Edition:

At this time, purchasing EASY Bot items is not available to all members. Read more - how to get access to purchase

Need top-tier trading services?

🚀 Our project provides:

🤖 Free EASY Trading AI Bots,

📡 Free Trading Signals,

📊 AI Bot .set Analyze / Cloud Optimization,

⚖️ Live Trading: Test Lab .set Files,

🔎 3rd party Trading Robot Lab,

These advanced features are reserved for authorized users. Sign up in just 1 minute—absolutely free—and unlock Free hidden sections that’ll elevate your trading ⚡. Have questions? Our official bot at @forexroboteasybot is here to guide you.

Join now and become an EASY Trader!

Reviews 30

Edition:

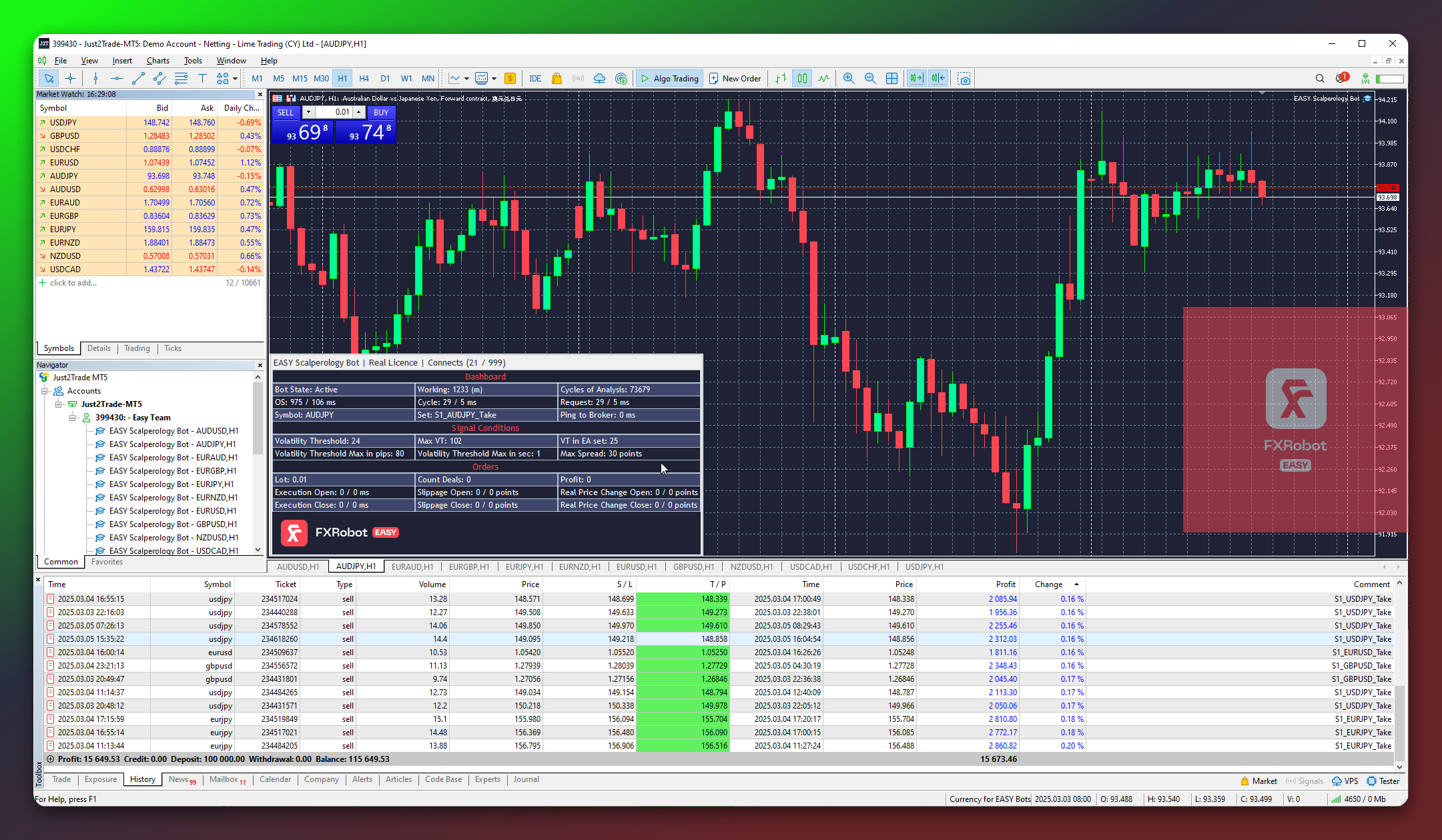

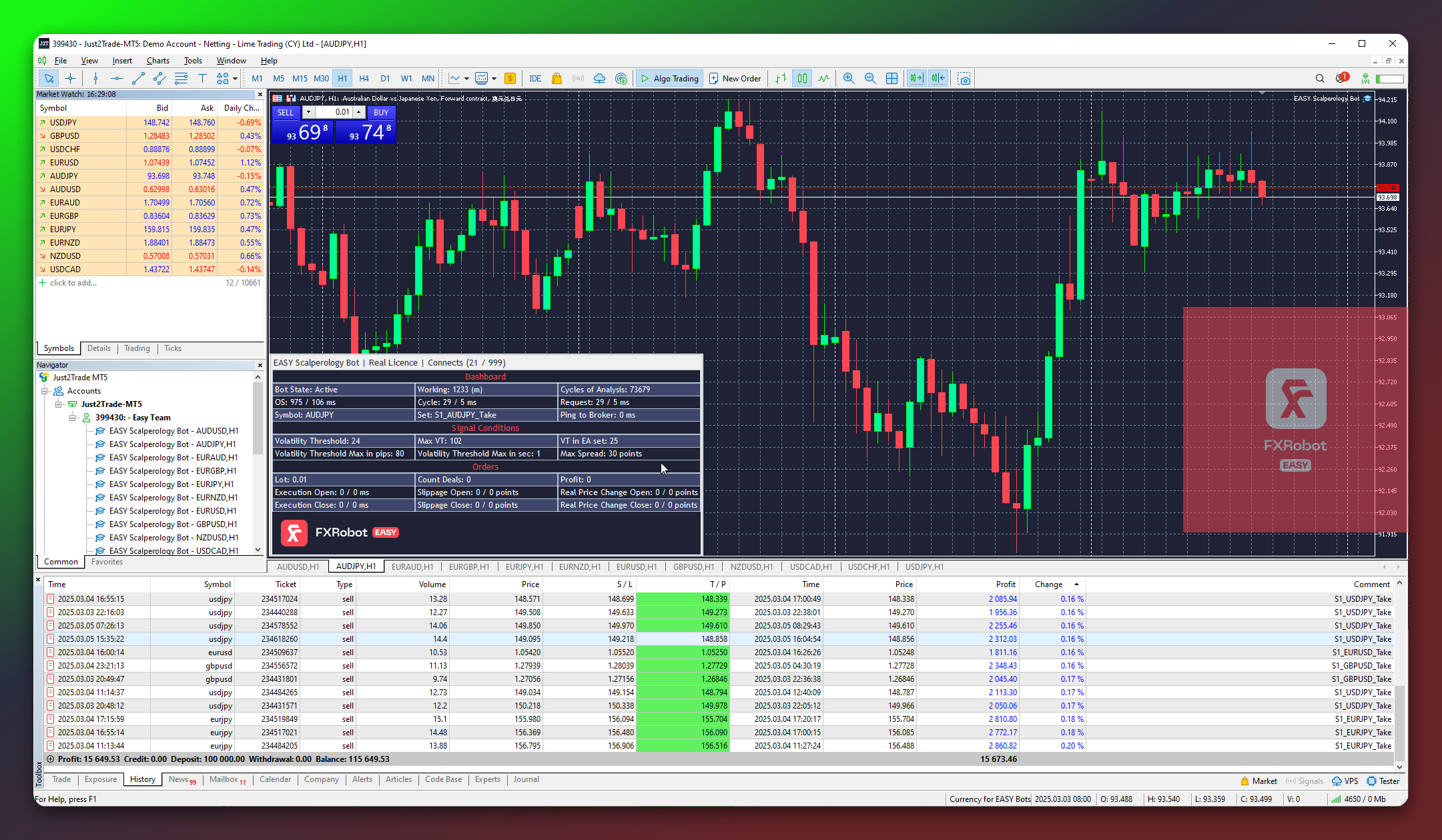

EASY Scalperology AI Bot is the flagship trading robot in the EASY Bots family, fully built on the EASY Trading AI strategy. With every price tick, the bot scans the current market movement and forms a “pattern” based on key parameters (volatility, rate of price change, local highs and lows, etc.). It then sends this data to our trained AI model, which is designed to recognize which market patterns typically lead to profitable trades.

If the AI model determines that the current market movement matches one of its “strong” patterns, it returns an “Open Trade” signal — and, without any additional technical filters, EASY Scalperology AI Bot instantly places an order. This approach is ideal for scalping, where quick entry and exit points are crucial. The bot seizes every opportunity to enter the market whenever the AI deems conditions favorable, and with proper settings, this can generate significant and clearly noticeable profits.

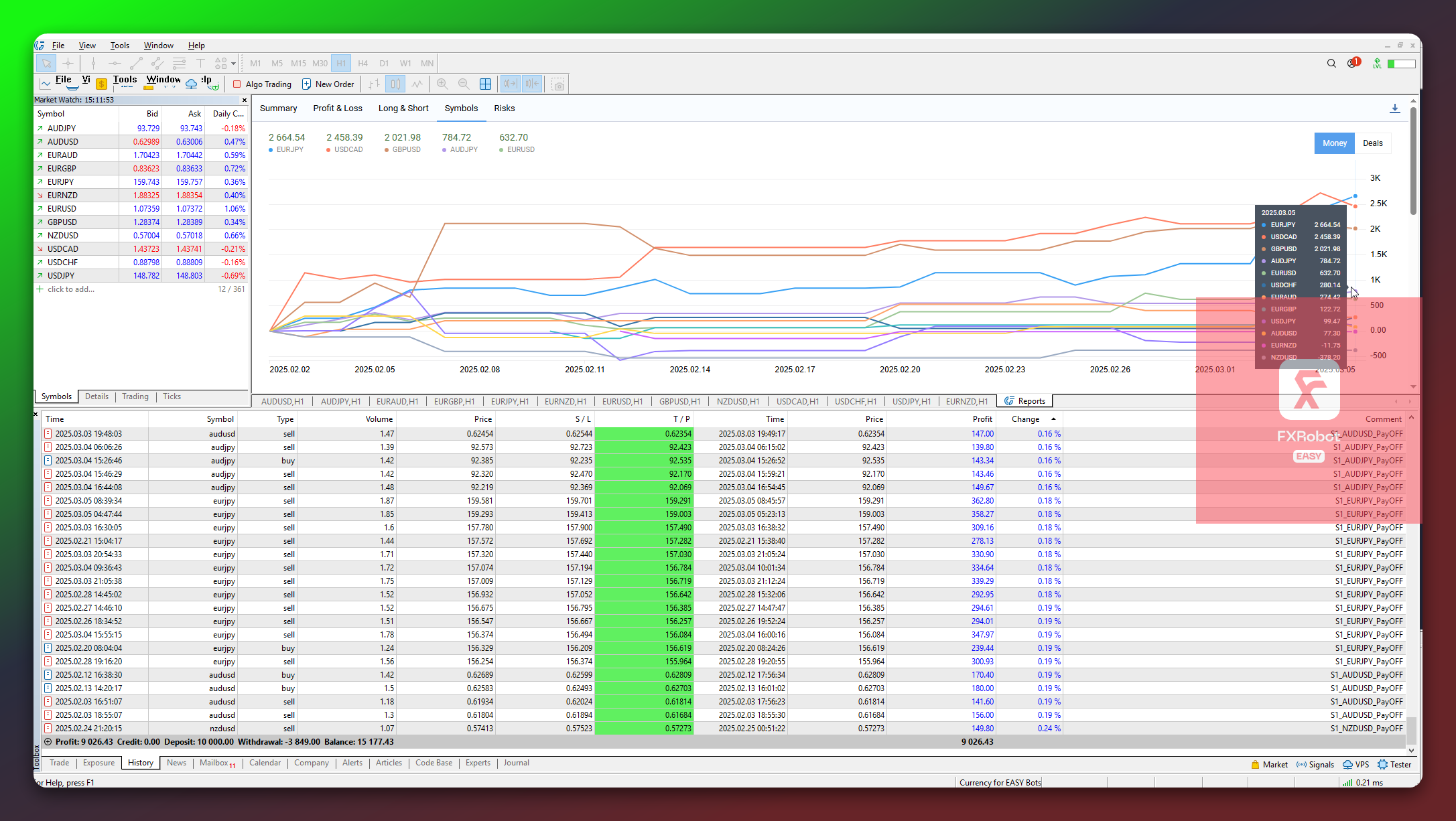

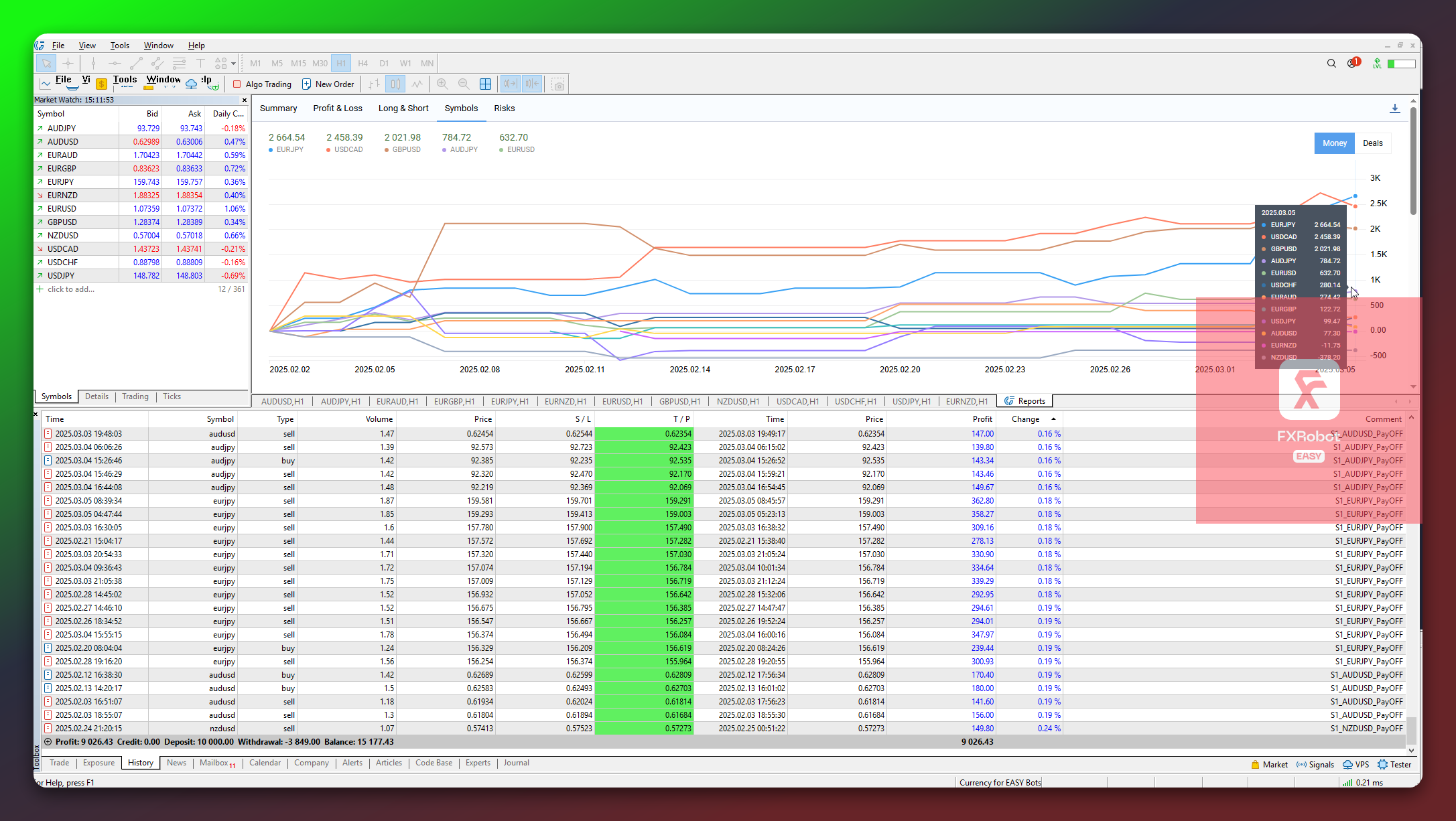

Scalperology AI Global supports 12 major currency pairs (AUD/JPY, AUD/USD, EUR/AUD, EUR/GBP, EUR/JPY, EUR/NZD, EUR/USD, GBP/USD, NZD/USD, USD/CAD, USD/CHF, USD/JPY). In addition to the Global version, there are also Cross and Major versions. It support a smaller number of currency pairs and trading accounts. For each pair, we used the MetaTrader 5 strategy tester to identify optimal .set files based on different criteria (PayOff/Profit/Take, etc.) and selection methods (S1, S2, S3). The resulting .set files from the strategy tester are then deployed to real trading accounts, where they’re tested in live market conditions. Many times, a .set file can perform well in strategy tester backtests but fail to deliver positive results under real trading conditions. The current test outcomes for those accounts can be found in Live Trading.

Each trade executed on these accounts is analyzed through the EASY Set Analyze system (.setAnalyze()), which identifies which .set file was used. Then it forms a performance ranking of profitable and unprofitable .set files. When installing this bot on your own trading account, you can simply choose to use the “best” sets, thus eliminating the need to manually optimize the strategy over time.

Our site features monitoring data for trading results on accounts using the best .set files. If you want to examine their detailed statements and stats from MyFxBook and MQL5, head over to the Best .set Result Page. Independent MyFxBook and MQL5 stats are also connected there. If you don’t wish to buy the bot for your own trading account, you can simply subscribe to the trading signals on a monthly plan.

This approach solves the biggest problem of any algorithmic trader: “What do I do when the market shifts, and my settings become outdated?” In practice, EASY Bots automatically adapt to new market cycles by uploading newly optimized .set files. Our MT5 strategy optimizer runs 24/7 in the cloud, requiring no manual re-optimization, thus saving you time and hassle.

You can install EASY Scalperology Bot in MetaTrader 5 at any broker. Because the MetaTrader 5 mobile app can’t run expert advisors (due to mobile OS architecture and energy-saving constraints), we strongly recommend using a VPS server for stable connectivity—crucial in a “scalping” style. If you need a VPS, please check out VPS providers.

What’s inside EASY Scalperology Bot? It automatically collects and loads fresh .set files from our cloud ecosystem, which comprises several modules. There are multiple strategic methods (S1, S2, S3) and criteria (PayOff, Take, etc.)—you can choose “Best among all” or narrower methods. If you prefer not to apply settings automatically, disable “Automatic Set Apply” and trade by your own rules. We provide a .set files catalog, allowing you to choose configurations that match your personal style. The bot implements specialized order management designed for quick trades (scalping up to 10 minutes) or moderate timeframes (up to a few hours). There’s no martingale here: it only opens one trade per currency pair at a time, with proper SL and TP. A convenient MT5 GUI panel shows key metrics and makes parameter adjustments straightforward.

Additionally, EASY Scalperology Bot was developed not as a “standalone advisor,” but as part of a broader ecosystem: EASY Trading AI identifies market patterns, EASY Strategy Tester handles search and optimization of settings, and EASY Set Analyze evaluates those settings in practical terms, deciding which are currently most successful. That means you get a stable trading tool that doesn’t lag behind the market.

If you’d like to delve deeper into how the entire infrastructure operates (AI model, re-optimization, and .set file management), please see our FAQ or contact support via:

• Email: support@forexroboteasy.com

• Telegram: @forexroboteasybot

This bot is truly a technological solution that lets you trade actively without constantly worrying about manual adjustments. Join EASY Scalperology Bot and discover the full benefits of fast, adaptive trading!

P.S. If you’re a beginner and unsure where to start your journey in algorithmic trading, we’ve prepared a step-by-step guide: How to Start Trading with Bots (from scratch). We wish you success and high profits! ⚡️🤖

| Parameter | Value | Type | Unit | Description |

|---|---|---|

| -= SETS MANAGEMENT =- | ||

| Automatic Set Apply | True/False | When enabled (True), the bot fetches and applies the optimal set configurations from our server based on predefined ‘Conditions for the best set’. |

| Conditions for the best set | Method/Best | Detailed information on optimization methods can be found in the FAQ section. When set to ‘Best’, the bot selects the most profitable configuration across all methods. |

| -= SIGNAL to OPEN an ORDER =- | ||

| Volatility Threshold (VT) | 5-50 | The threshold level defining market volatility required to trigger a trade. Higher values limit the analysis to fewer models, reducing trade frequency but potentially increasing accuracy. |

| Model analyze | Simple | This setting uses a simplistic model for market analysis; more complex models are planned for future integration, enhancing predictive accuracy. |

| Min Signal Retention Sequence (SRS) | 10-30 Points | This parameter defines how long a signal must persist in validating market conditions for a trade to be executed, ensuring that trades are based on substantiated market movements. |

| Signal Retention Sequence (SRS) | Interference / The purest | The choice of model affects the frequency and accuracy of trades: ‘Interference’ allows more frequent trades with varied accuracy, and ‘The purest’ focuses on fewer, more accurate trades. |

| Spread Mode | True/False | If set to True, the trading decision takes the current spread into account, increasing the likelihood of immediate profitability post-trade execution. |

| Spread Impact Coefficient (SIC) | 0-2.1 Unit: Coefficient (dimensionless). | Interacts with Spread Mode; defines how profoundly spread impacts trade decisions. A higher value (e.g., 2) signifies a higher threshold for trade activation, potentially enhancing profit margins by avoiding trades in higher-spread conditions. |

| Min Volume | 100 Unit: Lots. | This setting ensures an adequate market volume is present before executing a trade, minimizing potential slippage and safeguarding trade entry quality. |

| Inversion of Signals | True/False | If set to True, the bot inverts the trade direction based on received signals, offering strategy flexibility and potential risk management benefits. |

| Order Comment | EASY Scalperology Bot | Each trade will carry this comment, making it easier to track and analyze trades specifically executed by this bot within trading history. |

| -= OPEN ORDER MANAGEMENT =- | ||

| SL calculation model | Points/Percent | This parameter allows traders to choose how the Stop Loss level is calculated, either in points or as a percentage of the entry price, enabling precision in risk management settings. |

| -= SL/TP LEVEL =- | ||

| Stop Loss (if = 0, then OFF) | 1-9999 Points. | Configures the Stop Loss level to protect against significant losses. If set to ‘0’, the feature is disabled, otherwise, it adjusts the stop level within the specified range. |

| Take Profit (if = 0, then OFF) | 1-9999 Points. | Sets the Take Profit level where the trade will close when the desired profit is reached. If set to ‘0’, this function is disabled. |

| Close by Reverse Signal | True/False | Enables the trade to close based on a reverse signal, preventing potential losses from adverse market movements and securing profits by timely exits. |

| -= SMART TRAILING SYSTEM =- | ||

| Trailing is Virtual | True/False | Determines whether trailing stops are displayed to brokers (False) or managed internally within the system (True) to conceal strategy details. |

| Trailing Shift Start | True/False | Specifies when the trailing stop begins to follow the price movement; if True, trailing commences only after the trade becomes profitable. |

| Stop Loss Trailing Level in pp | 80 | Defines the distance for dynamically adjusting trailing stops as the market price moves in favor, enhancing profit protection. |

| Take Profit Trailing Level in pp | 140 | Adjusts the trailing limit for taking profit to capture favorable market movements beyond the initial take profit level. |

| -= BREAKEVEN =- | ||

| Break Even Trigger in pp | 30 | Sets the amount of profit in points at which the Stop Loss is adjusted to the breakeven point, thereby eliminating risk on the trade. |

| Break Even Level in pp | 10 | Defines the exact level to which the Stop Loss is adjusted once breakeven is triggered, securing no loss on the position. |

| -= MONEY MANAGEMENT =- | ||

| MM Mode | Fixed Lot | Select from options like Fixed Lot, Fixed Risk, Fixed Margin, or Fixed Margin Optimized to tailor the capital management strategy to your trading preferences and risk tolerance. |

| Lot (Only If MM Mode = Fixed Lot) | 0.01 | Specifies the exact lot size to be used per trade, providing a consistent and manageable risk on each trade. |

| Percent (Fixed Risk, Fixed Margin [Optimized]) | 1 | Determines the percentage of the account balance that will be risked per trade, enabling dynamic adjustment of trade size based on account equity. |

| Decrease Factor (Fixed Margin Optimized) | 2 | Used in Fixed Margin Optimized mode to dynamically adjust the trade size based on the performance and market conditions. |

| -= BALANCE PROTECTION =- | ||

| Max Profit Day (%) | 30 | Automatically stops trading when a specified percentage of profit is reached within a day, locking in gains and preventing over-trading. |

| Max Loss Day (%) | 10 | Halts all trading activities if losses exceed a set percentage of the account balance for the day, protecting the trader from significant declines. |

| -= ORDER PROTECTION =- | ||

| Volatility Threshold Max | 60 | Restricts trading during periods of extreme market volatility which is identified when the volatility exceeds the set threshold, reducing the risk of big losses during turbulent conditions. |

| Max Signal Deviation in sec | 1 Seconds. | Ensures that trade executions are based on the most up-to-date signal data by allowing only a minimal deviation in signal timing. |

| Max Spread Points | 30 | Limits trading to conditions where the spread is below a predefined point level, ensuring cost-efficient entry and exit. |

| -= GUI Setup =- | ||

| GUI | Enables or disables the graphical user interface on the chart. It is recommended not to enable it on all charts as it is resource-intensive. | |

| -= Telegram notifications =- | ||

| Notifications is active | Enable or disable sending trade notifications via Telegram, providing users with real-time updates about new trades. | |

| Telegram uid | Your unique Telegram identifier, obtained after initiating the bot @Easydealsbot, used for personalized notifications. | |

| -= LICENCE VALIDATION =- | ||

| URL or IP | http://easytradingai.com | Specifies the domain http://easytradingai.com for license validation. |

| Original Symbol | If the symbol name at your broker differs from the standard notation, specify it here for successful license authentication. | |

| Configuration file | scalperology.txt | The configuration file must be located in the \MQL5\Files directory for proper bot operation. |

AUDJPY

H1 (2024.01.01 - 2024.12.10)

10000.00$

283888.55$

Success in numbers!

The S1_AUDJPY_Complex set offers a fascinating look into how a robust trading strategy can deliver significant gains, as evidenced by its total net profit of 895,596.42. Despite starting with just 10,000, the strategy achieves a gross profit of 1,480,870.33, underscoring its capacity to optimize winning conditions. However, the maximal drawdown of 27.37% reveals the inherent risk and potential for significant temporary losses. The expected payoff stands at 279.44, suggesting that each trade, on average, contributes positively to the bottom line. A profit factor of 2.53 indicates that profits are over 2.5 times greater than losses, strengthening the strategy's efficiency narrative. Notably, the high percentage of profitable trades (88.55%) highlights its reliability, with a slight advantage in long trades at 89.75%. While the largest profit and loss trades reflect the potential volatility within the strategy, the AHPR and GHPR values of 0.14% suggest steady compounding over time. This balance between impressive profitability and elevated drawdown levels paints a picture of a trading approach that, if managed with care, could sustain growth with manageable risk.

Gross Profit

1 480 870.33Balance DD Maximal

38 971.06 (27.37%)Profit Traders(% of total)

2838 (88.55%)Loss Traders(% of total):

367 (11.45%)

AUDUSD

H1 (2024.01.01 - 2024.12.10)

10000.00$

447251.79$

Success in numbers!

The S1_AUDUSD_Complex set file yields an impressive historical net profit of 447,251.79, highlighting the efficacy of its trading strategy from an initial deposit of 10,000. The remarkably low balance drawdown of 2.78% underscores its exceptional risk management, making it appealing for those wary of volatility. A profit factor of 3.47 and recovery factor of 30.08 further validate its robust performance, with an overwhelming 89.73% of trades being successful. Particularly noteworthy is the high win rate in long trades at 94.47%. Yet, while these data have dazzled in the backtesting phase, continuous monitoring and adaptation are necessary to confirm that these results can be realized in actual trading conditions.

Gross Profit

628 252.21Balance DD Maximal

13 010.03 (2.78%)Profit Traders(% of total)

1345 (89.73%)Loss Traders(% of total):

154 (10.27%)

EURAUD

H1 (2024.01.01 - 2024.12.10)

10000.00$

2386746.47$

Success in numbers!

The S1_EURAUD_Complex delivers an outstanding historical net profit figure of 2,386,746.47, a testament to its robust trading strategy. Leveraging an initial deposit of just 10,000, the strategy shows a low balance drawdown of 3.27%, indicating efficient risk management despite the large figures involved. A profit factor of 2.31 and recovery factor of 22.54 emphasize its capability to sustain profitable trades and recover from downturns. With 74.55% of trades being profitable and a notable win rate in long trades at 80.66%, these backtested results are encouraging. However, such impressive historical gains must be approached with cautious optimism until proven in the unpredictable landscape of live trading.

Gross Profit

4 204 926.48Balance DD Maximal

75 623.78 (3.27%)Profit Traders(% of total)

1576 (74.55%)Loss Traders(% of total):

538 (25.45%)

EURGBP

H1 (2024.01.01 - 2024.12.10)

10000.00$

304849.08$

Success in numbers!

The S1_EURGBP_Complex presents a steady historical performance with a net profit of 304,849.08 from an initial investment of 10,000. Despite a moderate balance drawdown of 7.33%, the profit factor of 1.93 indicates a solid ability to produce gains relative to losses. This strategy sees a profitable outcome in 56.14% of trades, suggesting room for improved entry or exit strategies. The higher win rate for long trades at 61.62% gives an insight into potential directional strengths. While these results bode well historically, translating them into live trading demands meticulous risk management and strategy enhancements to address the close balance of win-loss rates.

Gross Profit

632 133.39Balance DD Maximal

13 827.87 (7.33%)Profit Traders(% of total)

667 (56.14%)Loss Traders(% of total):

521 (43.86%)

EURJPY

H1 (2024.01.01 - 2024.12.10)

10000.00$

11047.93$

Success in numbers!

The S1_EURJPY_Complex reflects a challenging historical performance with a modest net profit of 11,047.93 from a 10,000 initial deposit. Despite the gross profit reaching 110,204.24, the high balance drawdown of 27.78% points to significant risk. The profit factor of 1.11 barely outstrips break-even, signaling slim margins. While the strategy wins 55.97% of trades, its effectiveness is questionable, indicated by relatively even distribution between wins and losses. This strategy might benefit from refinement to optimize its profit-taking capacity or further adjustments to mitigate the high drawdown. Transitioning to live conditions would necessitate strategic improvements to enhance its reliability.

Gross Profit

110 204.24Balance DD Maximal

4 121.73 (27.78%)Profit Traders(% of total)

919 (55.97%)Loss Traders(% of total):

723 (44.03%)

EURNZD

H1 (2024.01.01 - 2024.12.10)

10000.00$

881633.48$

Success in numbers!

The S1_EURNZD_Complex illustrates a commendable historical net profit of 881,633.48 on a 10,000 initial deposit, showcasing its potential as a profitable trading strategy. The gross profit of 2,990,018.50 accompanied by a manageable drawdown of 13.40% indicates reasonable risk-taking with notable returns. With a profit factor of 1.42, the strategy reflects profitable inclinations, although there remains room for improvement in profit efficiency. The long trades, boasting a win rate of 75.43%, highlight a strength in directional trading. While this backtested success is promising, careful fine-tuning and adaptation will ensure these positive results can be consistently achieved under real market conditions.

Gross Profit

2 990 018.50Balance DD Maximal

64 855.52 (13.40%)Profit Traders(% of total)

1827 (69.97%)Loss Traders(% of total):

784 (30.03%)

EURUSD

H1 (2024.01.01 - 2024.12.10)

10000.00$

443359.60$

Success in numbers!

The S1_EURUSD_Complex demonstrates solid historical profitability, achieving a net profit of 443,359.60 from an initial 10,000 deposit. With a substantial gross profit of 829,191.32 and a modest drawdown of 5.53%, this strategy showcases strong risk management. Its profit factor of 2.15 and recovery factor of 17.17 indicate effective profitable recovery and stability in trading outcomes. An impressive 81.14% of trades were successful, reflecting a dependable trading approach. The favorable results in both short and long trades further highlight its robustness. However, it's vital to continue monitoring to ensure these results translate well in live trading conditions, adapting to market dynamics when necessary.

Gross Profit

829 191.32Balance DD Maximal

21 907.18 (5.53%)Profit Traders(% of total)

1037 (81.14%)Loss Traders(% of total):

241 (18.86%)

GBPUSD

H1 (2024.01.01 - 2024.12.10)

10000.00$

1423249.02$

Success in numbers!

The S1_GBPUSD_Complex presents a compelling historical performance, with a net profit of 1,423,249.02 from an initial deposit of 10,000. Its significant gross profit of 2,228,386.72, coupled with a manageable drawdown of 6.15%, highlights an effective balance between risk and reward. The high profit factor of 2.77 and recovery factor of 33.81 underscore its resilience and profitability. An impressive 91.01% of trades were profitable, with long trades achieving a remarkable 93.31% success rate, signifying reliable strategy execution. While these backtested results are promising, consistent performance in live market settings will depend on careful strategy adjustments and market monitoring.

Gross Profit

2 228 386.72Balance DD Maximal

38 814.96 (6.15%)Profit Traders(% of total)

3007 (91.01%)Loss Traders(% of total):

297 (8.99%)

NZDUSD

H1 (2024.01.01 - 2024.12.10)

10000.00$

80818.55$

Success in numbers!

The S1_NZDUSD_Complex delivers a solid historical performance with a net profit of 80,818.55 from an initial investment of 10,000. Despite the modest total, the strategy exhibits impressive risk management, as shown by its low balance drawdown of 3.21%. With a profit factor of 2.58 and recovery factor of 27.40, this setup demonstrates an efficient approach to profitability and loss recovery. An impressive 85.76% win rate, particularly high among long trades (93.41%), indicates a strong strategy execution over the tested period. Ensuring these promising backtesting results carry over to live trading will require vigilant monitoring and potential strategy adjustments in response to real market conditions.

Gross Profit

131 994.31Balance DD Maximal

2 561.13 (3.21%)Profit Traders(% of total)

873 (85.76%)Loss Traders(% of total):

145 (14.24%)

USDCAD

H1 (2024.01.01 - 2024.12.10)

10000.00$

439815.60$

Success in numbers!

The S1_USDCAD_Complex demonstrates a robust and consistent historical performance with a net profit of 439,815.60 from a 10,000 initial deposit. This strategy is particularly impressive due to its incredibly low balance drawdown of 1.00%, indicating exceptional risk management. A profit factor of 4.47 and a recovery factor of 56.82 highlight its strength in achieving profitability while minimizing losses. With a striking 93.24% of trades being profitable and long trades achieving a notable 96.69% success rate, this setup shows a remarkable level of reliability and precision. While these backtesting achievements are noteworthy, transitioning to live market conditions will still necessitate continuous oversight to ensure sustained performance.

Gross Profit

566 657.54Balance DD Maximal

4 389.20 (1.00%)Profit Traders(% of total)

1766 (93.24%)Loss Traders(% of total):

128 (6.76%)

USDCHF

H1 (2024.01.01 - 2024.12.10)

10000.00$

161719.96$

Success in numbers!

The S1_USDCHF_Complex showcases a respectable net profit of 161,719.96 derived from a 10,000 initial deposit. Its gross profit of 237,715.82, combined with a modest balance drawdown of 3.33%, reflects a prudent balance of risk-taking and gain. The strategy's profit factor of 3.13 and recovery factor of 20.86 underline the strategy's capability to capitalize on profitable opportunities effectively. Notably, 87.18% of trades are successful, especially long trades with a 90.85% win rate, demonstrating a strong strategy execution. While these backtested results suggest a competent trading approach, maintaining such success in a live setting requires adaptability to changing market conditions and disciplined execution.

Gross Profit

237 715.82Balance DD Maximal

5 575.10 (3.33%)Profit Traders(% of total)

952 (87.18%)Loss Traders(% of total):

140 (12.82%)

USDJPY

H1 (2024.01.01 - 2024.12.10)

10000.00$

1353905.24$

Success in numbers!

The S1_USDJPY_Complex demonstrates a formidable historical performance with a total net profit of 1,353,905.24 from an initial deposit of 10,000. This strategy's gross profit of 3,049,285.54 is noteworthy, paired with a balance drawdown of 8.98%, reflecting a sound balance between risk and reward. With a profit factor of 1.80, this strategy shows a strong ability to maintain profitable outcomes, especially considering 82.75% of trades are successful. The evenly distributed success in both short and long trades further solidifies its robustness. Yet, while the backtested data is promising, ensuring its effectiveness in real-time requires ongoing scrutiny to handle potential market shifts adequately.

Gross Profit

3 049 285.54Balance DD Maximal

116 929.45 (8.98%)Profit Traders(% of total)

2668 (82.75%)Loss Traders(% of total):

556 (17.25%)

30 total

5 stars

87%

4 stars

13%

3 stars

0%

2 stars

0%

1 stars

0%

5 months ago

Since purchasing EASY Scalperology AI Global, I have seen significant improvements in its performance. Initially, there were some difficulties at the start, but after several tests on demo accounts with different brokers, I managed to find the right configuration and choose a suitable broker. This really helped to achieve stable results. I am pleased that the bot continues to evolve and receive updates that only improve its functionality and adaptability to the market.

6 months ago

EASY Scalperology Global is a powerful and flexible solution for traders who want to maximize their profits with minimal effort. Strategy without any interruptions in operation! Thanks to automatic analysis of market conditions and optimization of trading parameters, which significantly save time. Integration with Metatrader 5 and high adaptability to current market conditions make it one of the best among competitors on the market at this price!

6 months ago

As an owner of Scalperology AI Global, I can confidently say that the future of auto-trading is here. I am impressed with the high level of support and the efforts the team puts into developing the project. I've been in trading for a long time and have tried many trading robots, but here, one can truly feel the innovation. Easy Set Analyzer takes auto-trading to a new level, allowing the loading of up-to-date set files from the cloud for each pair. This ensures continuous market adaptation without the need for manual adjustment of settings. Working with the demo version, I was pleasantly surprised by this feature. The free signals for all markets and the economic events calendar are tools that make engaging with the project interesting. I regularly visit the website and read posts on the Telegram channel due to their intrigue and practical value. I'm glad to be part of this community and to witness its continuous development. Regards, Norah!

7 months ago

Before I started using EASY Bots, I researched and compared different solutions on the market. Among them, I looked at one popular bot that promised very high returns. However, after analyzing reviews and statistics, it became clear that there was a lot of marketing and little transparency. In contrast, everything here seems more balanced: there is clear documentation, real statistics, and the option to start with a demo version. I am still testing it, but I can already see that the team's approach is clearly more professional and accurate. This is what inspires confidence — no grandiose promises, but real work behind the product.

8 months ago

Scalperology AI Global is not just an EA, but a full-fledged algorithmic complex for multi-asset trading. The ability to work simultaneously with currencies, gold, and crypto is a key advantage that cannot be overestimated. Instead of buying different robots for each market, you get a single tool with proven logic. Easy Set Analyze is worth mentioning separately — a function that automatically loads parameters adapted to the current market phase. This saves time and minimizes subjective errors in configuration. Thanks to the global license, I can simultaneously work on several accounts with different configurations, distributing the risk. If you are looking for an advanced solution for a professional approach, Scalperology Global covers this request!

8 months ago

Good bot

8 months ago

I have been working with algorithmic trading systems for over 8 years. Scalperology AI is one of the few solutions where the algorithm demonstrates adaptation to current market conditions. Tested on Tickmill and IC Markets brokers. Configurations S1_Stop and S2_Best showed stable operation at the autorisk level of 1%. The algorithm does not overload the account with excessive trading, and the system actions are consistent and can be analyzed. I would also like to mention Easy Set Analyze - a convenient system of automatic selection of actual configurations for each currency pair. It facilitates setup and eliminates manual errors.

8 months ago

Is trading review before i was using it to gain experience as much as today i have got it

9 months ago

Scalperology AI pleasantly surprised with its accuracy of entries and exits, as well as well thought-out logic of decision-making. Of all the EA I have tested - both paid and free - this particular bot has shown a systematic and stable approach to increasing profits, without chaotic actions. Yes, at the start it may be difficult to understand the site and how exactly the bot works, but the deeper you dive, the clearer it becomes: there is a powerful technical architecture behind the product.Thanks to the technical support who patiently explains everything. This is not a random bot - it is a tool that acts like an experienced trader.

9 months ago

Scalperology AI is a quality tool for those who value stability and control in automated trading. Clear algorithms, well thought-out logic of inputs and a minimum of unnecessary risks. An excellent choice for informed Forex trading.

10 months ago

I have been trading with different EA for many years, tried dozens of systems - I have something to compare it with. I have been using Scalperology AI since August 2024, and now it has pleasantly surprised me, the bot behaves confidently in such an unstable market, where “Trump-triggers” pull volatility. Yes, there are minus trades - that's the market, but the profit covers everything with a reserve. Entries are precise, without unnecessary fuss. A really working tool, especially in such swings!

10 months ago

I bought the Scalperology AI Global version about three weeks ago. Before that I tested different bots and traded manually, but without stability. This bot surprised me: the entries are accurate, the logic is clear, without aggressive averaging or martingale. I launched it on a real account ($1,500) with the recommended sets (Best/Best and S1_Stop). I trade on pairs with minimum spread. For 18 days I got +11.7% profit, drawdown - no more than 3%, not a single day in the minus. Cons? The interface of the site is a bit overloaded, it takes time to understand all the chips and different sets for the bot. But once you do, the scale of the whole system becomes clear. Scalperology AI is a serious product for those who understand that autotrading is not a passive income, but a tool. With the right broker and approach - you can get clean, controlled results without unnecessary nerves. Yes, the price of the bot is not small, but by the third week I have already recovered about 40% of the cost of the license. I recommend it to those who want stability, not chaos on the chart.

10 months ago

During the time of working with Scalperology AI, the bot has never failed: trades are clear, without rash entries. On the advice of technical support, I started with “Best/Best” settings to see how it behaves. to see how it will behave on my account. After several weeks of testing on several accounts with my broker, the result is that the best option for me was the setting of S1_Stop and S1_PayOff on one account. It is in this mode I observe stable profit, without sharp drawdowns. I continue to closely monitor its work and adjust the parameters if necessary. In the long term, it is important not just to launch a bot, but to understand how it interacts with the market.

10 months ago

Scalperology AI pleasantly surprised me with its well-thought-out architecture and focus on safe trading. The system shows stable results even without the use of risky strategies such as martingale, which was a key factor in my choice. The bot reacts flexibly to market changes, and its entries into deals look logical and verified - I don't have to guess why it made this or that decision.

10 months ago

I have been following the project and communicating with the support team for several months, which allowed me to understand the scope of the Easy Bots system from the inside. These are high quality trading bots. None of the bots presented on the MQL5 website has a backend like Easy, and I say this as an IT specialist with 15 years of experience. So, as soon as I found out about the purchase offer they provide to new users, I immediately bought the Global version! Thank you!

11 months ago

I bought Scalperology Ai last week, put it immediately on a real account Tickmill. At the beginning of the trading week, the bot made 7 trades, all winning, to judge of course early but I am very confident in the work and in its long-term success, as previously with other bots, I was difficult to get even a few profitable trades in a week!

11 months ago

I was one of the first customers, then the site and bot was completely different, but I believed and bought the Scalperology version, since then a couple of years have passed and I am always happy with the steady growth and development of the project. The latest update 8.01 , it's just the bomb! I work with ICM in Best/Best mode on all 12 pairs with a minimum drawdown of 7-10% percent per week to the initial deposit. Depends on volatility. Technical support of Easy project demonstrates a high degree of professionalism, and I am sure that their work will continue to please users in the future. Great team and a promising solution!

11 months ago

I successfully completed the challenge at FTMO broker in 3 days using the Scalperology AI bot. This is one of the few bots that I have been able to achieve such a result with for a long time. I am very pleased with the productivity and stability it provided during this challenge!

11 months ago

EASY Scalperology exceeded my expectations by showing a steady increase in profits. During the month the bot has been consistently providing about 7-10% weekly increase to the deposit at icmarkets broker. I plan to open another account with Tickmill or FBS to see how the bot will perform in other conditions and to collect more data for analysis.

12 months ago

EASY Scalperology may not promise instant success, but it offers a measured and methodical approach to forex trading on MetaTrader 5. Its strength lies in providing clarity and consistency, making it a solid choice for those who value rigour in their trading routine. I initially set up my accounts on the S1_EURUSD_Complex network, as it seemed to be effective based on backtests. I decided not to rely on automation as I believe that it is very important to stay abreast of market trends and not to rely entirely on automation - adjusting the settings according to the current market dynamics provides optimal results. For those who are willing to put effort into understanding and fully utilising its functionality, this bot can be an indispensable tool in achieving a well thought out trading strategy.

1 years ago

EASY Scalperology's S1_USDCAD_Complex set file showcases robust risk management with an exceptional 93.24% trade success rate and a minimal balance drawdown of 1%, making it an excellent choice for precision trading in volatile markets.

1 years ago

EASY Scalperology offers a solid performance with customizable options for risk management and execution speed. The ability to apply the best set files automatically stands out, allowing for less manual intervention while adapting to market changes effectively.

1 years ago

I recently dedicated some time to diving deep into the intricacies of the EASY Scalperology bot, and I must admit, it left an impressive mark on my trading experience. With brokers like Pepperstone and IC Markets that offer low spreads and fast execution speeds, the Scalperology bot seamlessly integrates and executes with precision. One of my experiments involved using the S1_Complex set file. The historical performance with a net profit of $439,815.60 from an initial deposit of $10,000 not only caught my attention but also its staggering 93.24% profitable trades, which translated incredibly well to live trading conditions .The robustness of this bot lies in its proactive updates—a crucial factor for navigating volatile markets. The automated application of set files mitigates human error, allowing me to focus on strategic aspects rather than manual configurations. On my account, I had two identically running EURUSD pairs, testing different set files, and the results were remarkable. The adaptive nature of EASY Scalperology makes it a formidable ally for any trader focusing on efficiency and reliability. By ensuring trades conform strictly to identified market patterns, the Scalperology bot consistently delivers solid, repeatable results. For those examining long-term investments with a robust strategy engine, EASY Scalperology is certainly worth considering.

1 years ago

After deploying EASY Scalperology Bot on a live ICMarkets ECN account, I can say that the experience was certainly educational. The flexibility of setting up multiple set files, such as S1_Complex and S1_PayOff, provided a solid testing ground for performance. Each suite file aimed to optimise SL and TP levels, effectively balancing risk and potential returns. While the initial backcasting showed promise, bridging the gap with live results is an ongoing process. One important point was the advantage of using a VPS server close to the broker's server, which minimised latency and slippage, crucial for scalping strategies. The integration of the bot with MetaTrader 5 went smoothly thanks to the detailed guide provided by EASY Bots.

1 years ago

EASY Scalperology makes scalping straightforward with its one-trade-per-currency-pair strategy and numerous currency options. The bot's precision in entry and exit points truly stands out, enhancing profitability.

2 years ago

EASY Scalperology's highlight is its adaptability to both quick and medium-term trades—up to 10 minutes or several hours, suiting different trading styles. The bot ensures only one trade per pair at a time, offering precise risk management. With the AI-powered adaptive system, managing trades has never been easier. Highly recommend for anyone looking for consistent results with minimal intervention.

2 years ago

Utilizing the S1_EURUSD_PayOff set file, EASY Scalperology excels in optimizing risk management while cleverly aligning Stop Loss and Take Profit levels to provide robust scalability and adaptability for diversified forex strategies.

2 years ago

Fine-tuning the EURUSD_Scalper settings, especially the stop-loss and take-profit levels, in combination with crafting personalized set files, reveals the true potential of EASY Scalperology in transforming market volatility into profitable opportunities.

2 years ago

EASY Scalperology truly revolutionized my trading routine. Its advanced AI engine seamlessly analyzes market patterns, turning trading into a less stressful endeavor. It maintains consistent returns by utilizing its precise stop-loss and take-profit strategies. What I appreciated most was the daily loss limitation feature, which provided an extra layer of security in volatile markets. Potential enhancements could focus on expanding its multi-currency support, but even now, Scalperology is a remarkable tool for any passionate trader.

2 years ago

Having traded with various Forex robots over the years, EASY Scalperology stands out for its adaptability and precision. Initially, I was skeptical given its competitors, but what drew me in was its unique ability to adjust strategies based on real-time data, unlike other bots that often follow a rigid, pre-defined path. The bot's integration with MetaTrader 5 was seamless, allowing easy setup with a straightforward interface that made even complex parameter settings accessible to both seasoned and new traders alike.

is an advanced trading bot for the Metatrader 5 platform, developed using the EASY Trading AI strategy. This bot is a true scalper, as there can only be one trade per currency pair at any one time. The scalping frequency can be adjusted by using different set files such as S1, S2, S3 that affect the frequency of trades.

The EASY Scalperology trading robot analyses market data in real time, identifying patterns or patterns of market behaviour that have a high probability of successful movement. After identifying such patterns, the bot automatically opens a trading position and then manages it according to the configured risk management parameters such as Stop Loss and Take Profit.

Installation of EASY Scalperology is done in a few simple steps: -After purchase, go to your personal account at ForexRobotEasy.com and download the trading bot files. Unpack the downloaded archive and copy its contents to the MQL5/Experts folder of your Metatrader 5 trading terminal. -Restart your trading terminal so that it can detect the new bot. -Drag the EASY Scalperology bot to the desired currency pair chart. - In the trading bot settings window, activate the ‘Allow automatic trading’ option and enter your activation keys. - Customise the bot parameters according to your trading requirements and select a suitable set file.

Yes, using a VPS server is mandatory to achieve consistent profitable trades with EASY Scalperology Bot. It is recommended to choose a VPS server located as close as possible to your broker's trading server to minimise signal delays and improve order execution speed. This significantly improves trading efficiency. VPS server is a computer located remotely in a data centre and connected to it via RDP. We recommend using only Windows VPS for EASY bots. More information about this is available in the extended FAQ.

The bot offers features such as stop loss and take profit settings, automatic lot calculation, and advanced risk management settings. This gives traders flexible tools to maximise profits and minimise risks.

We recommend choosing brokers that offer tight spreads and low commissions to reduce trading costs and increase profit potential. Preferably, the broker should have high order execution speed and low slippage, and should be regulated to ensure the safety of your funds and transparency of transactions. Although the trading robot can work with any broker, choosing a reliable broker with low costs will provide the best conditions for successful trading.

Specifying the number of Accounts in the licence conditions means that you can use EASY Scalperology Bot simultaneously on the specified number of trading accounts under one licence key at one point in time. To use other accounts, you need to disable the accounts used so as not to exceed the specified limit.

To enable notifications about new trades from the bot, simply message our bot at t.me/Easydealsbot and enter the command /start. In response, you will receive your unique Telegram ID, which you must then enter in the EA settings. This feature ensures you stay informed about all trading activities in real-time.

You can check the current performance of the EASY Scalperology Bot in the Live Trading section at https://forexroboteasy.com/trading-performance/. Each account name in this section corresponds to the set file being used, which you will receive after your purchase. Additionally, for insights into past performance, be sure to visit the previous results section at https://forexroboteasy.com/category/easy-bots-trading/. These resources will give you a clear picture of how the bot has performed over time and help guide your trading decisions.

Backtests can provide a benchmark of the potential profitability of settings, but the truth is tested in real trading. Our service allows you to monitor the results of sets in real time and on this basis the system can automatically apply the most successful settings.

Yes, you can enable the auto mode of applying set files, which automatically selects the best settings for the current market conditions. This minimises your involvement and makes trading as automated as possible.

The update period is the time during which your trading robot receives current market patterns and strategic updates created by EASY Trading AI. After this period, the robot stops receiving updates, which can affect its efficiency and accuracy as market conditions are constantly changing.

No, we only offer certain update periods that are optimal for testing the real effectiveness of the algorithm over long time periods. The shortest available update period is 4 months. This duration is chosen so that users can adequately evaluate how the algorithm copes with different market conditions and changes.

You can run two identical currency pairs on a single account using the same license key. This flexibility allows you to optimize your trading strategy without the need to purchase additional licenses for the same pairs. For example, if the bot supports currency pairs like EURUSD, GBPUSD, and USDJPY, this means that on one account, you can launch two instances of EURUSD, two charts of GBPUSD, and two charts of USDJPY simultaneously. This capability lends itself to diversifying your trading approach while maximizing the efficiency of the bot.

The license key is limited: - Number of trading accounts to run simultaneously - Supported currency pairs - Supported trading platform - Key for Demo version, works on Demo accounts only - The key works only with the EA it was generated for

Personal Support for the Global version: Users of the Global version receive personal support from a developer who can help with customisation and optimisation. Team Support: Regardless of version, all users have access to support through the AI assistant and our team who can help resolve any issues.

Technical support is available via the Telegram bot, email and chat on the website. These channels provide fast and efficient answers to any questions related to bot usage.

EASY Scalperology stands out by integrating advanced AI technologies that ensure high accuracy and adaptability of trades. In addition, support for multiple trading tools and accounts makes it one of the most flexible and powerful solutions on the market.

When using any trading robot, there is a risk of capital loss, especially if the risk management rules are not followed. It is important to emphasise that since the introduction of EASY Bots, no cases of complete capital loss have been recorded. This is achieved due to the fact that the bot does not keep trades in the market for a long time. Each trade is closed upon reaching the Stop Loss (SL) or Take Profit (TP) level, after which only the next one can be opened. Users are notified of each trade, allowing them to evaluate the results in real time. In addition, the bot has a daily loss limitation function, which prevents the loss of funds beyond the configured limit in one trading day in case of an unfavourable market scenario. Despite the use of advanced algorithms and strategies, EASY Scalperology, like any other trading bot, cannot guarantee 100% success. Forex trading requires active management and constant monitoring, so it is important to regularly check the effectiveness of trading operations. In addition, the trading bot may encounter technical errors or connectivity problems, which can also affect the efficiency of trading operations.

We cannot guarantee a specific profit or success as trading results are highly dependent on many variables including market conditions, risk management settings and the trading strategy chosen. EASY Scalperology uses advanced algorithms to process market data and seeks to maximise profitable trades, however Forex trading always involves risk. Our system is powerful and has great potential for success, especially when used in conjunction with sound money and risk management. Users are advised to test on demo accounts and carefully analyse the results of real trades to determine whether the bot meets their trading expectations.

The EASY Scalperology Bot purchase process is fully automated and takes place on our website. To purchase, you need to go to the product page, select the desired version and click the ‘Buy Now’ button. Only cryptocurrency is available as a payment method, which avoids problems with bank sanctions and simplifies international transactions. After successful payment, you will get immediate access to the robot files and your unique activation keys via your personal account on the website.

The cost of the EASY Scalperology Bot licence reflects the technical complexity and high cost of developing the solutions we provide. The development of the project and trading systems took over three years, during which time we invested approximately $300,000 and a significant amount of time. Working on the project required building complex database systems, developing an EASY Trading AI strategy, and numerous iterations to achieve optimal performance. In addition, it costs approximately $4,000 monthly to maintain the project infrastructure, including salaries for the development team, SMM specialists and support team. These investments are essential to maintain high quality services and ensure the reliability and stability of our trading systems. EASY Scalperology Bot is a product designed to work effectively in challenging market conditions, with all the features necessary for consistent profitability. We provide a ready-to-use solution that eliminates the need to develop, configure and test your own trading systems. This allows traders to focus on trading rather than the technical aspects of creating and maintaining trading algorithms.

The cost of an EASY Scalperology Bot licence depends on a number of factors and is subject to change over time. The main reasons for this flexible pricing policy include the high financial costs associated with developing and maintaining the product, as well as the desire to maintain a stable and constant flow of customers. We have the ability to service tens of thousands of trading accounts simultaneously through the use of Node.js and powerful multiprocessor servers, but our human resources for customer support are limited. Therefore, we cannot offer the perfect combination of price and availability that would satisfy all requests and be perfectly balanced at all times. Our flexible pricing policy helps us to adapt to the different needs and capabilities of our clients. For traders with smaller deposits, the return on investment can take several months, while clients with larger deposits can see a payback within days. Depending on the current load on our systems and our clients' demand, we may offer lower or higher prices to ensure we provide the best value for money service. We regularly conduct experiments and reserve the right to change the licence price and terms and conditions depending on current market conditions and the company's strategic decisions. If the current licence terms and conditions seem acceptable to you, we recommend that you do not delay your purchase, as these terms may change in the future.

To activate EASY Scalperology Bot, you need to enter the licence key that you will receive after purchase. AI Access ID and AI Access Key. These keys are used for authentication and licence validation. The file with the licence keys should be placed in a designated folder inside your trading terminal at the path /MQL5/Experts/Files/scalperology.txt. The name of this file can be any. The main thing is to specify this name in the EA settings. This solution saves you from having to enter the licence key on each chart separately.

A product

Auto Adapt EA Settings

Set Analysis System

How Install EA?

Results From Live

Trading instruments

Participants

Authorization is available only on the main domain - forexroboteasy.com