously crafted to balance potential gains and losses. For instance, the stop-loss is set at 25 pips, and the take-profit at 10 pips, creating a controlled trading environment. The EA also adapts to different market conditions, thanks to its flexible time settings (GMT+2 or GMT+3). This adaptability, combined with stringent risk controls, makes it a robust choice for traders aiming to capitalize on short-term market movements while keeping their exposure in check. 🌍📈

Algo Samurai Gold vs. BOT Smiles: A Battle of Scalping Robots ⚔️

In the world of Forex scalping, Algo Samurai Gold and BOT Smiles are two warriors battling it out for supremacy. Algo Samurai Gold, with its non-martingale approach, offers a disciplined strategy for trading XAUUSD. This bot locks in profits with a built-in profit protection system, ensuring that gains are secured while still allowing trades to run for potentially greater rewards. It employs predefined take profit (TP) and stop loss (SL) levels on every trade, providing traders with greater control and transparency. 🥇 BOT Smiles, on the other hand, is an aggressive multi-cycle scalper designed for EURUSD M1. It uses a martingale system, leveraging strong recurrences from the past to achieve a high success rate. Each cycle is independent, with its own TP and SL, making it a robust choice for traders looking to capitalize on quick market movements. 🎯

Comparing these two, Algo Samurai Gold stands out for its risk management features, appealing to traders who prefer a more conservative approach. It avoids the pitfalls of increasing trade size after losses, which is a common risk with martingale systems. On the flip side, BOT Smiles thrives on its aggressive nature, opening multiple trades a day and closing them within the same day, making it a favorite for those who enjoy high-frequency trading. ⚡️ Both robots have their unique strengths and cater to different trading styles, providing options for traders whether they seek stability or aggressive growth.

Harnessing the Power of Price Action in Scalping Strategies 📈

Price action scalping strategies, such as those employed by top-tier forex robots like the ‘Price Action Scalping EA,’ are meticulously designed to capitalize on short-term price movements, making them a go-to for traders aiming to maximize quick profits. By analyzing historical price data and identifying key levels of support and resistance, these systems can pinpoint lucrative entry and exit points with commendable precision. Imagine a trading robot that operates on the XAUUSD pair with an M5 timeframe, leveraging the swift nature of scalping while ensuring each trade is backed by a robust stop-loss mechanism. This approach not only amplifies the potential for rapid gains but also mitigates risks, making it an appealing choice for both novice and seasoned traders. 📊💰

The beauty of price action in scalping lies in its simplicity and effectiveness. For instance, tools like the ‘Price Action Trade Panel EA MT4’ streamline the trading process by offering real-time insights into market sentiment based on pure price action data. This panel meticulously calculates the buying and selling force levels, providing traders with a clear picture of market dynamics. Moreover, features like automatic partial closure and virtual take profit levels ensure that trades are managed with precision, enhancing the overall trading experience. With such sophisticated tools at their disposal, traders can navigate the volatile forex market with greater confidence and efficiency. 🚀📉

Scalping the Forex Market: Techniques, Tools, and Real-World Examples 🧰

When it comes to scalping the Forex market, precision and speed are the name of the game. Take, for instance, the Blitz Trade Scalper, an expert advisor designed for the 15-minute timeframe. This little beast works best on EURUSD and GBPUSD, seizing short-term market opportunities with surgical precision. Its trailing stop loss feature dynamically adjusts to market conditions, protecting your profits while minimizing losses. All you need to do is activate it, and Blitz Trade Scalper takes care of the rest. It’s like having a high-frequency trading robot at your fingertips, ready to pounce on every fleeting opportunity without the need for constant adjustments. Talk about a stress-free trading experience! 🚀📈

For those who prefer a more customized approach, the Price Action Toolkit EA is a scalper’s dream. It allows you to enter trades instantly or at candle highs and lows with pending orders. The toolkit adjusts stops and take profits as the market moves, ensuring you capture the maximum profit. It even includes an EMA filter to filter out long or short patterns based on the trend. With features like session opening ranges and recent ranges, this EA helps you spot and trade breakouts with ease. Whether you’re a scalping aficionado or a trend follower, this toolkit adapts to your trading style, making it an indispensable part of your trading arsenal. 🎯📊

Q&A

Q: What is Forex scalping and how do Forex scalping robots work?

A: Forex scalping is a trading strategy that aims to profit from small price movements within the Forex market. Scalping robots, or automated trading systems, execute trades based on predefined criteria, enabling rapid entry and exit from trades. These robots utilize advanced algorithms and technical indicators to identify short-term trading opportunities, often focusing on high-frequency trades to capitalize on minute price fluctuations.

Q: What are some common techniques used by Forex scalping robots?

A: Forex scalping robots employ several techniques to optimize trading performance. Key techniques include:

– Utilizing technical indicators such as moving averages and Heiken Ashi candles to identify trends and smooth out price action.

– Implementing volatility channels to detect range boundaries and potential breakout opportunities.

– Incorporating risk management features like automatic stop-loss orders and dynamic position sizing to minimize potential losses.

– Backtesting and forward-testing strategies to refine performance under various market conditions.

Q: What tools are essential for Forex scalping robots?

A: Essential tools for Forex scalping robots include:

– Technical analysis indicators such as moving averages, RSI, MACD, and Heiken Ashi candles.

– Volatility channels to identify trading ranges and breakout points.

– Risk management systems, including stop-loss and take-profit mechanisms.

– High-speed internet connections and low-latency trading platforms to ensure rapid execution of trades.

– Backtesting software to evaluate the effectiveness of trading strategies in historical market conditions.

Q: How do Forex scalping robots handle risk management?

A: Effective risk management is crucial for Forex scalping robots due to the high frequency of trades and the volatile nature of the market. Scalping robots typically use several risk management techniques, including:

- Setting automatic stop-loss orders to limit potential losses on individual trades.

– Employing dynamic position sizing to adjust trade volumes based on account equity and market conditions.

– Using trailing stops to lock in profits as the market moves in favor of the trade.

– Avoiding risky strategies like martingale and grid trading, which can exponentially increase risk.

Q: Are Forex scalping robots suitable for all types of traders?

A: Forex scalping robots can be beneficial for traders who prefer high-frequency trading and have the necessary infrastructure to support rapid trade execution. However, they may not be suitable for all traders, particularly those who prefer longer-term trading strategies or lack access to low-latency trading platforms. Additionally, traders should be aware of the risks associated with scalping and ensure they have robust risk management practices in place.

Q: What are the advantages of using Forex scalping robots?

A: The advantages of using Forex scalping robots include:

– Automation of trading processes, reducing the need for constant manual monitoring.

– Ability to execute trades at high speeds, often faster than human traders.

– Consistent application of predefined trading strategies without emotional interference.

– Potential to capitalize on small price movements and generate frequent profits.

– Enhanced risk management through automated stop-loss and position sizing features.

Q: What are the limitations of Forex scalping robots?

A: Despite their advantages, Forex scalping robots also have limitations, such as:

- Dependence on high-speed internet and low-latency trading platforms for optimal performance.

– Potential for significant losses if risk management features are not properly configured.

– Susceptibility to market conditions that may not favor high-frequency trading strategies.

– Requirement for ongoing monitoring and adjustment of trading parameters to maintain effectiveness.

– Risk of technical issues or software malfunctions that could impact trading performance.

Concluding Remarks

As we close the chapter on Forex Scalping Robots, it’s clear that these automated warriors of the trading world bring both promise and peril. Their techniques, from volatility channels to Heiken Ashi candles, offer a tantalizing glimpse into the future of swift and strategic market maneuvers. Tools like the ATR Stop Loss Finder and the ScalpAuT bot exemplify the cutting-edge technology that drives these digital traders. However, the path to profit is paved with cautionary tales and the ever-present need for diligent oversight. Whether you’re a seasoned trader seeking to enhance your toolkit or a novice stepping into the frenetic pace of forex scalping, these robots are but one piece of the complex puzzle that is successful trading. As always, happy trading, and may your pips be plentiful.