Navigating the financial markets can feel like tightrope walking without a safety net. Enter MetaTrader 4 (MT4), a platform that offers a plethora of tools to help traders manage risk effectively. In this article, we will explore best practices for risk management in MT4, ensuring that your trading journey is both safe and profitable. From setting appropriate stop-loss levels to leveraging automated risk management tools, we’ll cover essential strategies to protect your capital. And remember, in trading, the only thing that should be sky-high is your profits, not your blood pressure.

Risk and Reward: The Art of Setting Stop Loss and Take Profit in MT4

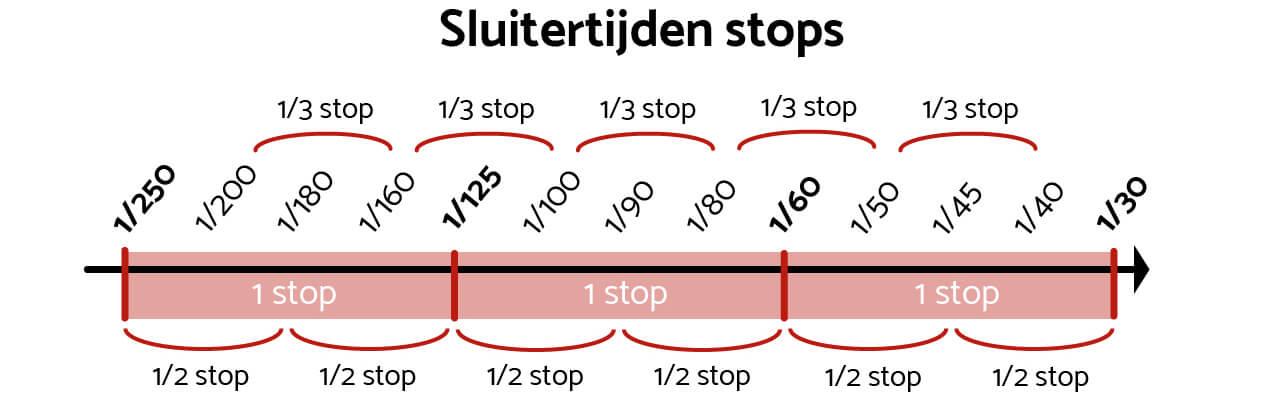

Setting stop loss and take profit levels is both an art and a science that can significantly impact the success of your trading strategy. Utilizing tools like the Average True Range (ATR) indicator can help determine appropriate levels by accounting for market volatility. For instance, if the current ATR is 20, you might set your stop loss 40 points away from your entry price using a multiplier of 2. This provides a buffer against sudden price movements while limiting potential losses. Similarly, for take profit, a multiplier of 3 could place your target 60 points away from the entry, allowing you to capture larger market moves while still considering volatility.

In addition to ATR-based strategies, tools like the Trade Dashboard in MT4 can streamline the process by allowing you to set stop loss and take profit levels visually on the chart. This tool can also calculate the appropriate lot size based on your risk tolerance and automatically adjust these levels as the trade progresses. Features like trailing stop loss and partial close options further enhance your ability to manage trades dynamically, ensuring you lock in profits and minimize losses effectively.

Trailing Stops vs. Fixed Stops: Which is Better for Risk Management?

When it comes to protecting profits and managing risk, traders often face the dilemma of choosing between trailing stops and fixed stops. Trailing stops offer a dynamic approach, adjusting the stop-loss level as the market price moves in favor of the trade. This method ensures that as the price climbs, the stop-loss follows at a predetermined distance, locking in profits while still allowing the trade to capitalize on potential further gains. For instance, an EA might use a trailing stop that advances upward in an uptrend until the close crosses under the trailing line, thereby securing profits without requiring constant manual adjustments.

On the other hand, fixed stops provide a more straightforward, static approach. They are set at a specific level and remain unchanged regardless of market movements. This simplicity can be advantageous, especially in volatile markets where frequent adjustments could lead to premature exits. For example, setting a stop-loss level at a key Fibonacci retracement level can provide a clear exit strategy that withstands short-term market noise. However, the rigidity of fixed stops can sometimes result in missed opportunities if the market continues to move favorably beyond the stop level. Ultimately, the choice between trailing and fixed stops depends on the trader’s strategy and risk tolerance.

Case Study: How the Ultra AI Pro Bot Manages Risk with ATR and Fibonacci Levels

The Ultra AI Pro Bot employs a robust risk management system centered around the Average True Range (ATR) and Fibonacci levels. By leveraging the daily ATR movement, the bot defines precise risk thresholds, ensuring that traders can navigate volatile markets with confidence. The bot’s position gap feature allows traders to manage the spacing between positions above and below the market price, providing a balanced approach to capturing favorable market shifts while minimizing exposure during adverse movements. Additionally, the integration of high Fibonacci levels enhances this risk management framework, enabling traders to ride market momentum with an added layer of safety.

For instance, if a trade signal is generated, the bot waits for the current candle to close to confirm the signal’s validity. It then checks the ATR value to determine appropriate stop-loss and take-profit levels, ensuring the trade aligns with current market volatility. By entering the trade at the start of the next candle, the bot ensures momentum is on its side. Moreover, the bot uses trailing stops and Fibonacci retracement levels to dynamically adjust stop-loss and take-profit points, ensuring that trades are not only profitable but also protected against sudden market reversals. This meticulous approach allows traders to strategically manage their trades with a blend of technical precision and adaptive risk management.

The Role of Martingale Strategies in Risk Management: An In-depth Look

Martingale strategies often involve doubling the trade size after a loss to recover previous losses and gain a small profit. While this sounds mathematically sound, it can lead to significant risks if not managed properly. In a ranging market, martingale strategies can be quite effective, efficiently opening and closing positions without substantial drawdown. However, during periods of high volatility or trending markets, the risk of incurring large losses increases. To mitigate this, some EAs offer features like a ‘Max Lot’ parameter to cap the maximum trade size, a ‘Max Trades’ parameter to limit the number of trades, and a virtual Stop Loss to close all positions when a certain drawdown level is reached.

Furthermore, some advanced EAs incorporate additional risk management measures. For instance, implementing a ‘Late Start’ option allows the martingale strategy to activate only after a series of trades, thus avoiding immediate exposure to market uncertainties. Integrating these features helps traders customize their risk exposure according to their account size and market conditions. It’s also essential to consider factors like trading sessions, as volatility can vary significantly across different times of the day. By employing such comprehensive risk management tools, traders can harness the potential of martingale strategies while safeguarding their capital from the inherent risks.

Virtual Stop Loss: A Hidden Gem for Protecting Your Trades

Virtual Stop Loss, often overlooked, offers a unique advantage by keeping your stop loss levels hidden from your broker. This can be particularly useful in markets where stop hunting is prevalent. By setting a virtual stop loss, traders can avoid having their stop loss levels targeted by brokers or other market participants. This approach ensures that your stop loss is only triggered on your trading platform, not on the broker’s server. Not only does this provide an additional layer of security, but it also allows for more precise control over your trades, especially in volatile market conditions.

Moreover, virtual stop loss can be seamlessly integrated with other advanced features like trailing stops and break-even points. For example, you can set a virtual trailing stop that adjusts as the market moves in your favor, locking in profits while keeping the stop loss hidden. This combination of virtual stop loss and trailing stop can significantly enhance your risk management strategy, providing a dynamic approach to protecting your trades. Additionally, the ability to set break-even points virtually allows traders to secure positions without revealing their strategy to the broker, further optimizing the trading process.

Comparing Risk Management Techniques in Popular MT4 Trading Robots

When it comes to managing risk in MT4 trading robots, one cannot overlook the adept use of stop loss and take profit orders. Stop loss orders are designed to limit potential losses by automatically closing a trade when the market moves against the trader beyond a certain point. For instance, a forex robot might set a stop loss at 2% of the account balance, ensuring that no single trade can wipe out more than that percentage of the trader’s capital. This technique is crucial for maintaining long-term profitability and avoiding catastrophic losses. Additionally, take profit orders help lock in gains by closing a trade once it has reached a predetermined profit level, thus securing profits without the need for constant monitoring.

Another vital aspect of risk management embedded in these trading robots is position sizing. This technique involves adjusting the size of each trade based on the trader’s account balance and risk tolerance. For example, a robot might use a fixed lot size for trades, or it might calculate the lot size dynamically based on a percentage of the account balance. This ensures that the risk taken on each trade is proportional to the account size, preventing overexposure and promoting a more balanced approach to trading. By combining these strategies, MT4 trading robots not only aim to maximize profits but also to safeguard the trader’s capital against significant market fluctuations.

Q&A

Q&A: Risk Management in MT4: Best Practices

Q: What is the importance of risk management in MT4 trading?

A: Risk management is crucial in MT4 trading because it helps protect your capital from significant losses. By setting appropriate risk parameters, traders can ensure that they do not overexpose themselves to market volatility and maintain consistent profitability over time.

Q: What are some of the best practices for risk management in MT4?

A: Some of the best practices for risk management in MT4 include using stop-loss and take-profit orders, setting maximum allowable lot sizes, controlling the number of trades per day, and avoiding overtrading. Additionally, employing tools like virtual stop loss and trailing stop can help mitigate risks effectively.

Q: How can I set a stop loss and take profit in MT4?

A: To set a stop loss and take profit in MT4, you need to open a trade order window, where you can specify the stop loss and take profit levels. These levels should be based on your trading strategy and market analysis, ensuring they align with your risk tolerance and target profit objectives.

Q: What is a virtual stop loss, and how does it work?

A: A virtual stop loss is a risk management feature that automatically closes all open positions when a specified drawdown level is reached. This helps in mitigating potential larger risks by ensuring that losses do not exceed a predefined amount, providing an additional layer of safety.

Q: How can I avoid overtrading in MT4?

A: To avoid overtrading in MT4, you can set limits on the number of trades you make per day, week, or month. Using tools that enforce these limits can help you stick to your trading plan and prevent emotional or revenge trading, which often leads to significant losses.

Q: What role does leverage play in risk management?

A: Leverage can significantly amplify both profits and losses. It is essential to use leverage cautiously, keeping it between 1:1 and 1:5 to avoid excessive risk. While higher leverage can lead to higher returns, it also increases the potential for substantial losses, making prudent leverage management a key aspect of risk control.

Q: How can I use the MT4 platform to manage risk for multiple trades?

A: MT4 offers several tools to manage risk for multiple trades, including setting maximum allowable lot sizes, limiting the number of open trades, and using trailing stops. Additionally, you can employ expert advisors (EAs) that automate risk management functions, ensuring consistent application of your risk parameters across all trades.

Q: What are the benefits of using a risk management expert advisor (EA) in MT4?

A: Using a risk management EA in MT4 can automate many aspects of risk control, such as setting stop losses, take profits, and managing trade sizes. This not only saves time but also ensures that risk management rules are consistently applied, reducing the chances of human error and emotional decision-making.

Q: Can you explain the concept of trailing stop in MT4?

A: A trailing stop is a type of stop loss that moves with the market price. As the price moves in your favor, the trailing stop adjusts to lock in profits while still allowing the trade to run. This helps maximize potential gains while protecting against reversals and unexpected market movements.

Q: What is the significance of setting a maximum daily loss limit?

A: Setting a maximum daily loss limit ensures that you do not lose more than a certain percentage of your account balance in a single day. This helps preserve your trading capital and prevents significant drawdowns that can be difficult to recover from. It also promotes disciplined trading by enforcing a stop to trading activities once the loss limit is reached.

Final Thoughts

As we close the chapter on the intricate art of risk management in MT4, remember that the market is a wild beast, unpredictable and untamed. But with the right strategies and tools, you can ride the waves instead of being swallowed by them. Keep your stops tight, your emotions in check, and your strategies robust. After all, in the grand theater of forex trading, it’s not just about making a profit—it’s about surviving to trade another day. Happy trading, and may your pips be plentiful!