Edition:

At this time, purchasing EASY Bot items is not available to all members. Read more - how to get access to purchase

Reviews 7

Edition:

AUD/USD

AUD/USD

AUD/JPY

AUD/JPY

EASY Breakopedia Bot is a sophisticated trading system grounded in EASY Trading AI. It is designed to identify key market patterns, preceding significant movements, while using a level breakout indicator for signal verification. This additional verification step aims to exclude potentially weak trades, offering a theoretically more reliable approach.

Key Characteristics and Benefits

Advanced Pattern Recognition: The integration of EASY Trading AI enables the bot to analyze countless market conditions continuously, providing precision and efficiency in trade execution. The unique feature of using a breakout indicator further refines trade decisions by ensuring signals align with prominent market breakouts.

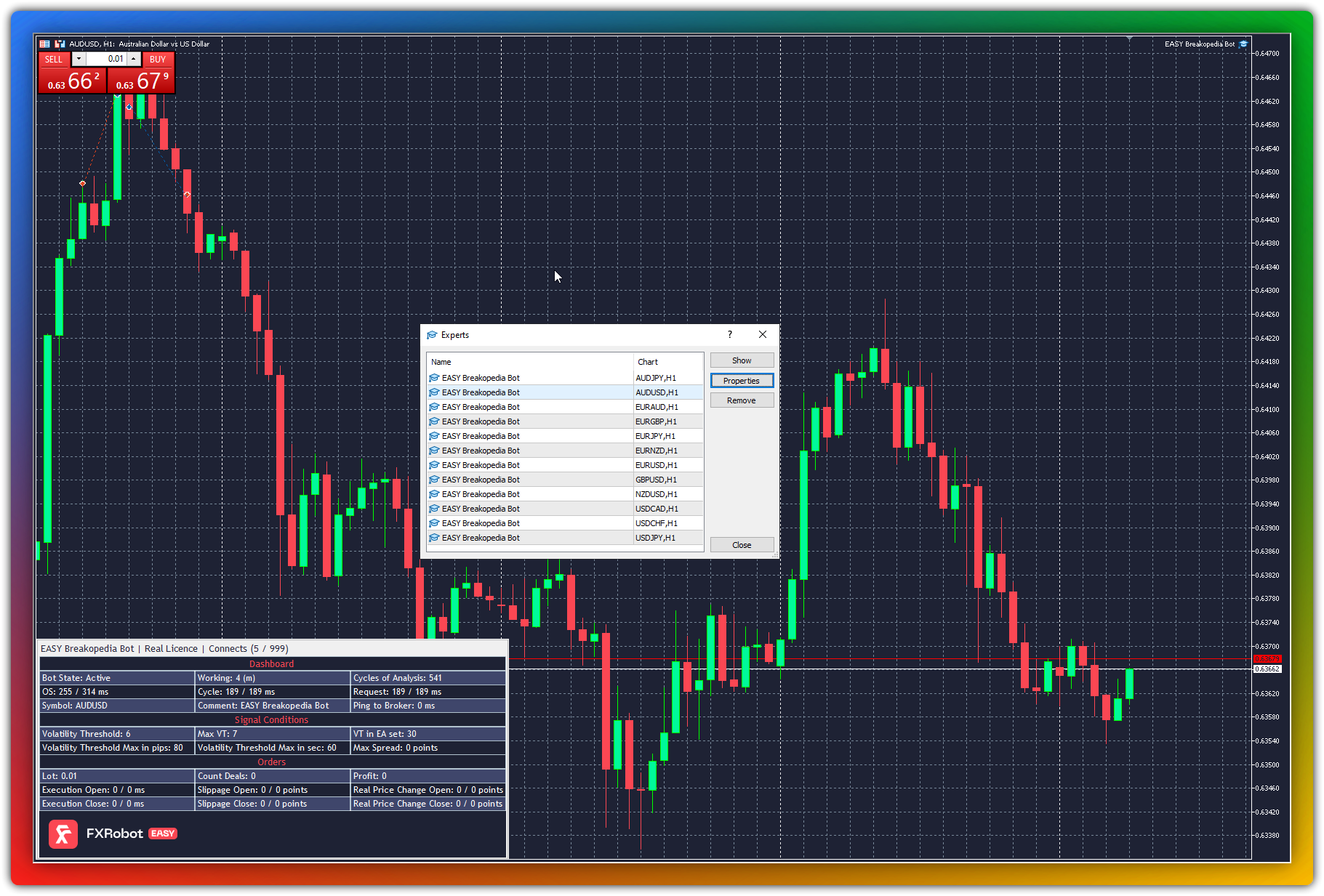

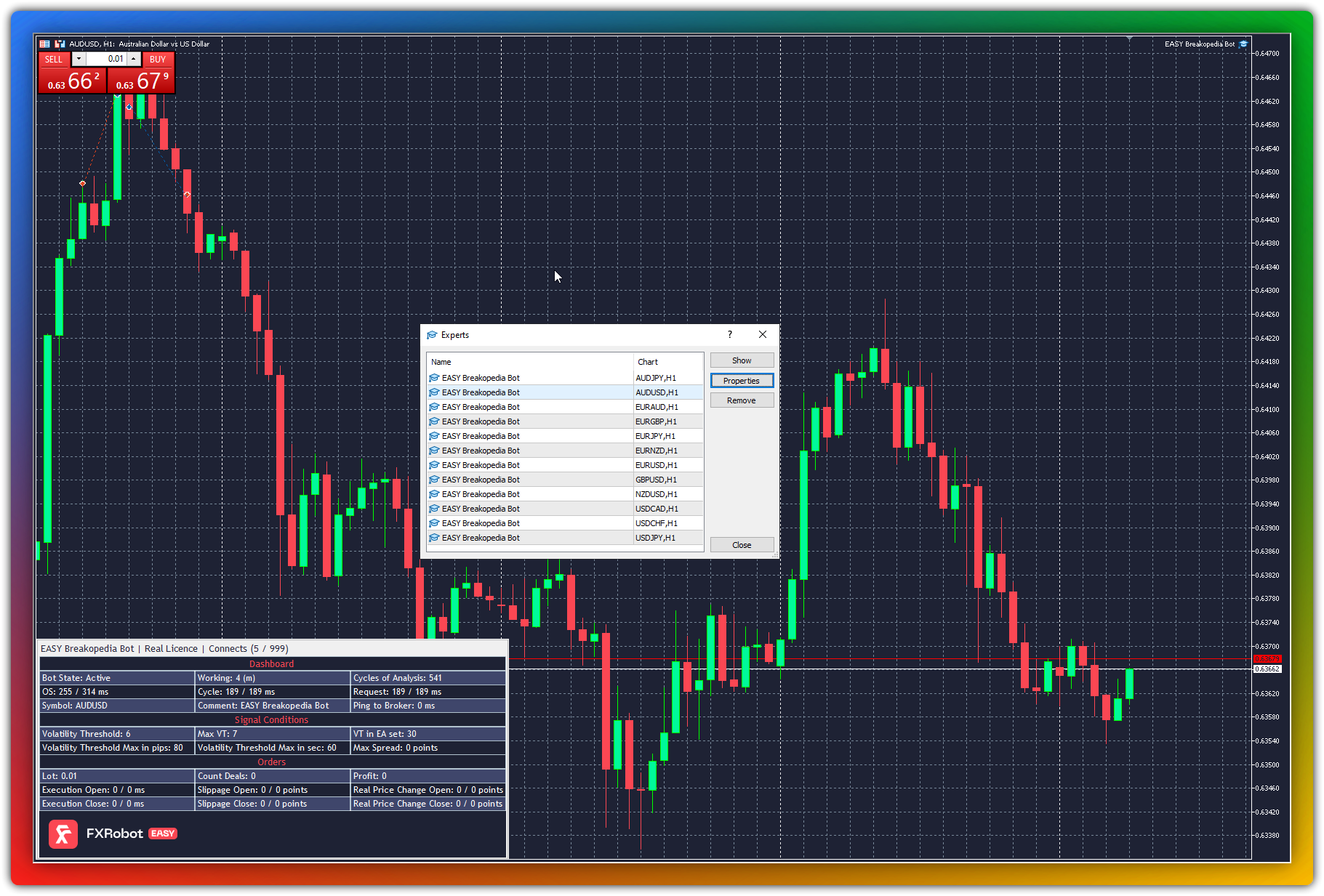

Practical Implementation: The bot swiftly installs on any Metatrader 5 chart, automatically applying the most optimal settings from our EASY Set Analyze system. Users have the flexibility to select settings via the ‘Best of the Best’ approach or specific methods (1, 2, 3). There’s also an option for manual configuration, allowing traders to tailor the solution to their specific needs.

Trading Scope and Instrumentation: While EASY Breakopedia Bot may have a slightly lower profitability compared to the Scalperology Bot, its use of breakout verification enhances reliability. Traders can engage with numerous trading instruments, providing widened market access without the commitment of higher-risk strategies.

Shared Licensing Conditions: Mirroring Scalperology Bot, the licensing for Breakopedia Bot allows simultaneous operation on 4 trading accounts, offering flexibility and ease of access. This feature ensures that traders can efficiently manage multiple accounts without additional constraints.

Cost Efficiency

Despite its sophisticated analytical capabilities, EASY Breakopedia Bot is offered at a lower price point, making it an accessible option for traders seeking reliable signal verification without the need for more aggressive trading styles

Additional Information

Explore with us the power of structured trading with EASY Breakopedia Bot and improve your trading strategy without the hassle of risky moves.

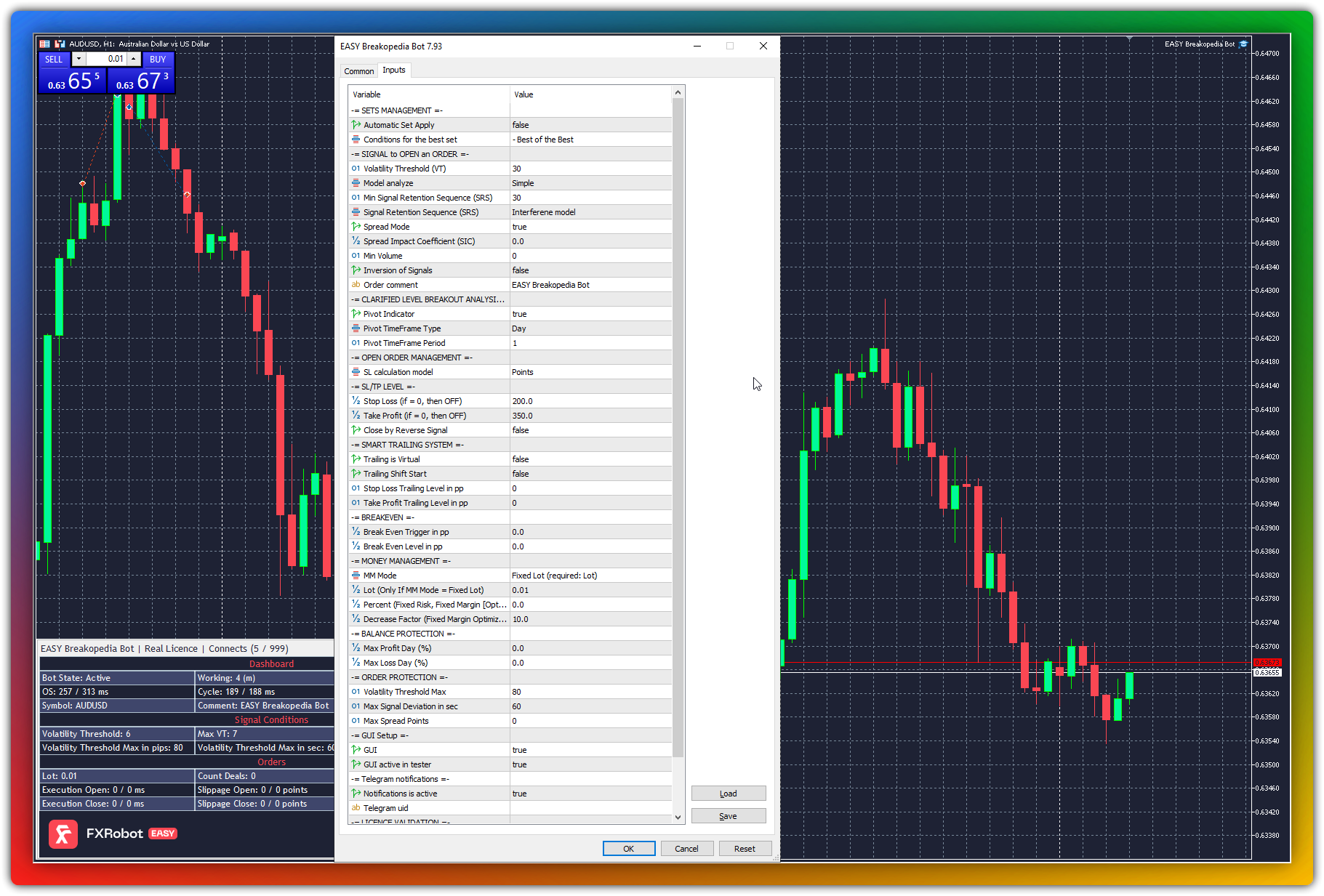

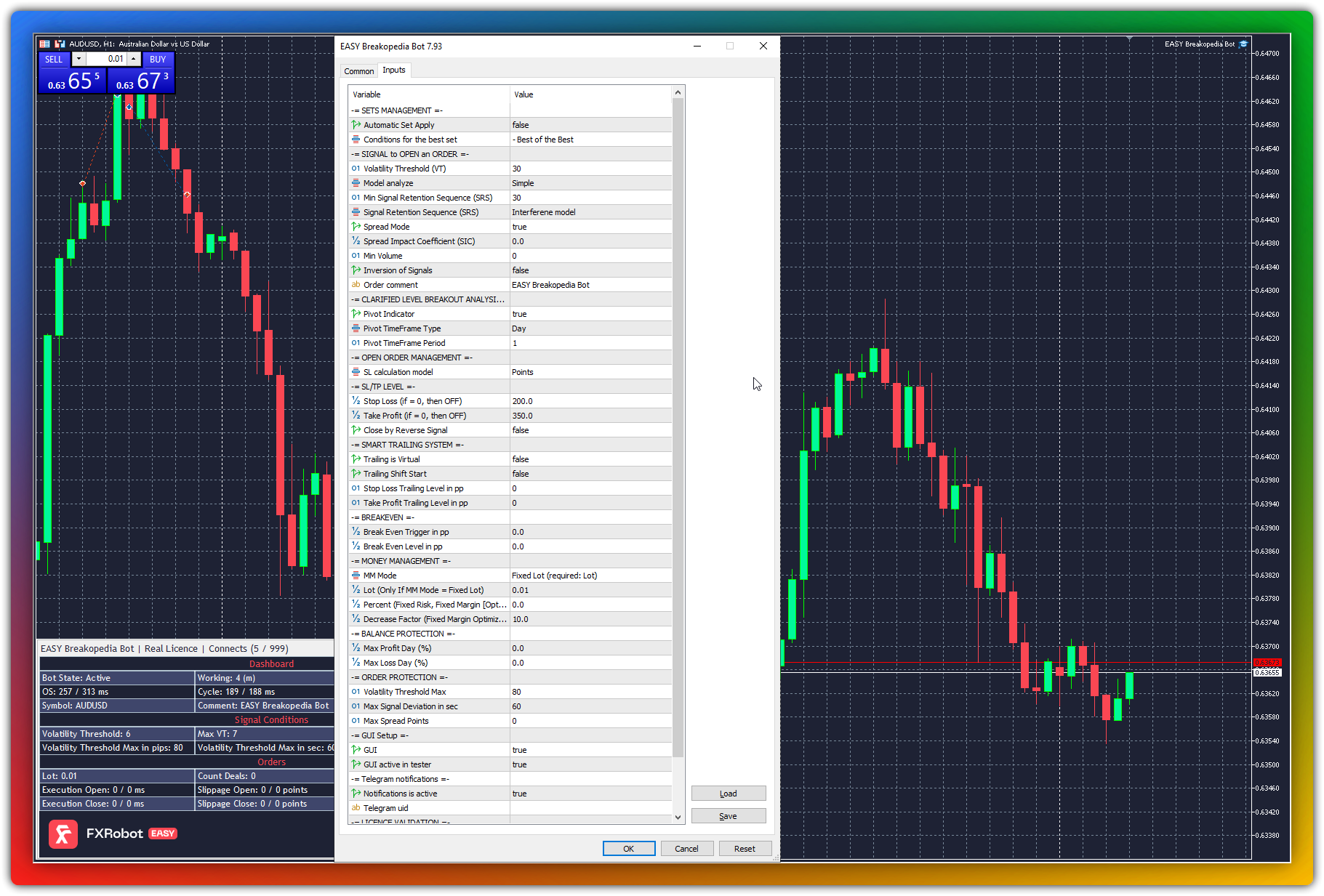

| Parametr | Value | Type | Unit | Description |

|---|---|---|

| -= SETS MANAGEMENT =- | ||

| Automatic Set Apply | True/False | When enabled (True), the bot fetches and applies the optimal set configurations from our server based on predefined ‘Conditions for the best set’. |

| Conditions for the best set | Method/Best | Detailed information on optimization methods can be found in the FAQ section. When set to ‘Best’, the bot selects the most profitable configuration across all methods. |

| -= SIGNAL to OPEN an ORDER =- | ||

| Volatility Threshold (VT) | 5-50 | The threshold level defining market volatility required to trigger a trade. Higher values limit the analysis to fewer models, reducing trade frequency but potentially increasing accuracy. |

| Model analyze | Simple | This setting uses a simplistic model for market analysis; more complex models are planned for future integration, enhancing predictive accuracy. |

| Min Signal Retention Sequence (SRS) | 10-30 Points | This parameter defines how long a signal must persist in validating market conditions for a trade to be executed, ensuring that trades are based on substantiated market movements. |

| Signal Retention Sequence (SRS) | Interference / The purest | The choice of model affects the frequency and accuracy of trades: ‘Interference’ allows more frequent trades with varied accuracy, and ‘The purest’ focuses on fewer, more accurate trades. |

| Spread Mode | True/False | If set to True, the trading decision takes the current spread into account, increasing the likelihood of immediate profitability post-trade execution. |

| Spread Impact Coefficient (SIC) | 0-2.1 Unit: Coefficient (dimensionless). |

Interacts with Spread Mode; defines how profoundly spread impacts trade decisions. A higher value (e.g., 2) signifies a higher threshold for trade activation, potentially enhancing profit margins by avoiding trades in higher-spread conditions. |

| Min Volume | 100 Unit: Lots. |

This setting ensures an adequate market volume is present before executing a trade, minimizing potential slippage and safeguarding trade entry quality. |

| Inversion of Signals | True/False | If set to True, the bot inverts the trade direction based on received signals, offering strategy flexibility and potential risk management benefits. |

| Order Comment | EASY Scalperology Bot | Each trade will carry this comment, making it easier to track and analyze trades specifically executed by this bot within trading history. |

| -= OPEN ORDER MANAGEMENT =- | ||

| SL calculation model | Points/Percent | This parameter allows traders to choose how the Stop Loss level is calculated, either in points or as a percentage of the entry price, enabling precision in risk management settings. |

| -= SL/TP LEVEL =- | ||

| Stop Loss (if = 0, then OFF) | 1-9999 Points. | Configures the Stop Loss level to protect against significant losses. If set to ‘0’, the feature is disabled, otherwise, it adjusts the stop level within the specified range. |

| Take Profit (if = 0, then OFF) | 1-9999 Points. | Sets the Take Profit level where the trade will close when the desired profit is reached. If set to ‘0’, this function is disabled. |

| Close by Reverse Signal | True/False | Enables the trade to close based on a reverse signal, preventing potential losses from adverse market movements and securing profits by timely exits. |

| -= SMART TRAILING SYSTEM =- | ||

| Trailing is Virtual | True/False | Determines whether trailing stops are displayed to brokers (False) or managed internally within the system (True) to conceal strategy details. |

| Trailing Shift Start | True/False | Specifies when the trailing stop begins to follow the price movement; if True, trailing commences only after the trade becomes profitable. |

| Stop Loss Trailing Level in pp | 80 | Defines the distance for dynamically adjusting trailing stops as the market price moves in favor, enhancing profit protection. |

| Take Profit Trailing Level in pp | 140 | Adjusts the trailing limit for taking profit to capture favorable market movements beyond the initial take profit level. |

| -= BREAKEVEN =- | ||

| Break Even Trigger in pp | 30 | Sets the amount of profit in points at which the Stop Loss is adjusted to the breakeven point, thereby eliminating risk on the trade. |

| Break Even Level in pp | 10 | Defines the exact level to which the Stop Loss is adjusted once breakeven is triggered, securing no loss on the position. |

| -= MONEY MANAGEMENT =- | ||

| MM Mode | Fixed Lot | Select from options like Fixed Lot, Fixed Risk, Fixed Margin, or Fixed Margin Optimized to tailor the capital management strategy to your trading preferences and risk tolerance. |

| Lot (Only If MM Mode = Fixed Lot) | 0.01 | Specifies the exact lot size to be used per trade, providing a consistent and manageable risk on each trade. |

| Percent (Fixed Risk, Fixed Margin [Optimized]) | 1 | Determines the percentage of the account balance that will be risked per trade, enabling dynamic adjustment of trade size based on account equity. |

| Decrease Factor (Fixed Margin Optimized) | 2 | Used in Fixed Margin Optimized mode to dynamically adjust the trade size based on the performance and market conditions. |

| -= BALANCE PROTECTION =- | ||

| Max Profit Day (%) | 30 | Automatically stops trading when a specified percentage of profit is reached within a day, locking in gains and preventing over-trading. |

| Max Loss Day (%) | 10 | Halts all trading activities if losses exceed a set percentage of the account balance for the day, protecting the trader from significant declines. |

| -= ORDER PROTECTION =- | ||

| Volatility Threshold Max | 60 | Restricts trading during periods of extreme market volatility which is identified when the volatility exceeds the set threshold, reducing the risk of big losses during turbulent conditions. |

| Max Signal Deviation in sec | 1 Seconds. | Ensures that trade executions are based on the most up-to-date signal data by allowing only a minimal deviation in signal timing. |

| Max Spread Points | 30 | Limits trading to conditions where the spread is below a predefined point level, ensuring cost-efficient entry and exit. |

| -= CLARIFIED LEVEL BREAKOUT ANALYSIS =- | ||

| Pivot TimeFrame Type | Defines the timeframe for which the pivot points are calculated, impacting the adaptability of the strategy to various market conditions. | |

| Pivot TimeFrame Period | Specifies the period over which the pivot points are analyzed, allowing traders to adapt the bot’s sensitivity to specific market dynamics. | |

| -= GUI Setup =- | ||

| GUI | Enables or disables the graphical user interface on the chart. It is recommended not to enable it on all charts as it is resource-intensive. | |

| -= Telegram notifications =- | ||

| Notifications is active | Enable or disable sending trade notifications via Telegram, providing users with real-time updates about new trades. | |

| Telegram uid | Your unique Telegram identifier, obtained after initiating the bot @Easydealsbot, used for personalized notifications. | |

| -= LICENCE VALIDATION =- | ||

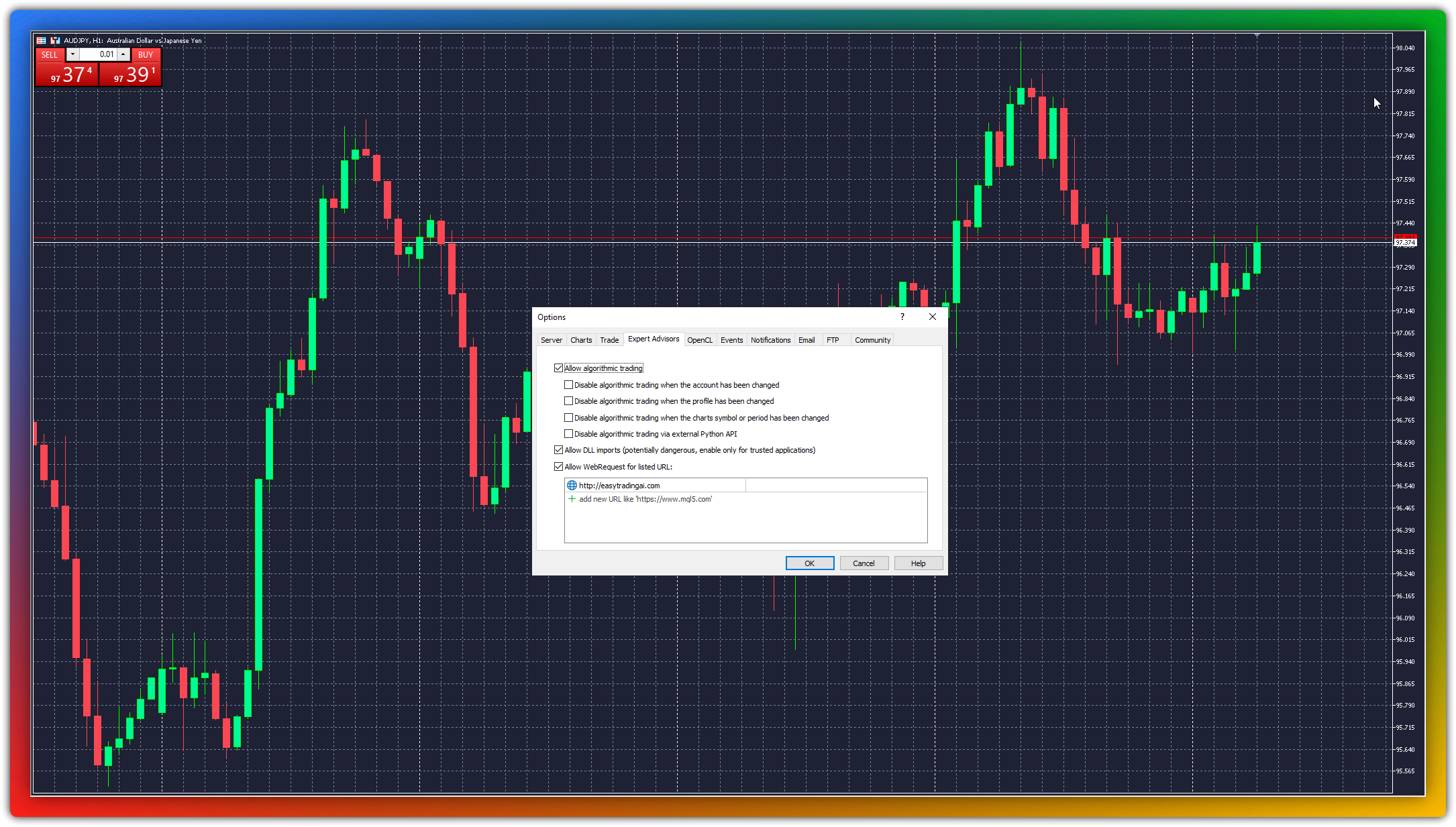

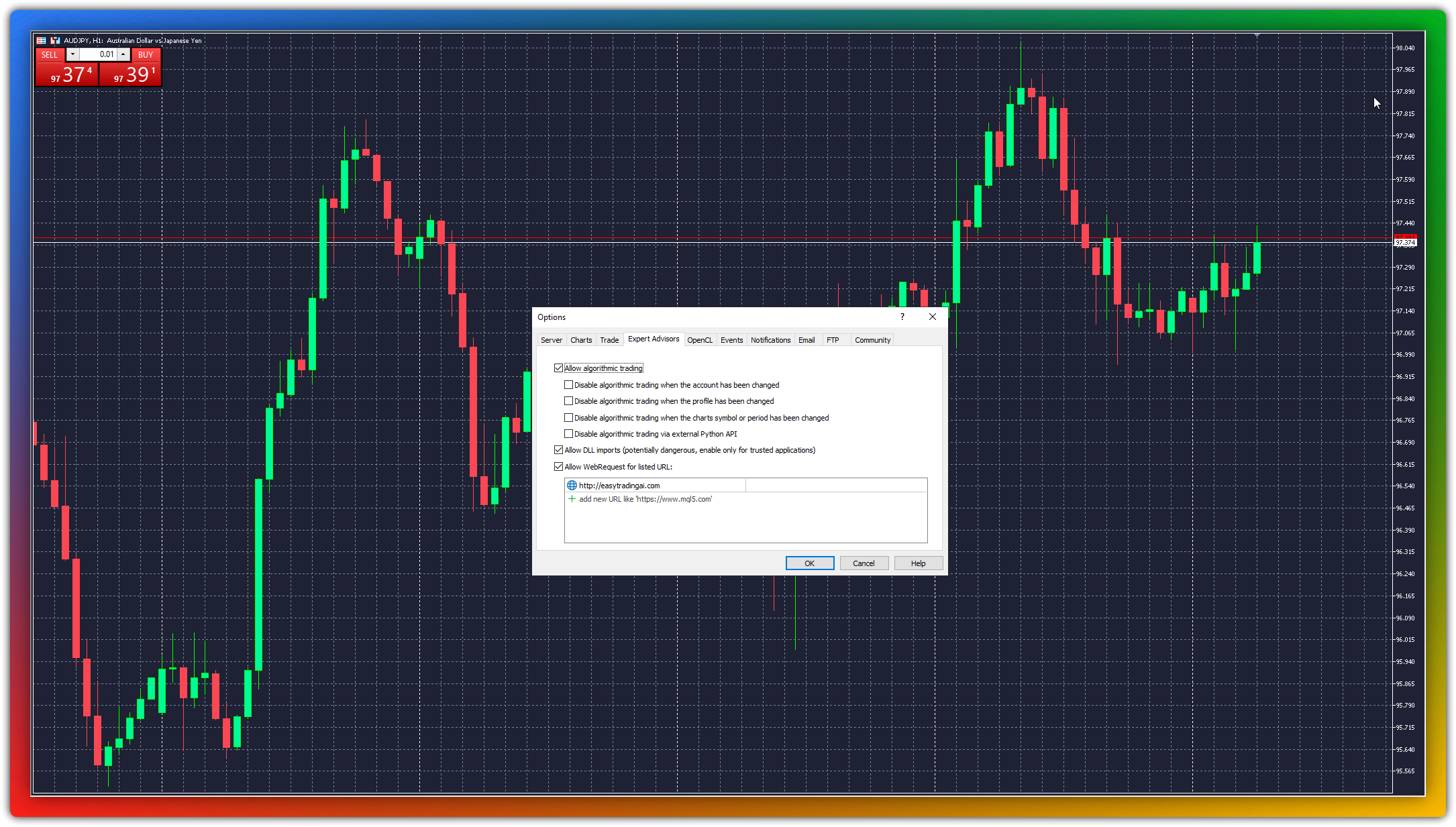

| URL or IP | http://easytradingai.com | Specifies the domain http://easytradingai.com for license validation. |

| Original Symbol | If the symbol name at your broker differs from the standard notation, specify it here for successful license authentication. | |

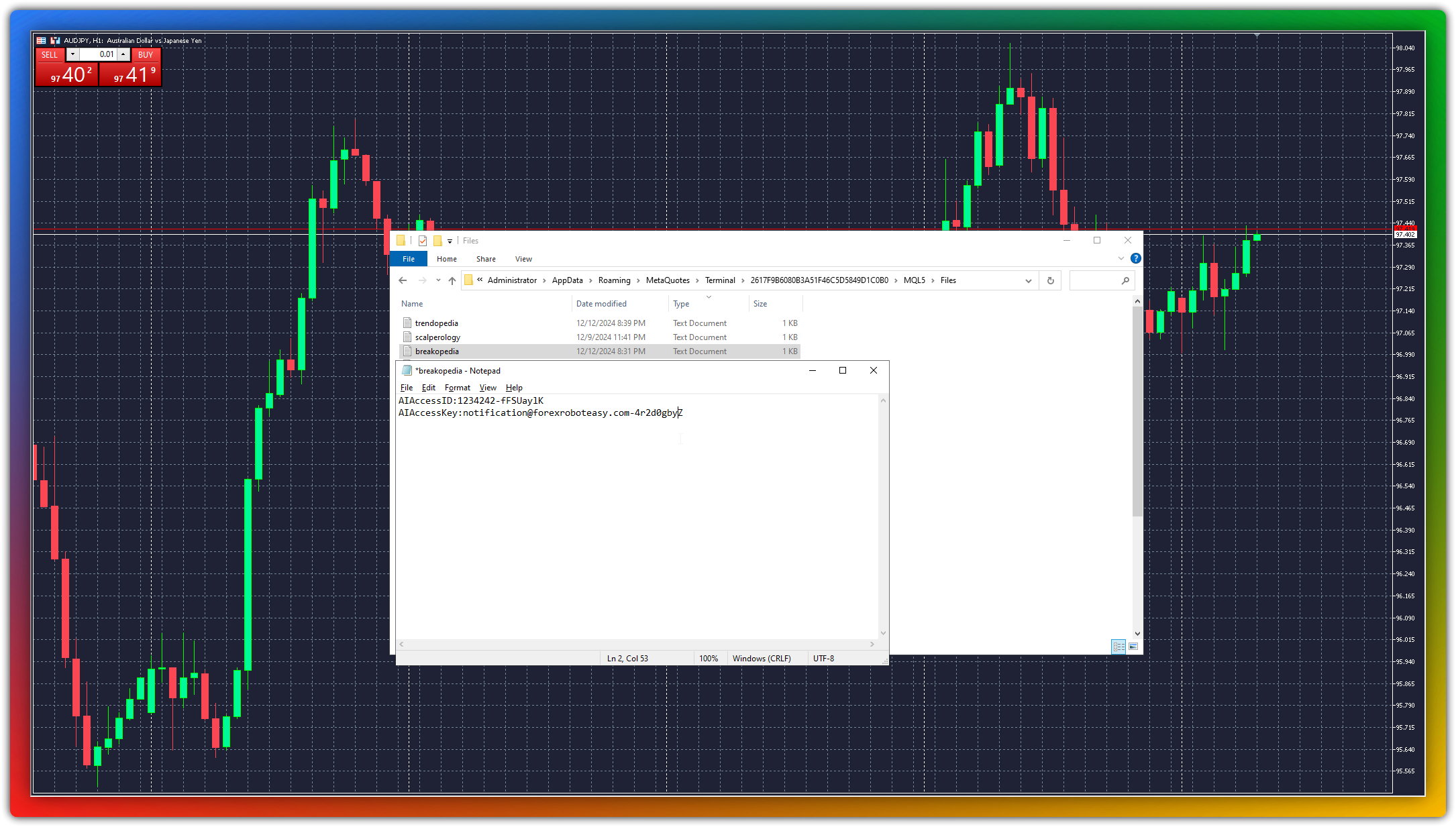

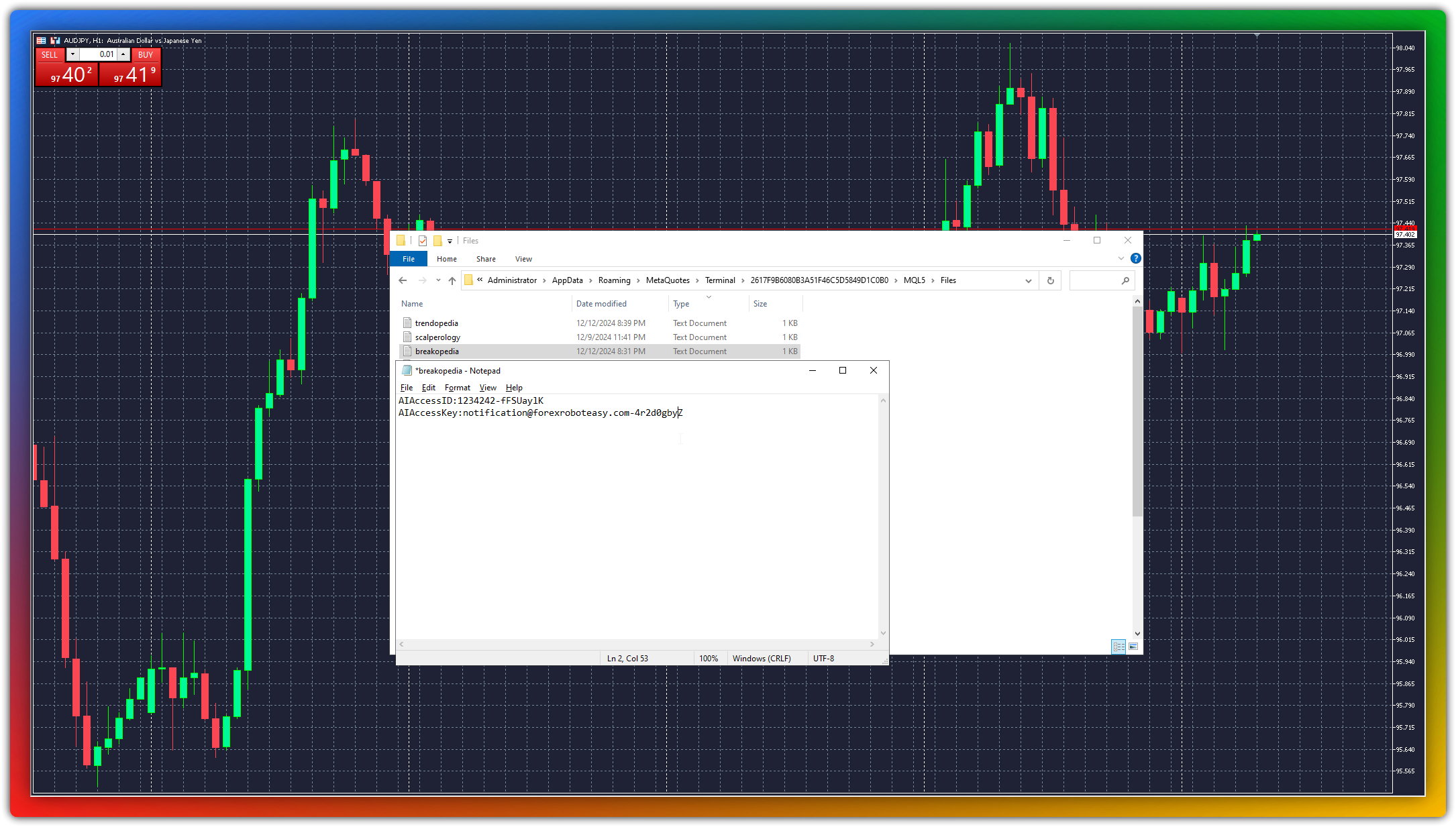

| Configuration file | breakopedia.txt | The configuration file must be located in the \MQL5\Files directory for proper bot operation. |

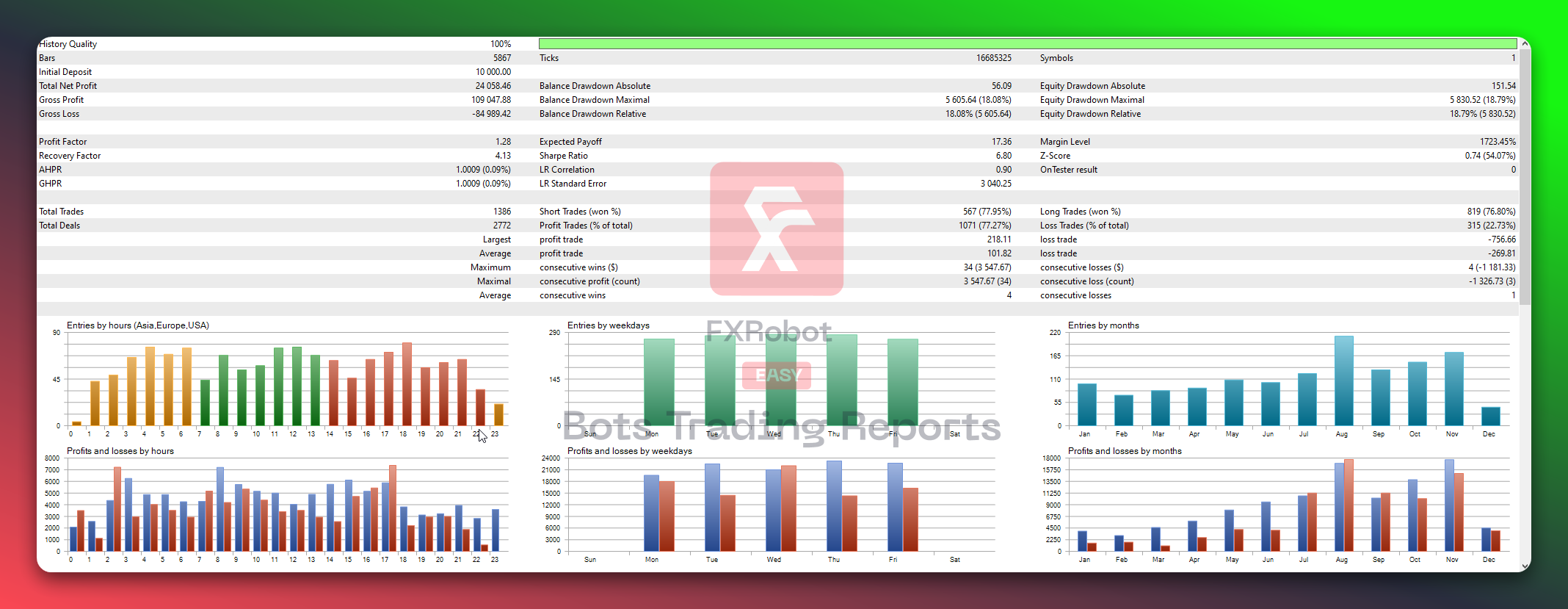

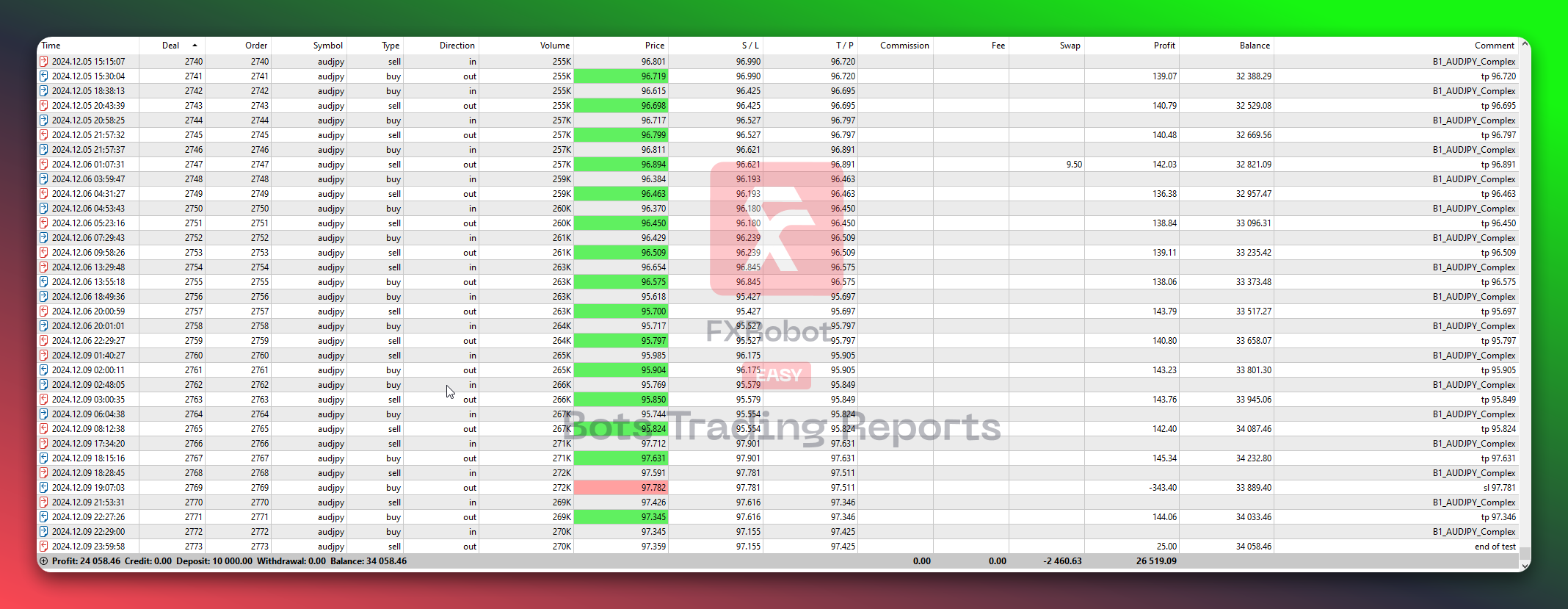

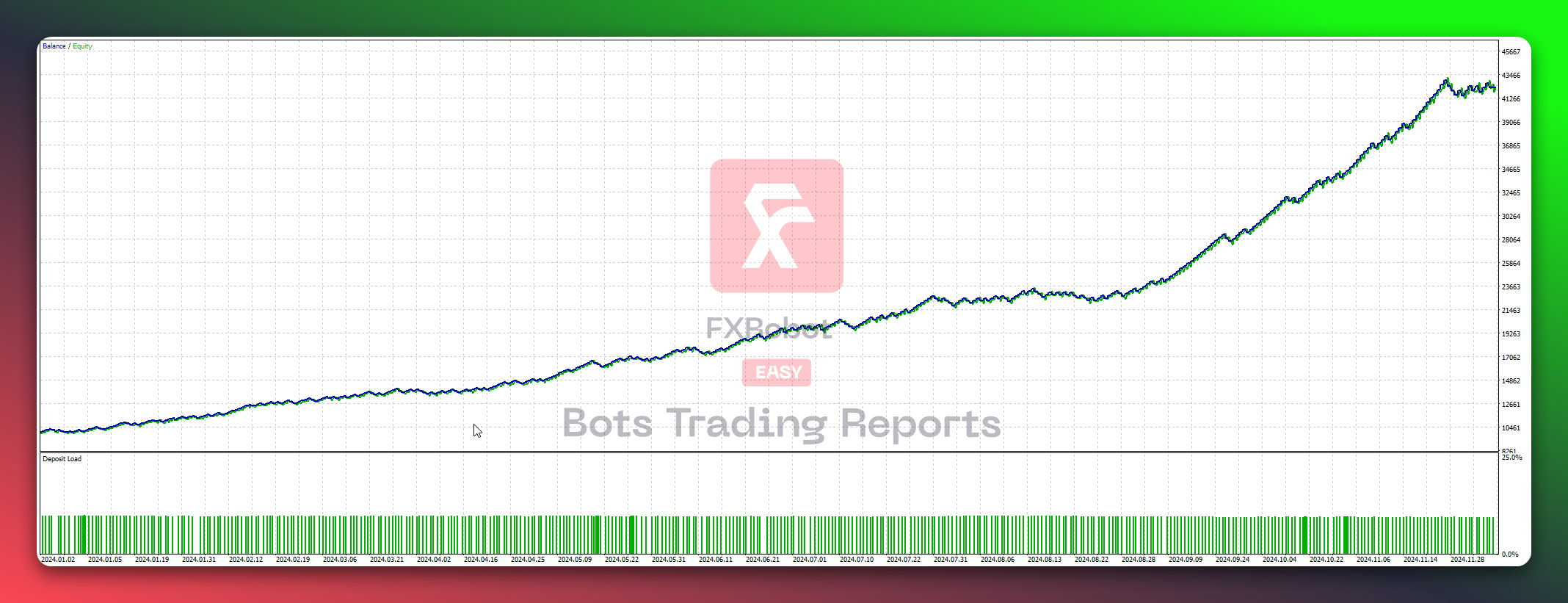

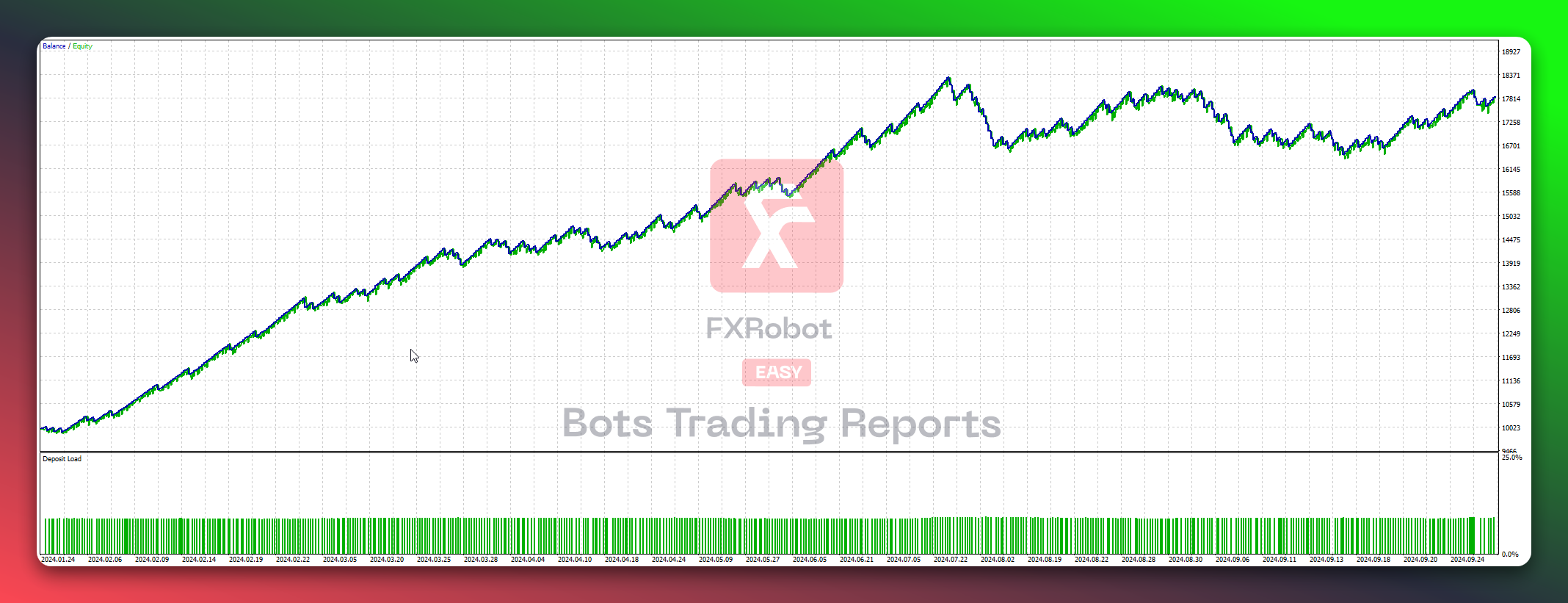

H1 (2024.01.01 - 2024.12.10)

10000.00$

24058.46$

Success in numbers!

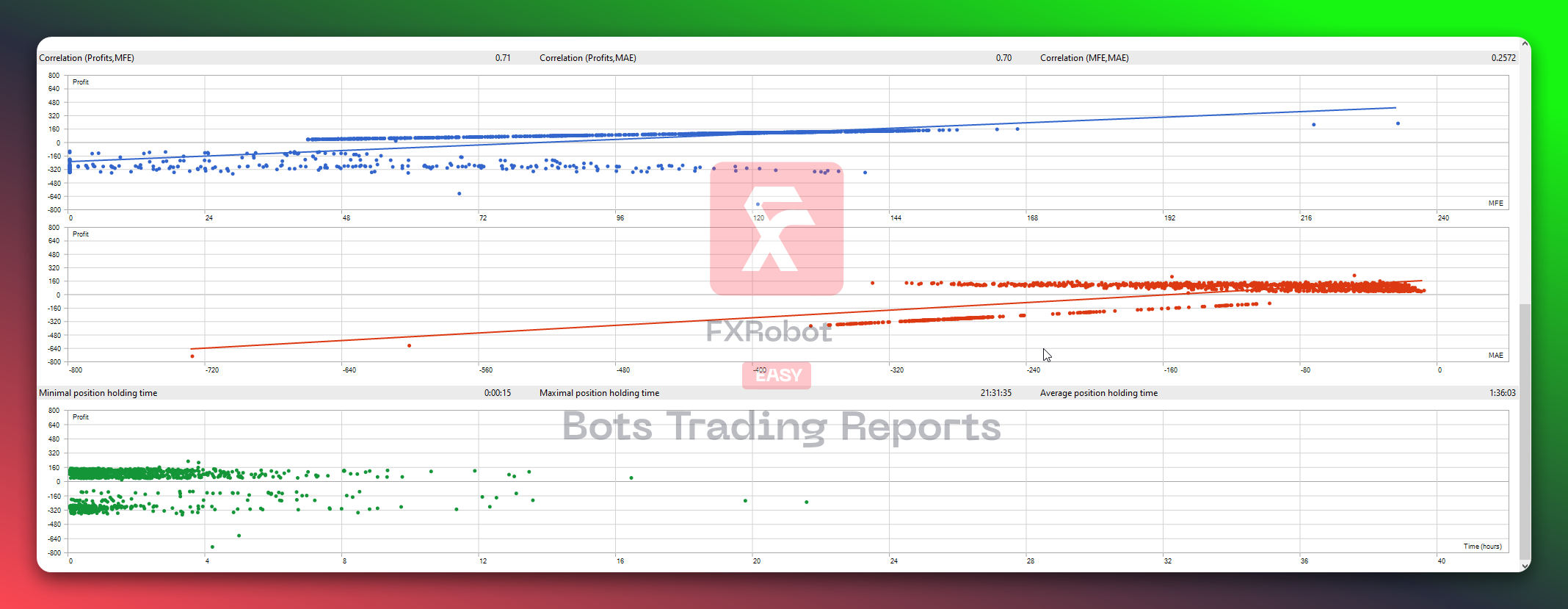

The B1_AUDJPY_Complex showcases a modest net profit of 24,058.46, reflecting a cautious yet potentially resilient approach. With a profit factor of 1.28, the strategy maintains profitability, albeit with narrower margins. The balance drawdown of 18.08% suggests moderate risk, but this is partially mitigated by a respectable win rate of 77.27%. The expected payoff is 17.36, indicating small incremental gains per trade. Short trades slightly outperform long trades, though both hover around a similar success rate. While the largest profit trade is modest at 218.11, the strategy delivers a consistent AHPR and GHPR of 0.09%, signifying gradual but stable growth. It's a strategy suited for those preferring steady, albeit less aggressive, trading tactics.

Gross Profit

109 047.88

Balance DD Maximal

5 605.64 (18.08%)

Profit Traders(% of total)

1071 (77.27%)

Loss Traders(% of total):

315 (22.73%)

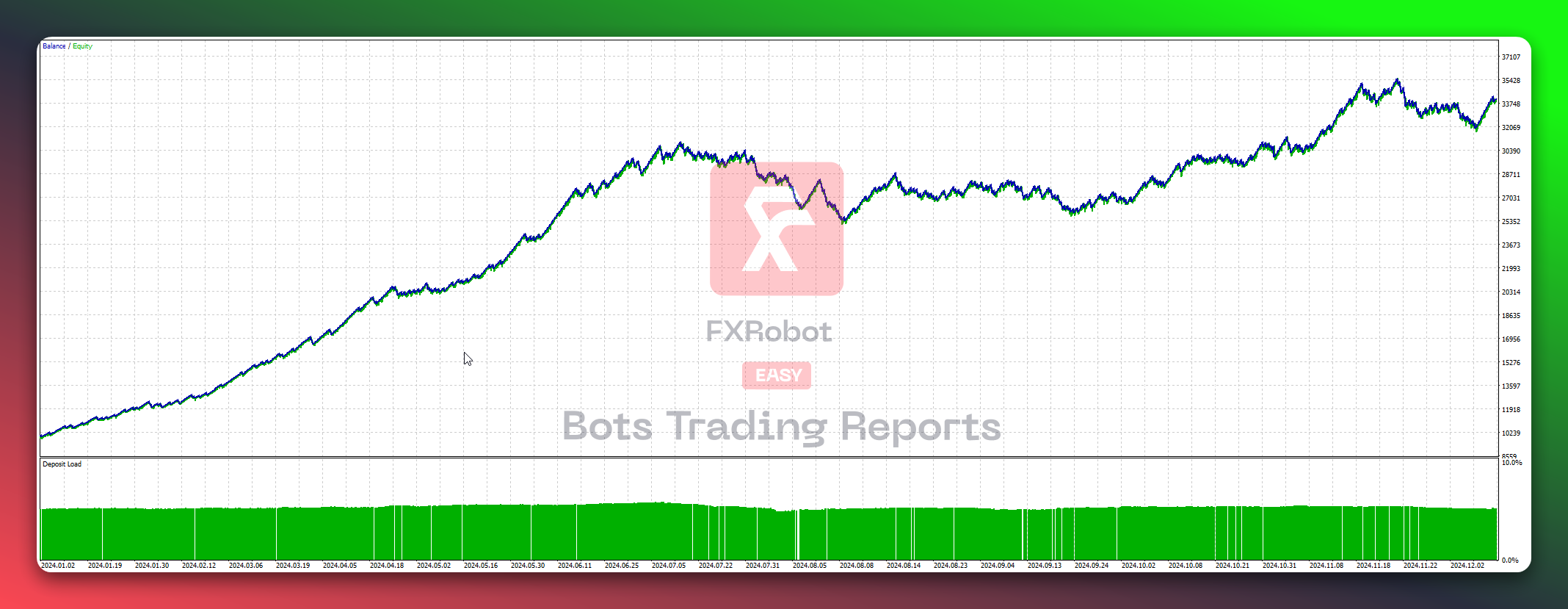

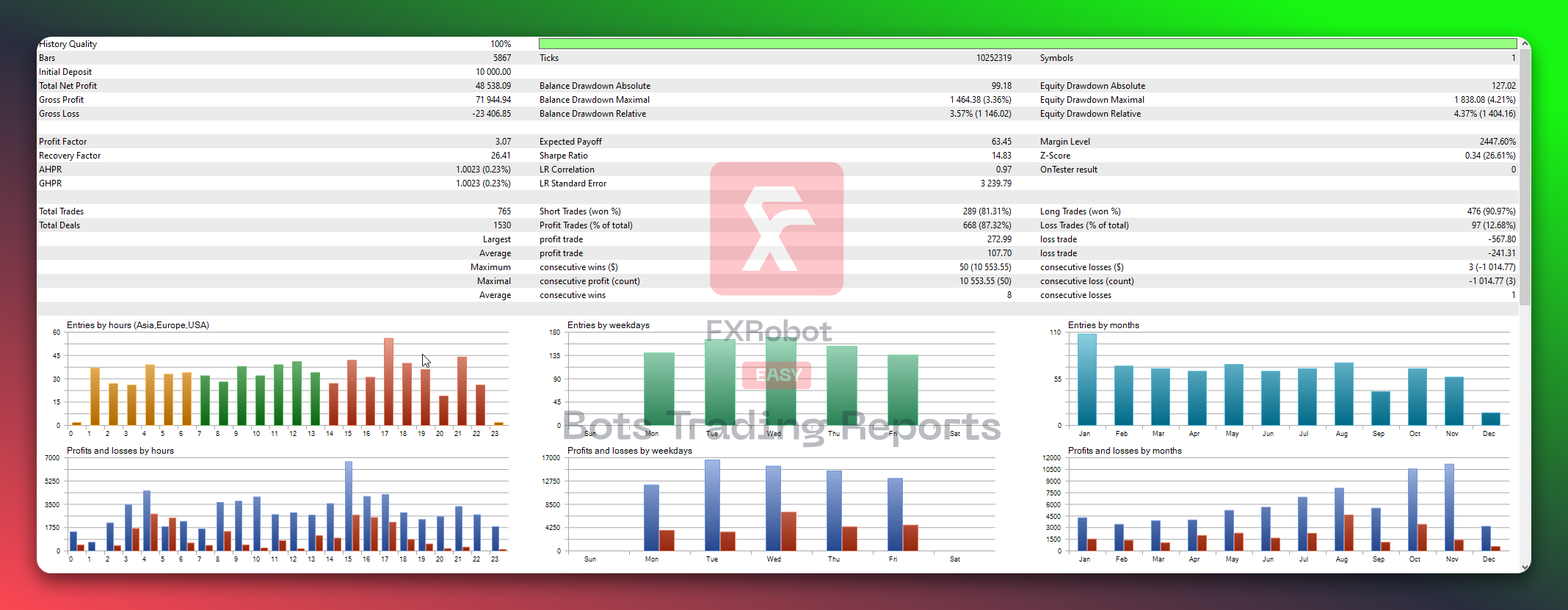

H1 (2024.01.01 - 2024.12.10)

10000.00$

48538.09$

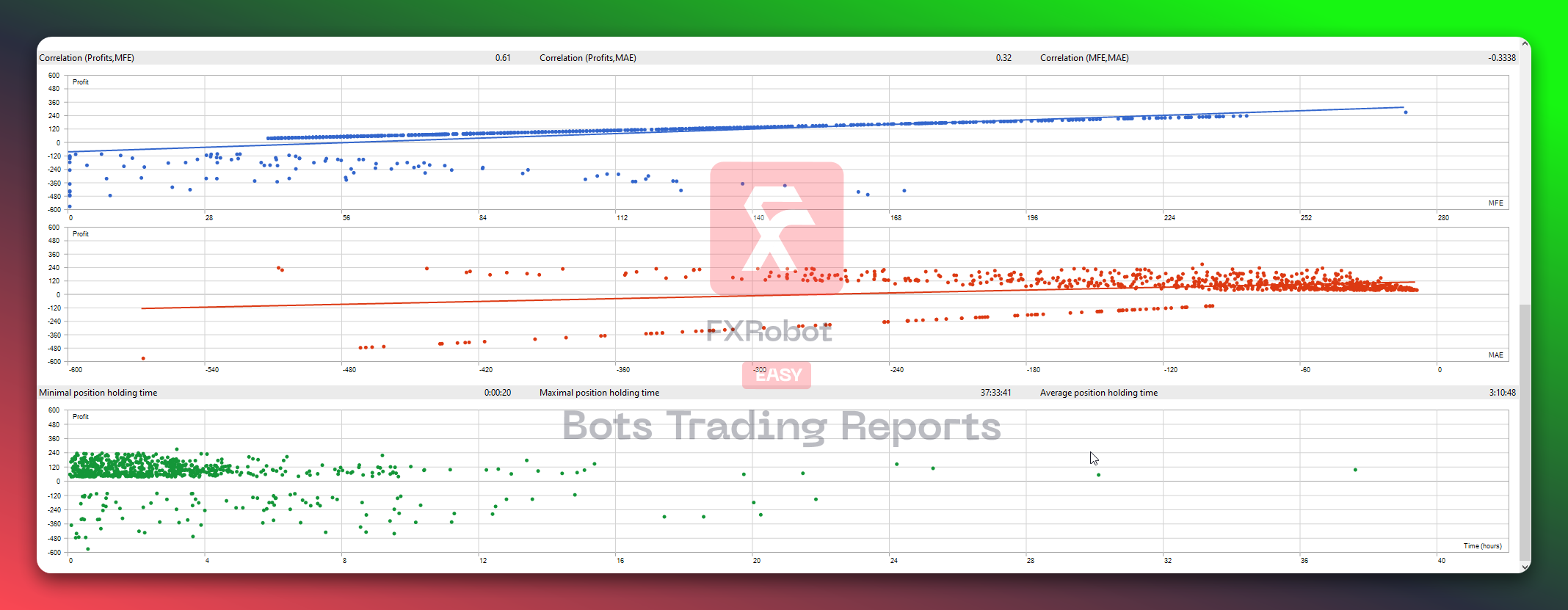

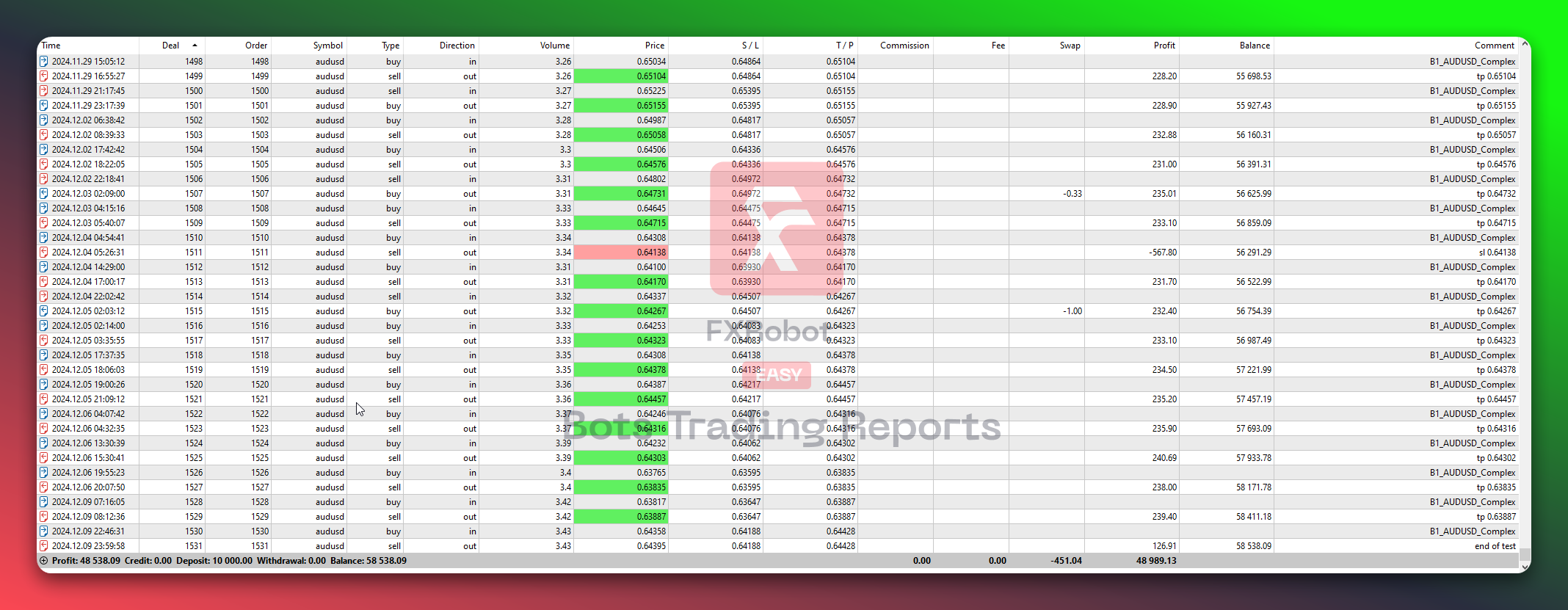

Success in numbers!

The B1_AUDUSD_Complex reflects a prudent yet effective trading strategy, with a net profit of 48,538.09 and a low drawdown of 3.36%, highlighting excellent risk management. The strategy enjoys a strong profit factor of 3.07, suggesting well-controlled profitability with 87.32% win rate overall. Long trades particularly excel with a 90.97% success rate, indicating a favorable bias in the strategy's execution. Despite the largest profit trade being relatively small at 272.99, consistency is key, as evidenced by an expected payoff of 63.45. The average profit and loss figures suggest efficient trade management, supported by AHPR and GHPR of 0.23%, signaling steady, incremental growth over time.

Gross Profit

71 944.94

Balance DD Maximal

1 464.38 (3.36%)

Profit Traders(% of total)

668 (87.32%)

Loss Traders(% of total):

97 (12.68%)

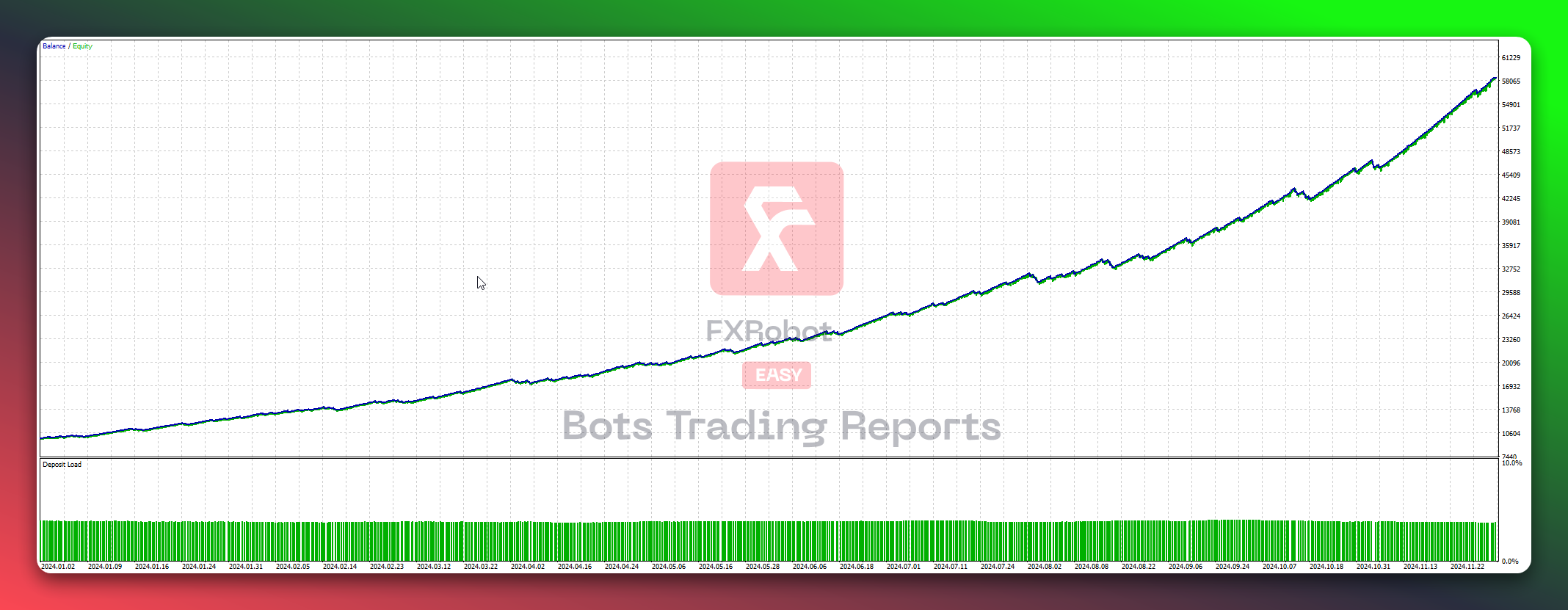

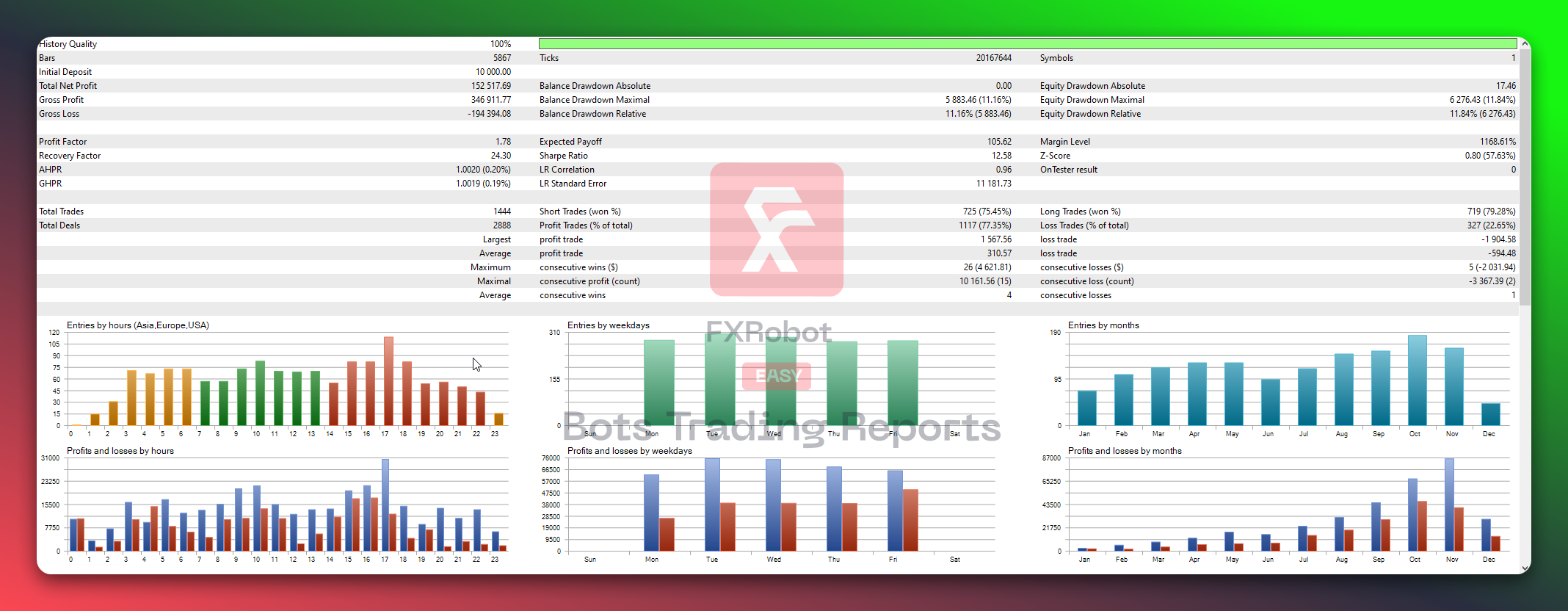

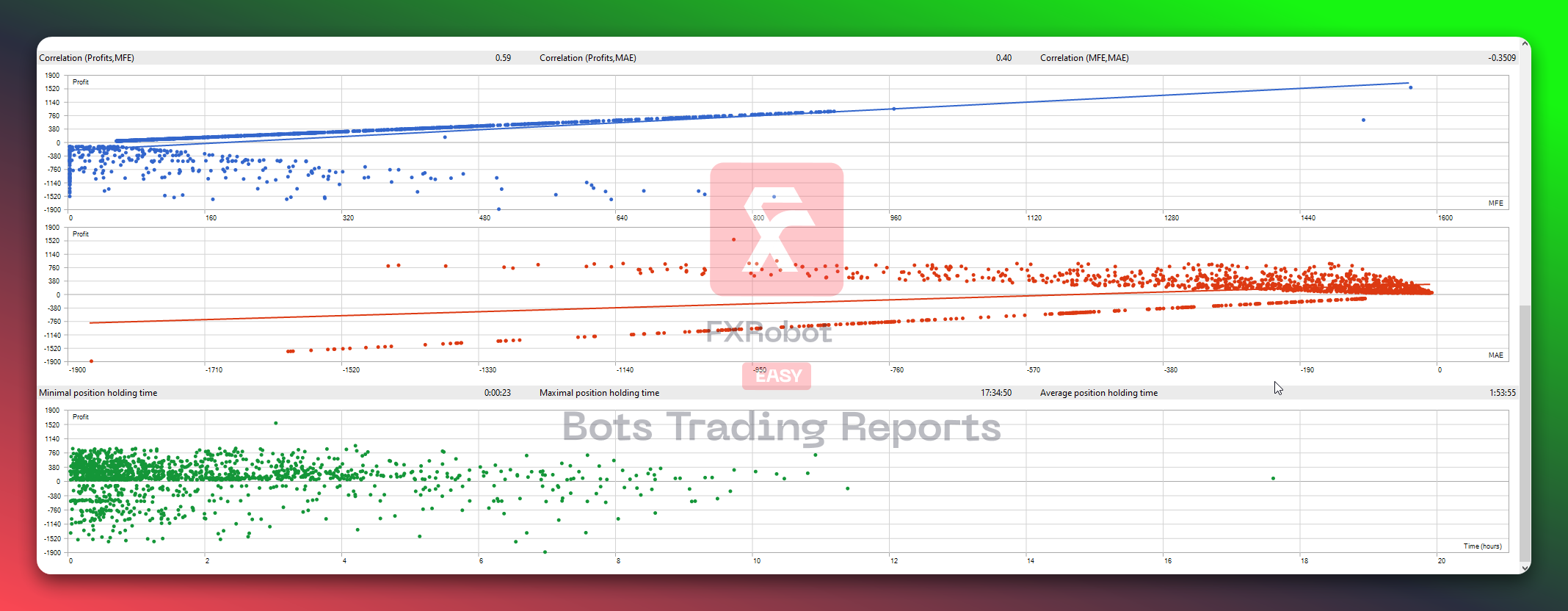

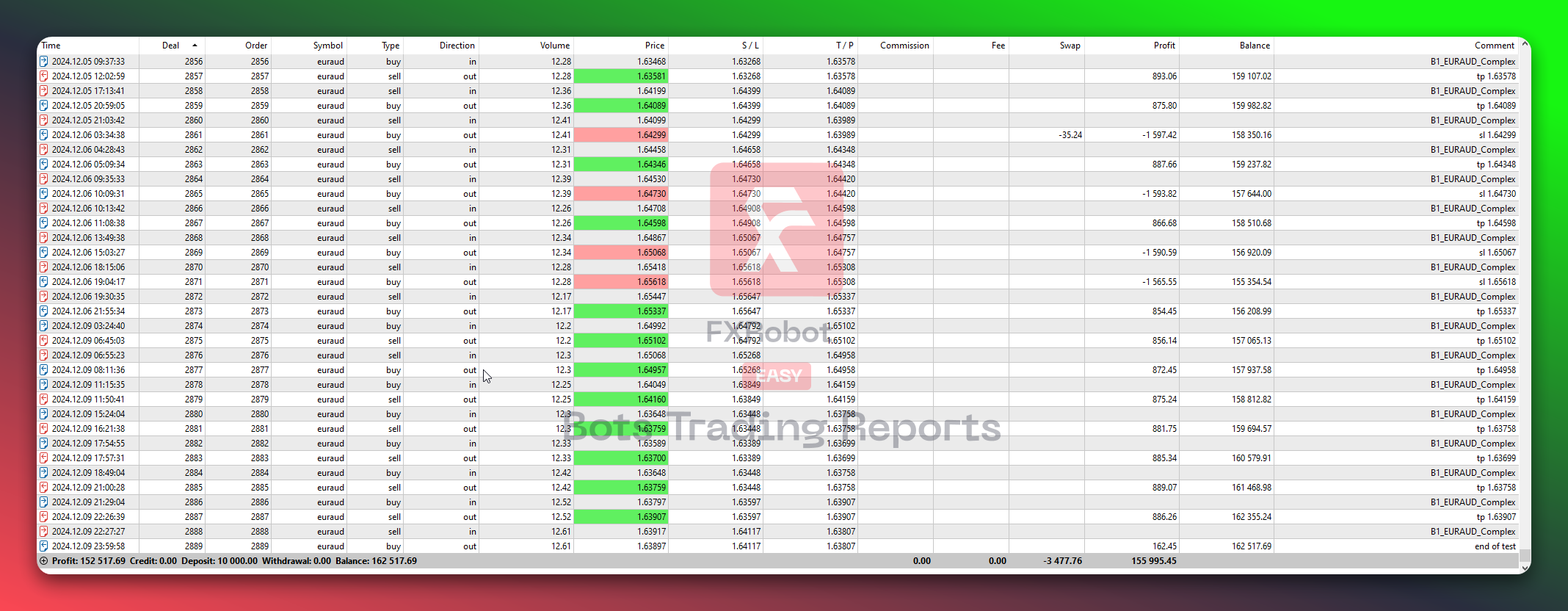

H1 (2024.01.01 - 2024.12.10)

10000.00$

152517.69$

Success in numbers!

The B1_EURAUD_Complex displays a solid performance with a net profit of 152,517.69 and a gross profit of 346,911.77, arising from a 10,000 initial deposit, illustrating a robust trading framework. With a profit factor of 1.78 and a drawdown of 11.16%, the strategy balances profitability and risk modestly well. Short and long trades have a decent win rate, slightly favoring long trades at 79.28%. While the largest profit and loss trades suggest some volatility, the expected payoff of 105.62 signifies consistent gains per trade. The average profit and loss metrics highlight the strategy's efficiency in capitalizing on market moves, complemented by an AHPR of 0.20% and GHPR of 0.19%, pointing towards sustainable growth with measured risk exposure.

Gross Profit

346 911.77

Balance DD Maximal

5 883.46 (11.16%)

Profit Traders(% of total)

1117 (77.35%)

Loss Traders(% of total):

327 (22.65%)

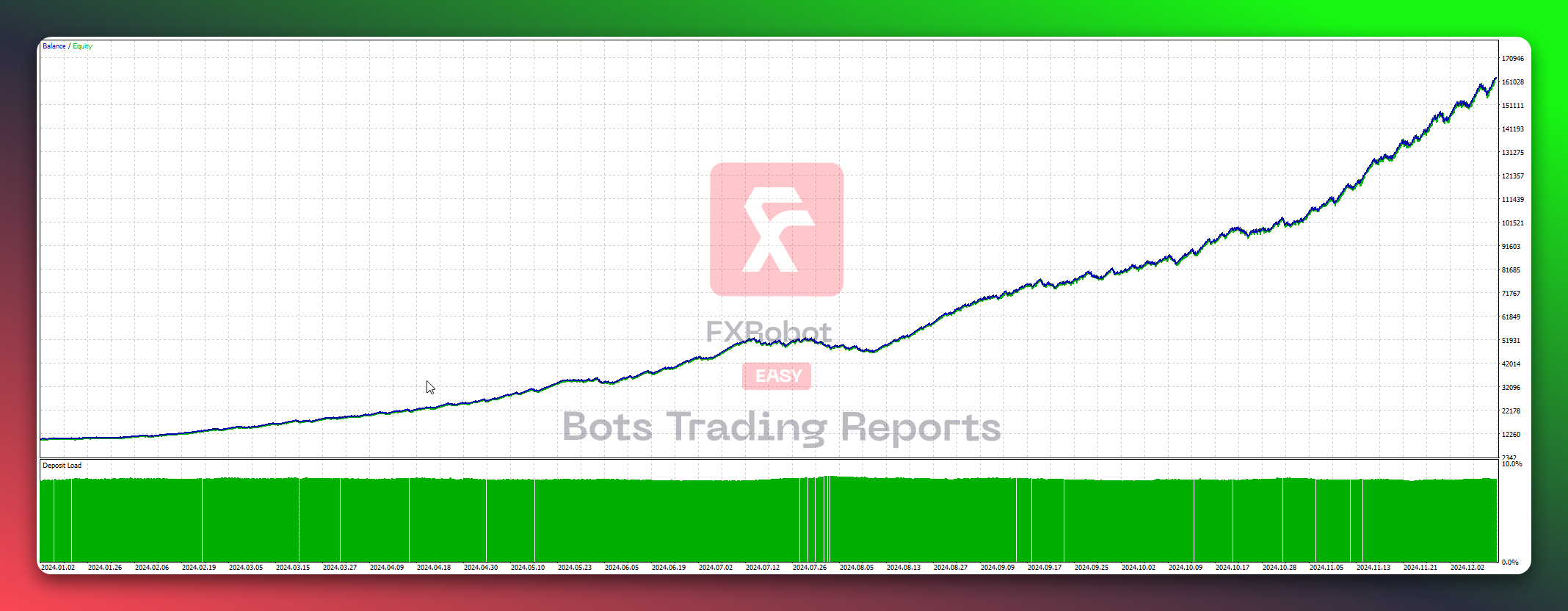

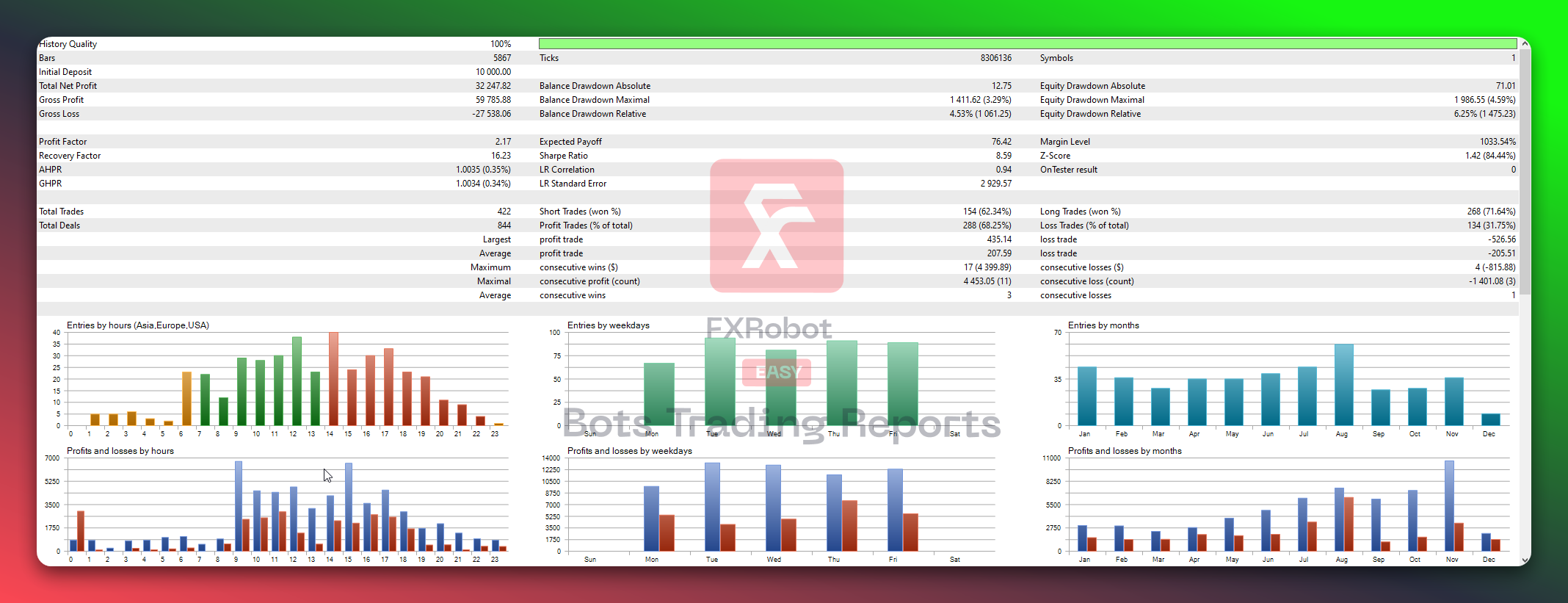

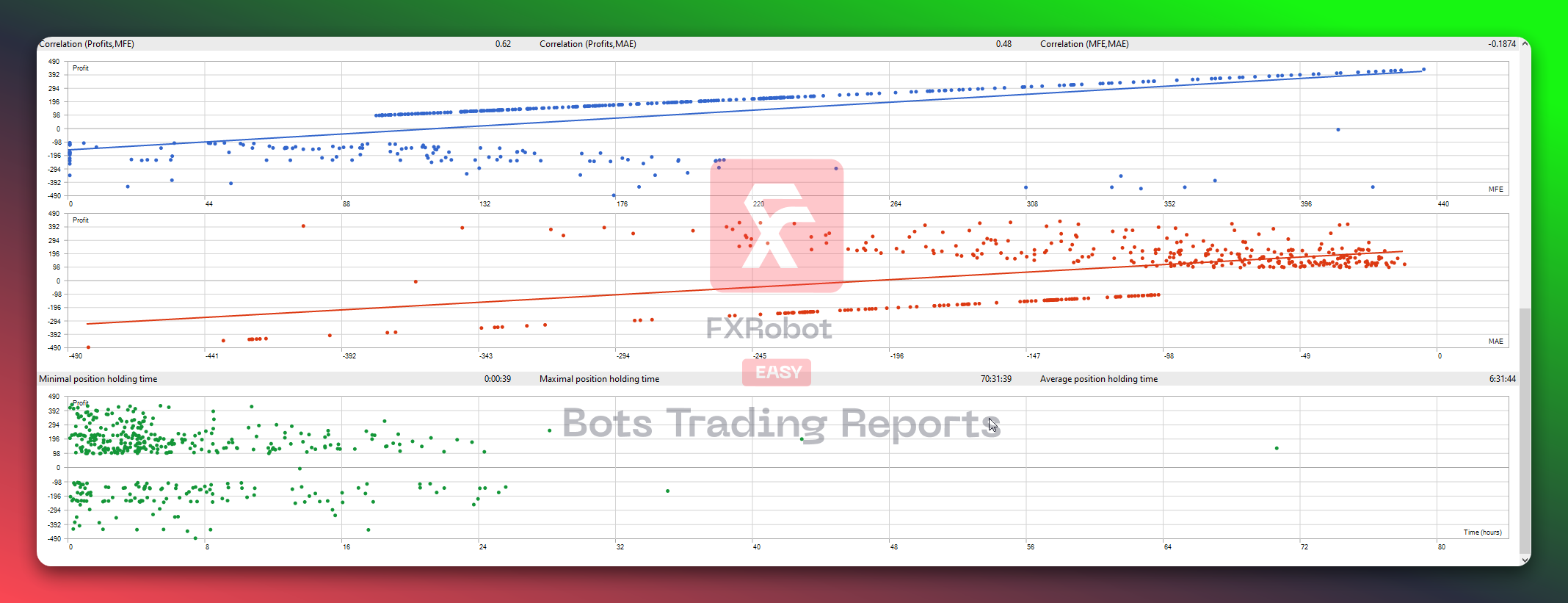

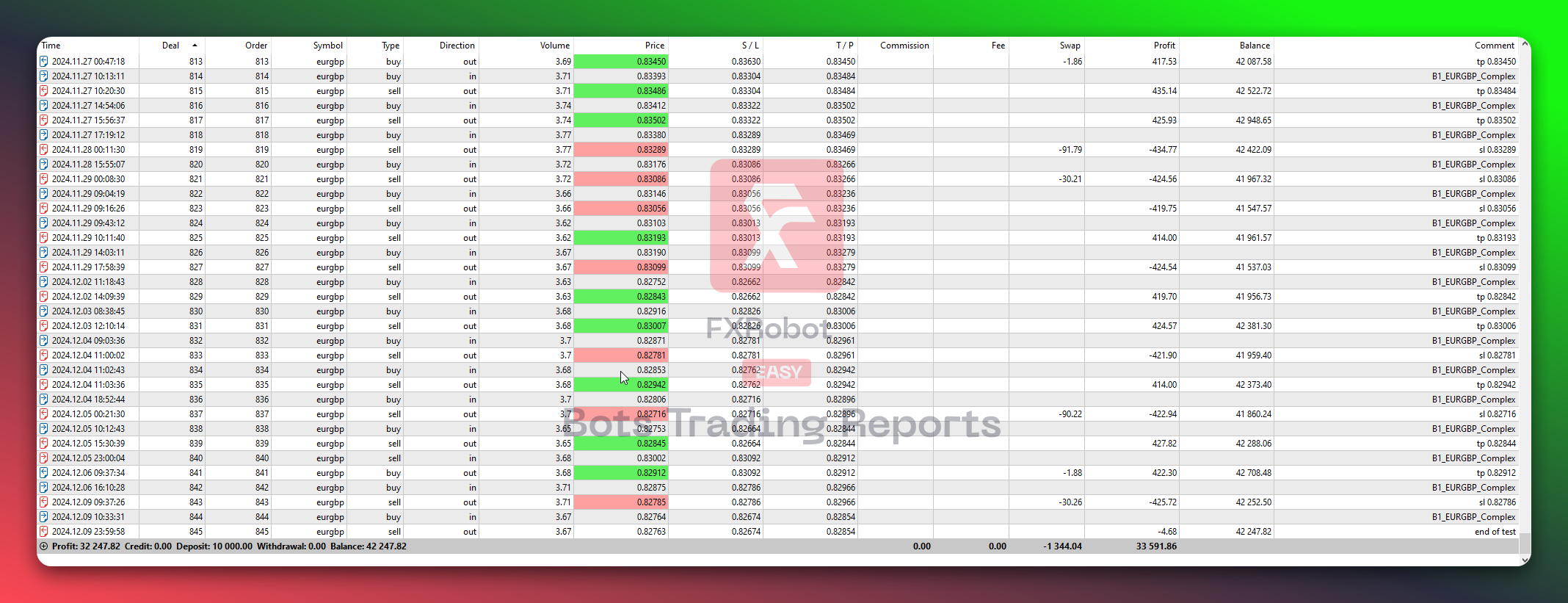

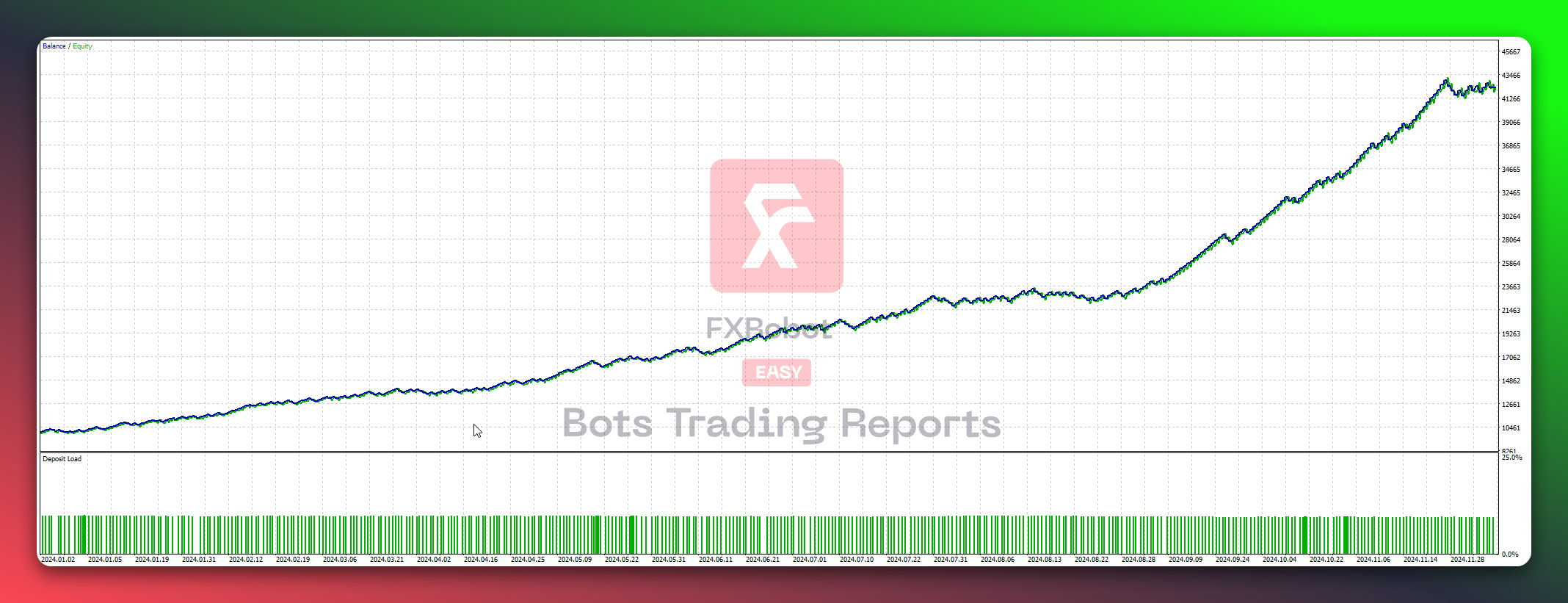

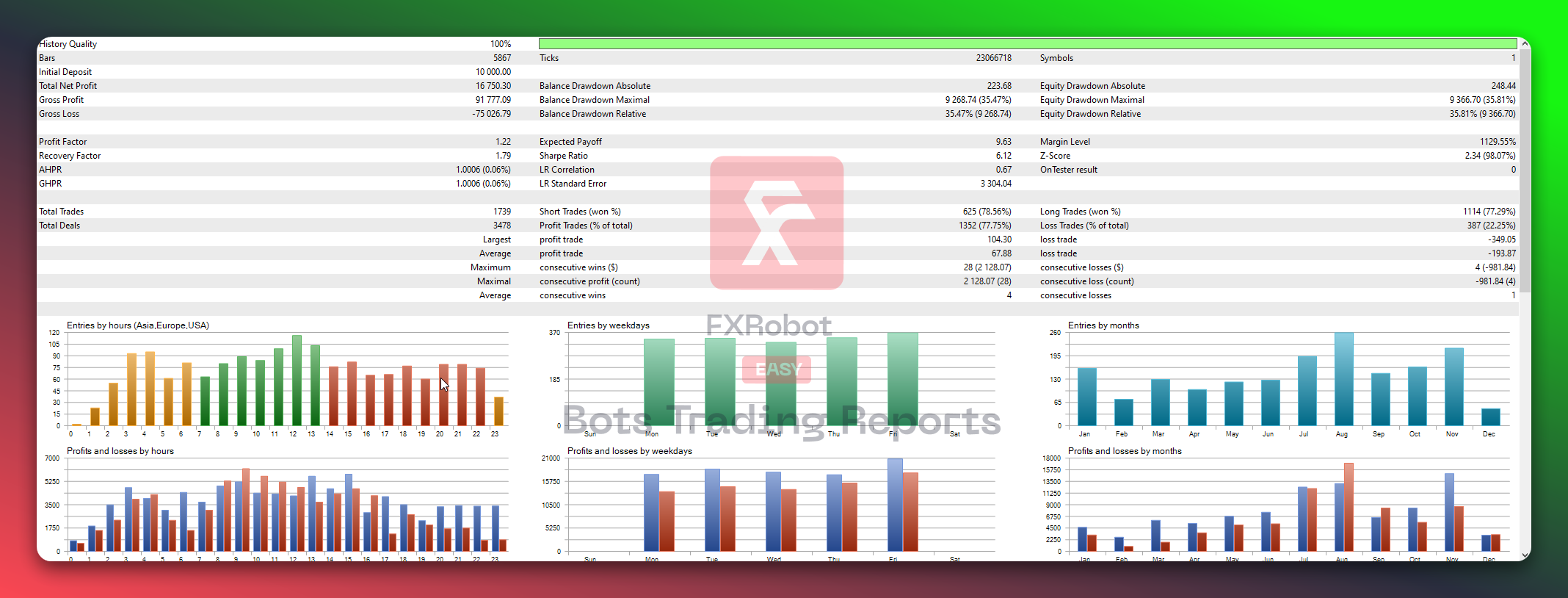

H1 (2024.01.01 - 2024.12.10)

10000.00$

32247.82$

Success in numbers!

The B1_EURGBP_Complex delivers a net profit of 32,247.82 from an initial deposit of 10,000, emphasizing steady gains. With a profit factor of 2.17 and low drawdown of 3.29%, it manages risk effectively while maintaining profitability. The strategy's win rate of 68.25%, boosted by long trades success at 71.64%, showcases a reliable approach. The largest profit trade of 435.14 and a balanced average profit and loss illustrate efficient execution. The expected payoff of 76.42 reflects consistent earnings per trade, while AHPR and GHPR rates around 0.35% suggest gradual, sustainable growth in capital, aligned with its solid risk management.

Gross Profit

59 785.88

Balance DD Maximal

1 411.62 (3.29%)

Profit Traders(% of total)

288 (68.25%)

Loss Traders(% of total):

134 (31.75%)

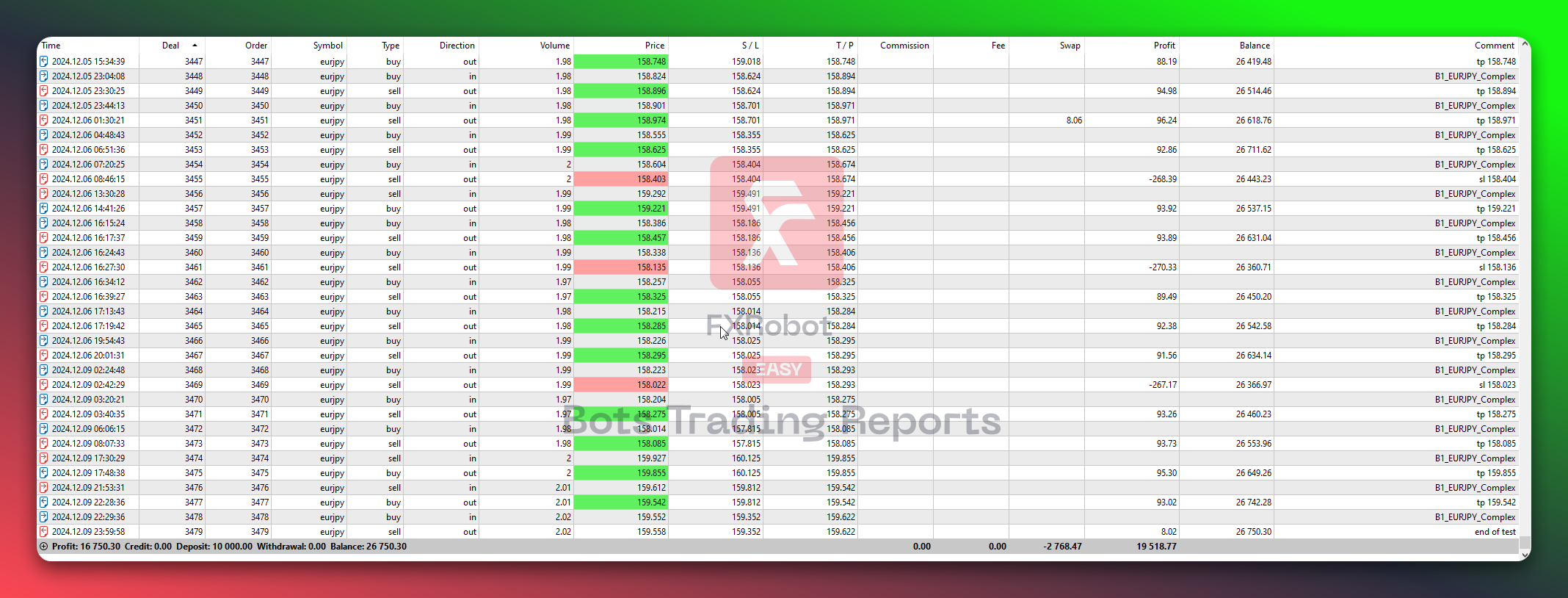

H1 (2024.01.01 - 2024.12.10)

10000.00$

16750.30$

Success in numbers!

The B1_EURJPY_Complex reveals a modest net profit of 16,750.30, suggesting conservative gains that may be suited for low-risk appetites. With a profit factor of 1.22, the strategy skims profitability, and a high drawdown of 35.47% indicates elevated risk exposure. The win rates for short and long trades hover around 77.75%, demonstrating acceptable execution but also potential for enhancement. Despite the average profit being relatively low at 67.88, compared to the average loss of 193.87, there is room for optimizing trade entries and exits. An expected payoff of 9.63 highlights small transaction gains. This strategy's AHPR and GHPR values are stable at 0.06%, reflecting incremental growth that favors cautious but steady performance improvements.

Gross Profit

91 777.09

Balance DD Maximal

9 268.74 (35.47%)

Profit Traders(% of total)

1352 (77.75%)

Loss Traders(% of total):

387 (22.25%)

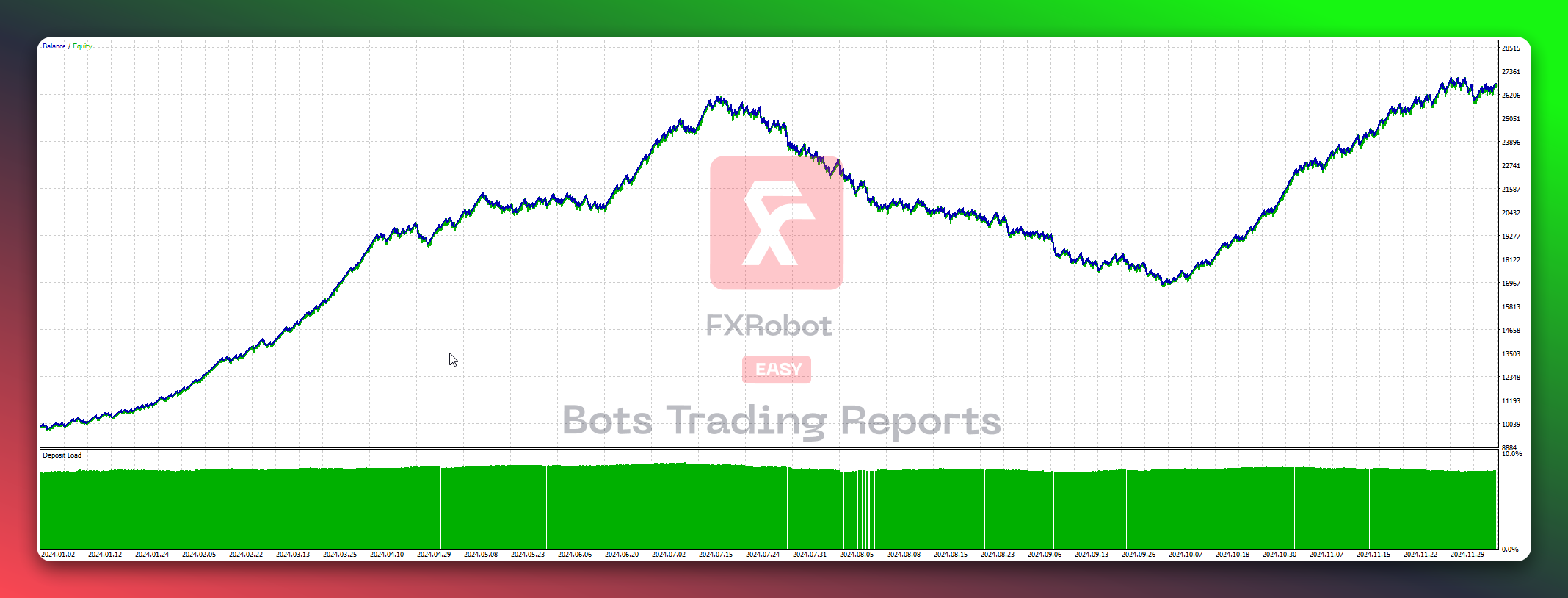

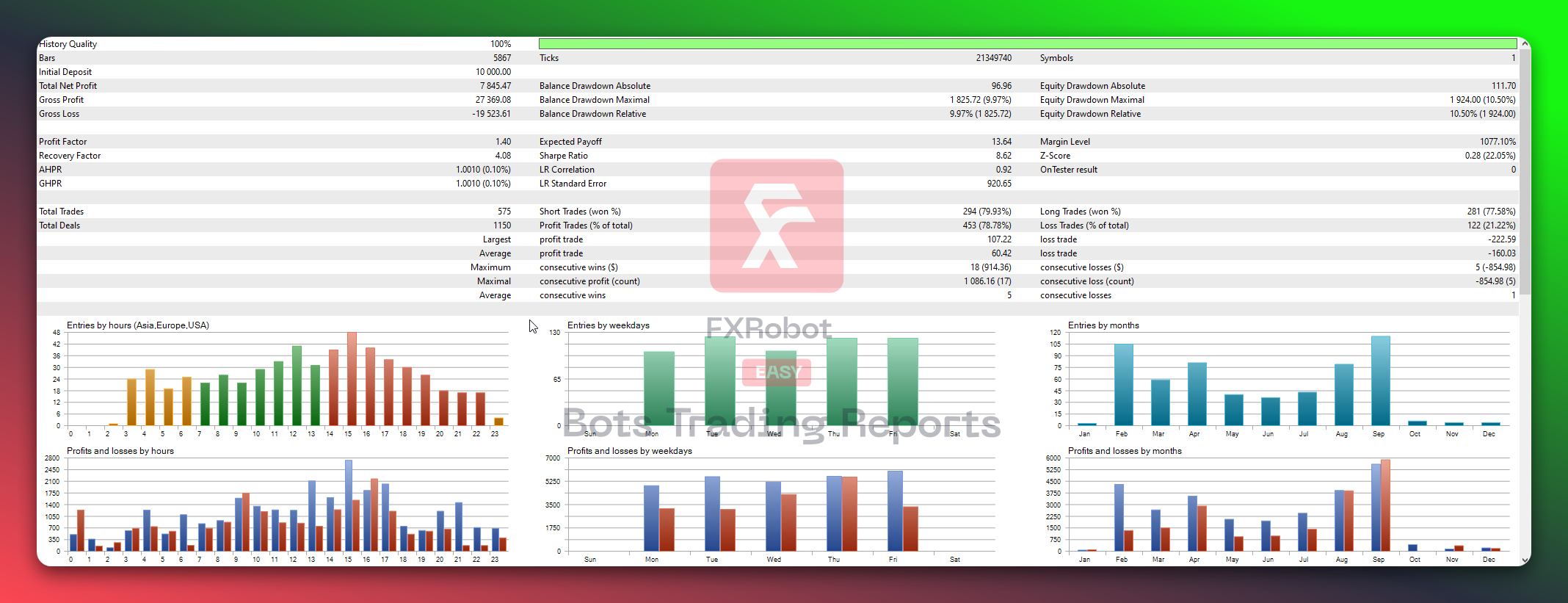

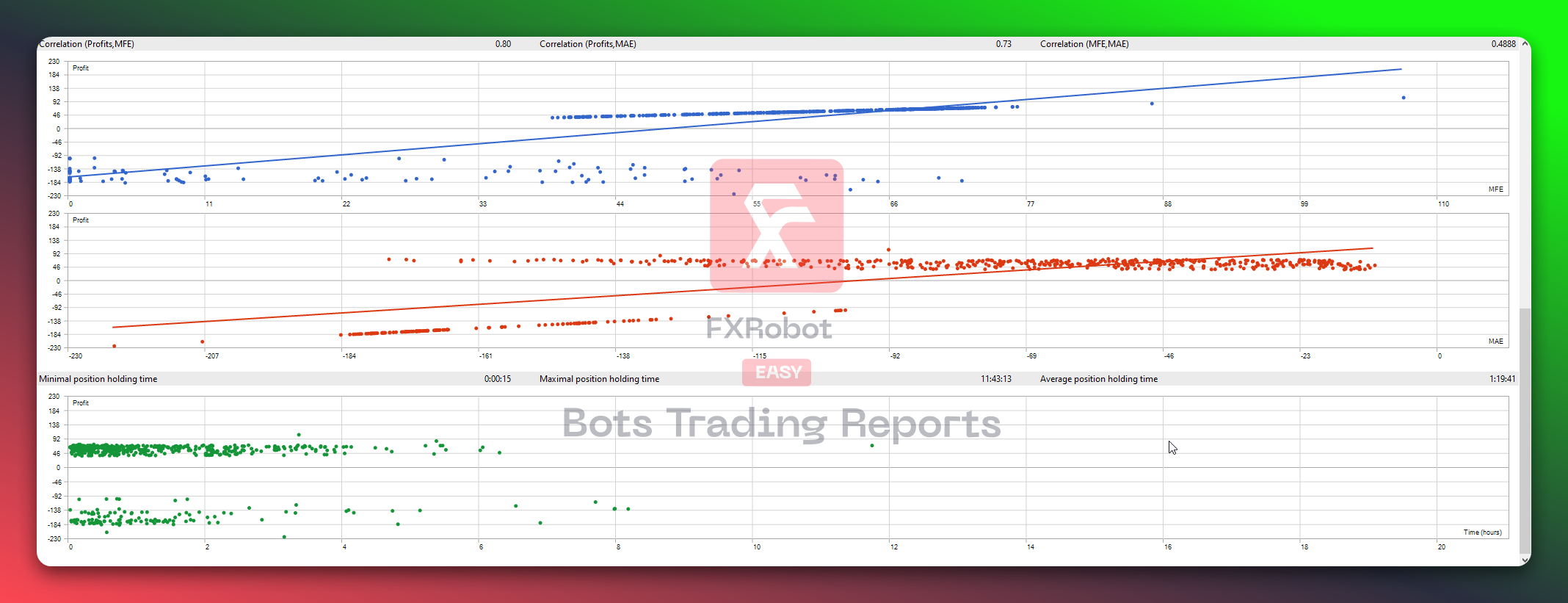

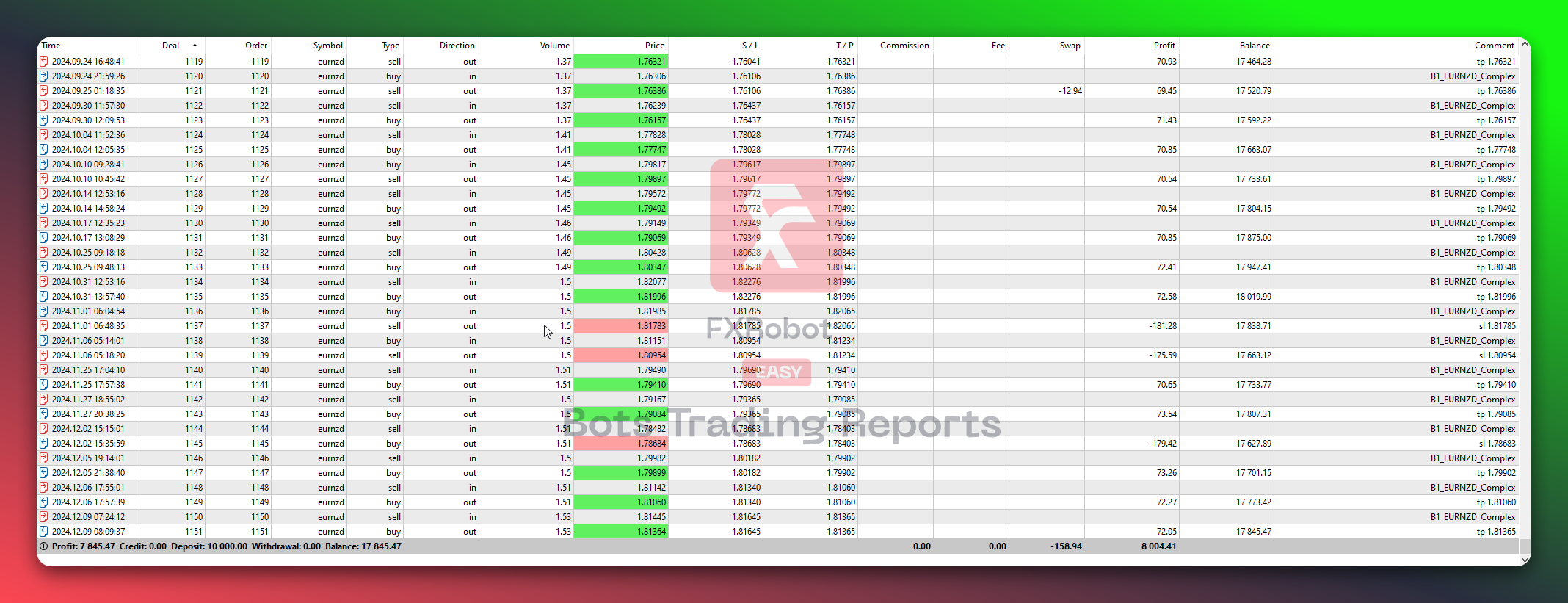

H1 (2024.01.01 - 2024.12.10)

10000.00$

7845.47$

Success in numbers!

The B1_EURNZD_Complex reports a net profit of 7,845.47, reflecting a low yet steady gain strategy from a 10,000 deposit. A profit factor of 1.40 indicates modest profitability, and the drawdown of 9.97% points to cautious risk exposure. The win rate stands strong at 78.78%, with short trades slightly outperforming long ones. The expected payoff of 13.64 per trade suggests small, steady gains, coupled with a concentrated balance between average profit and loss trades. The AHPR and GHPR of 0.10% highlight gradual but persistent capital compounding, ideal for traders seeking a methodical, less aggressive approach with stable returns.

Gross Profit

27 369.08

Balance DD Maximal

1 825.72 (9.97%)

Profit Traders(% of total)

453 (78.78%)

Loss Traders(% of total):

122 (21.22%)

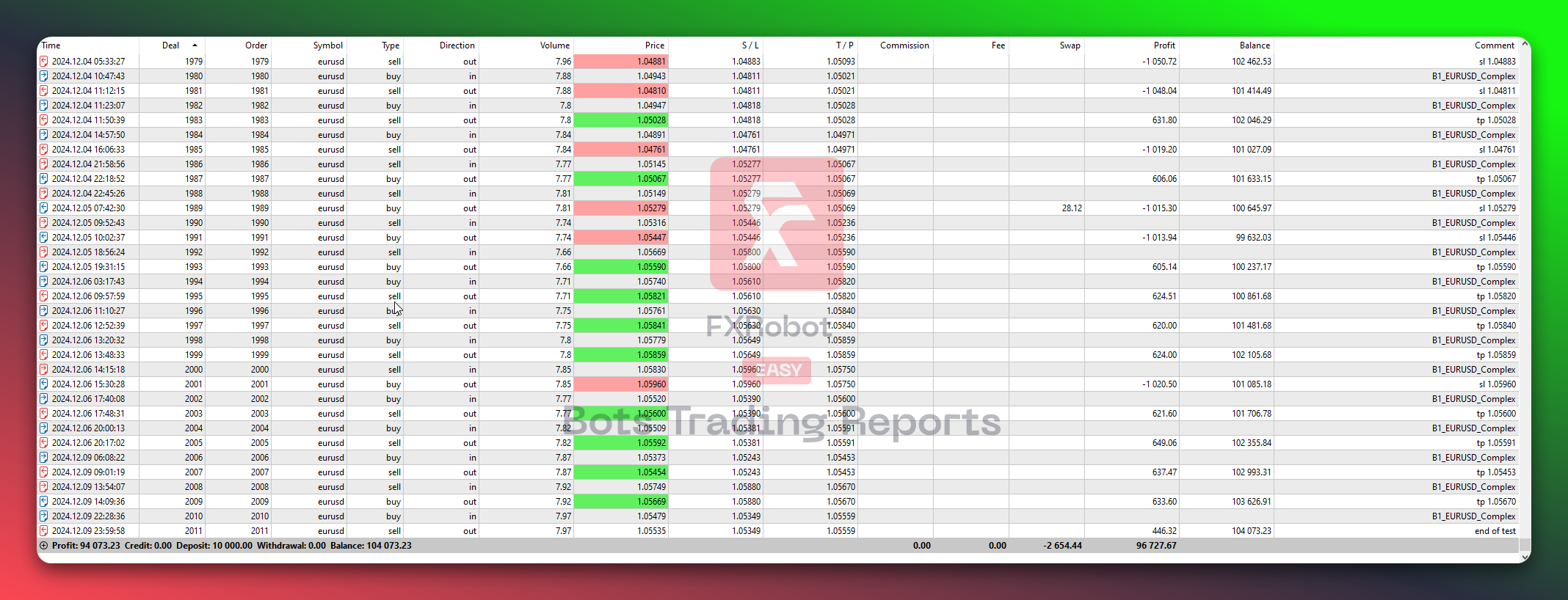

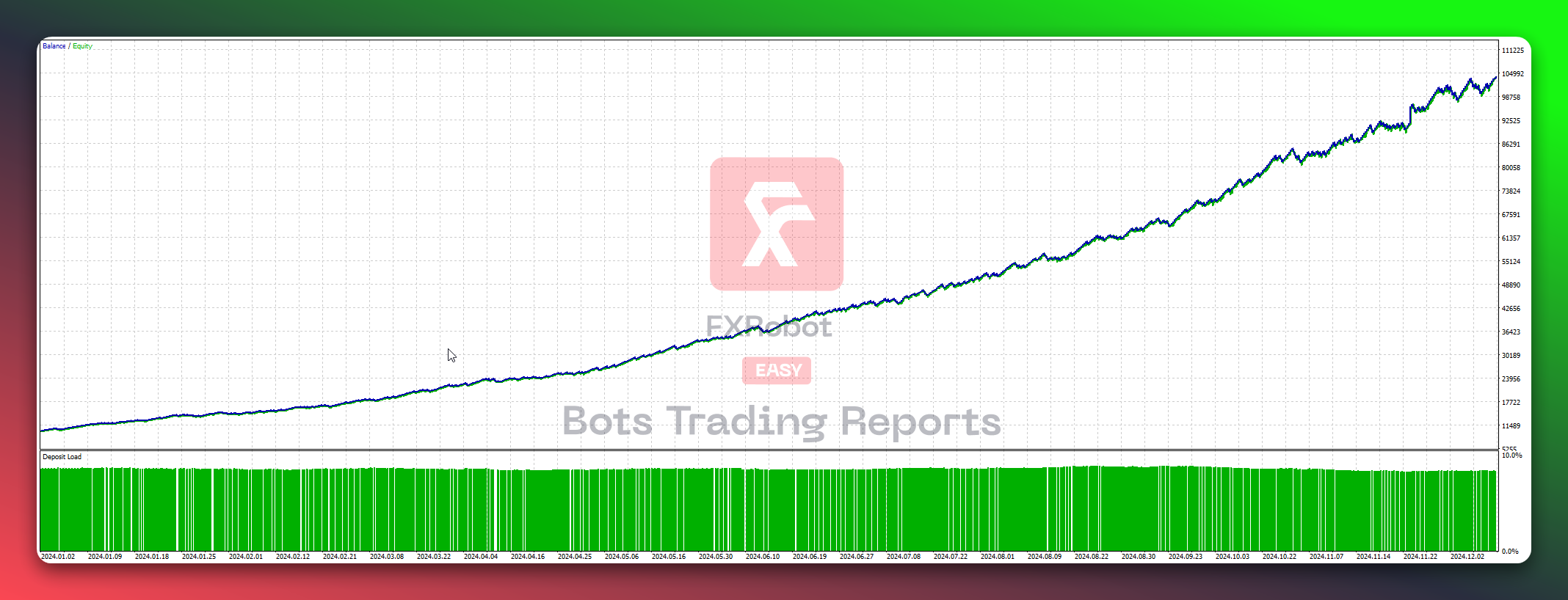

H1 (2024.01.01 - 2024.12.10)

10000.00$

94073.23$

Success in numbers!

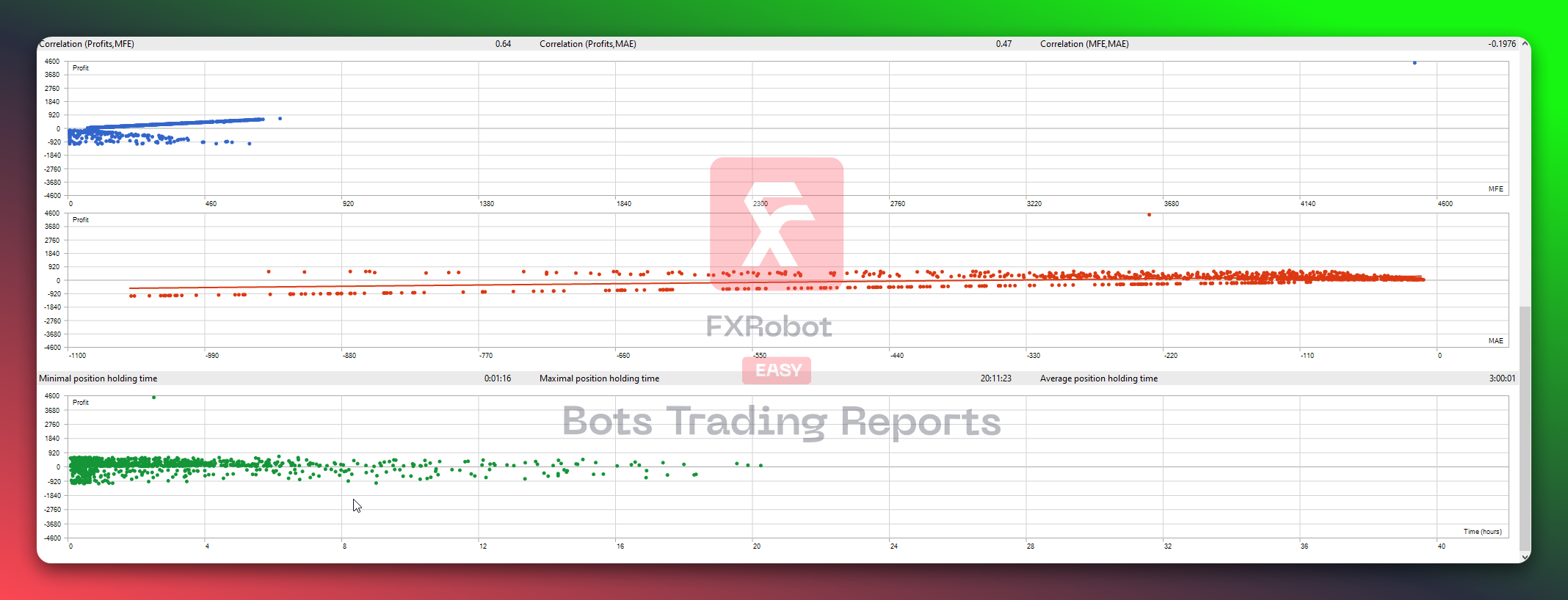

The B1_EURUSD_Complex reveals a robust performance with a net profit of 94,073.23, demonstrating strong profitability relative to its initial 10,000 deposit. With a profit factor of 1.85, the strategy maintains a commendable balance between gains and losses, supported by a low drawdown of 3.75%. The win rate of 76.42%, particularly in long trades at 78.56%, indicates effective market alignment. Notably, the largest profit trade of 4,453.48 suggests potential for high-impact trades, while average profit and loss figures reflect controlled risk-taking. The expected payoff of 93.61 per trade and an AHPR and GHPR around 0.24% underscore the strategy's capability for consistent capital growth through strategic, disciplined execution.

Gross Profit

205 231.51

Balance DD Maximal

3 881.22 (3.75%)

Profit Traders(% of total)

768 (76.42%)

Loss Traders(% of total):

237 (23.58%)

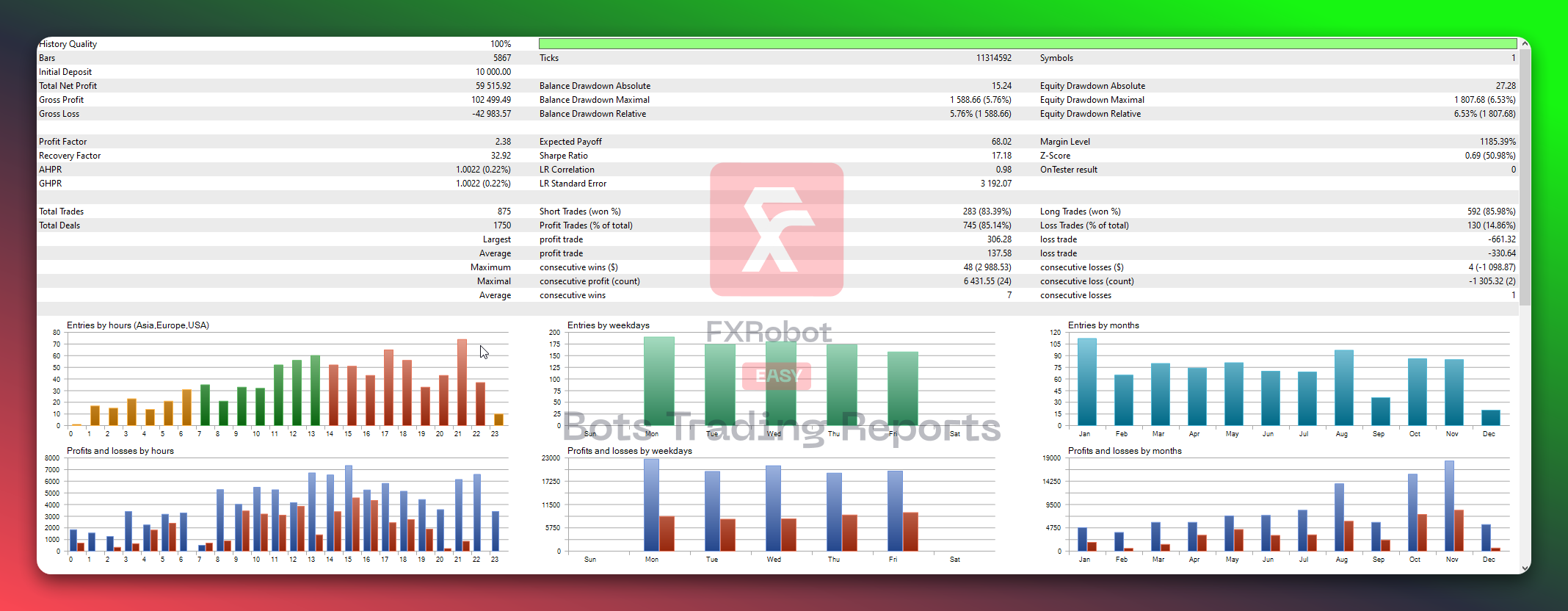

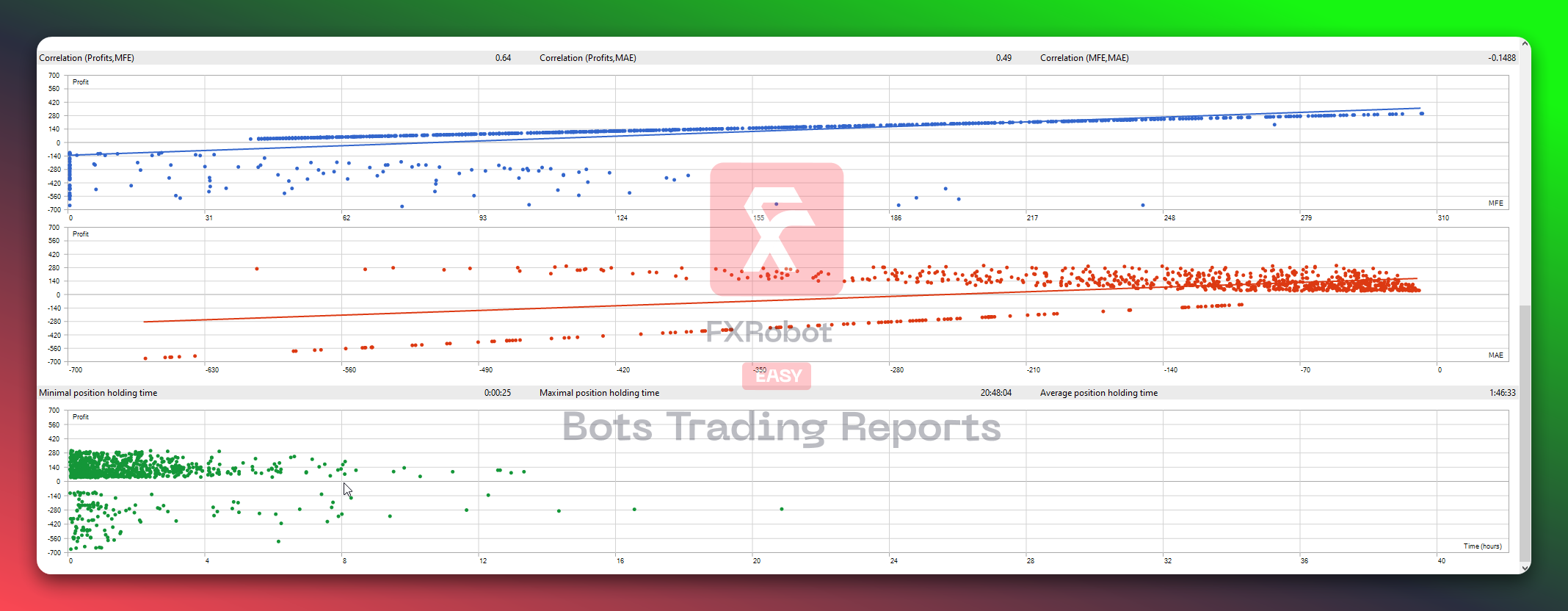

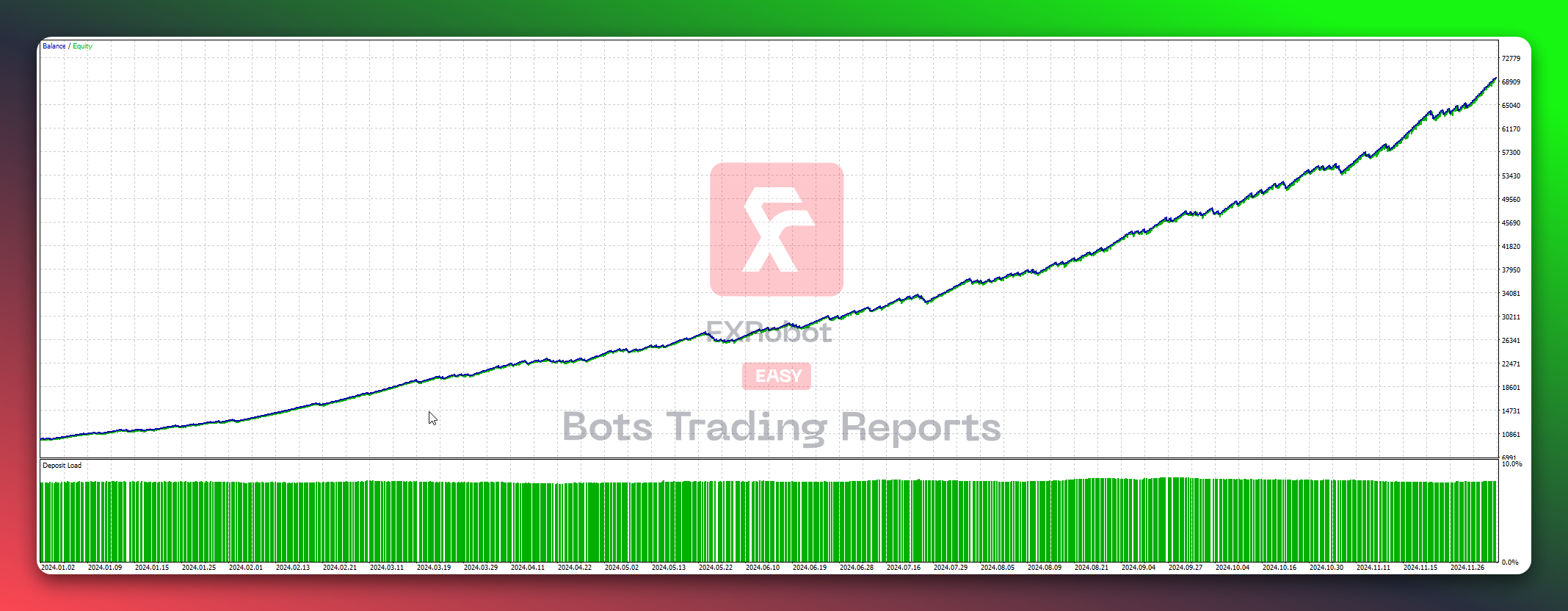

H1 (2024.01.01 - 2024.12.10)

10000.00$

59515.92$

Success in numbers!

The B1_GBPUSD_Complex illustrates a well-balanced trading approach, producing a net profit of 59,515.92 from a 10,000 initial capital, indicative of strong strategy efficacy. The profit factor of 2.38 reveals robust profitability relative to risk, with a manageable drawdown of 5.76%. A high win rate of 85.14%, especially for long trades at 85.98%, suggests precise market entries. The expected payoff of 68.02 shows consistent gains per transaction, while the largest profit and loss trades indicate strategic risk management. Both AHPR and GHPR rates of 0.22% highlight steady capital growth, making it an attractive strategy for sustained profitability while maintaining risk control.

Gross Profit

102 499.49

Balance DD Maximal

1 588.66 (5.76%)

Profit Traders(% of total)

745 (85.14%)

Loss Traders(% of total):

130 (14.86%)

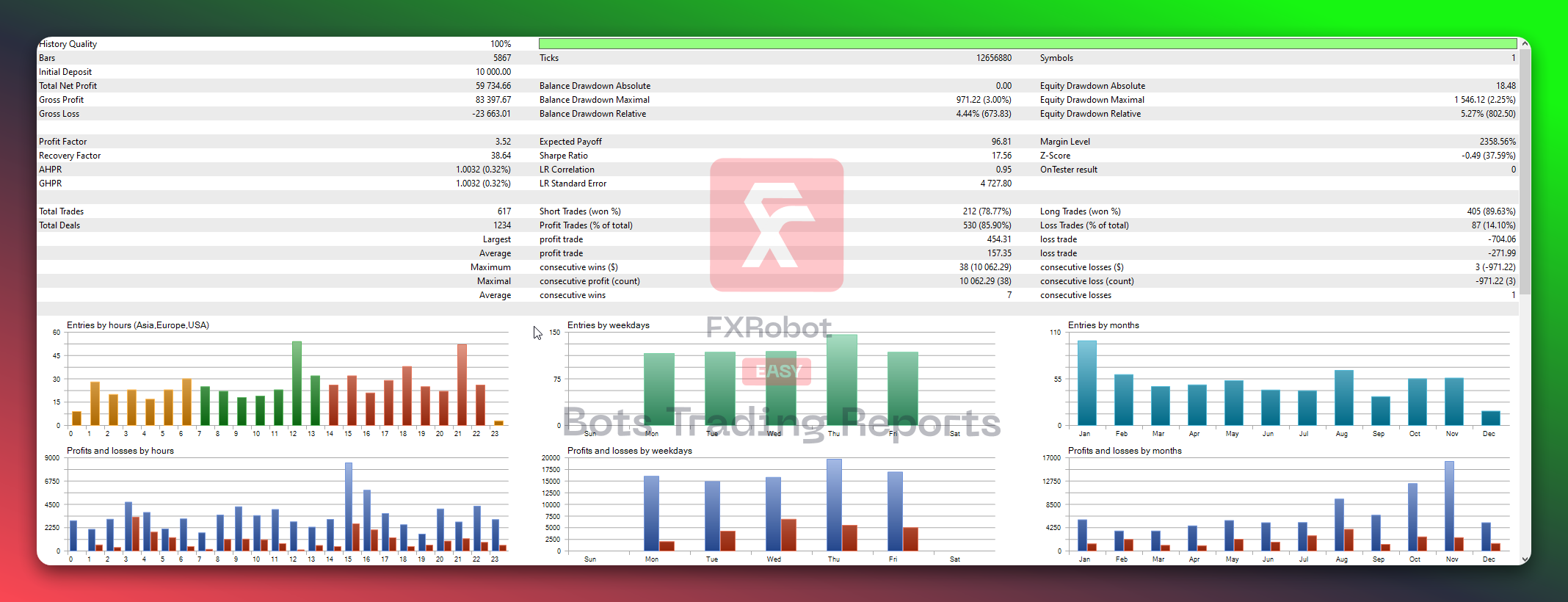

H1 (2024.01.01 - 2024.12.10)

10000.00$

59734.66$

Success in numbers!

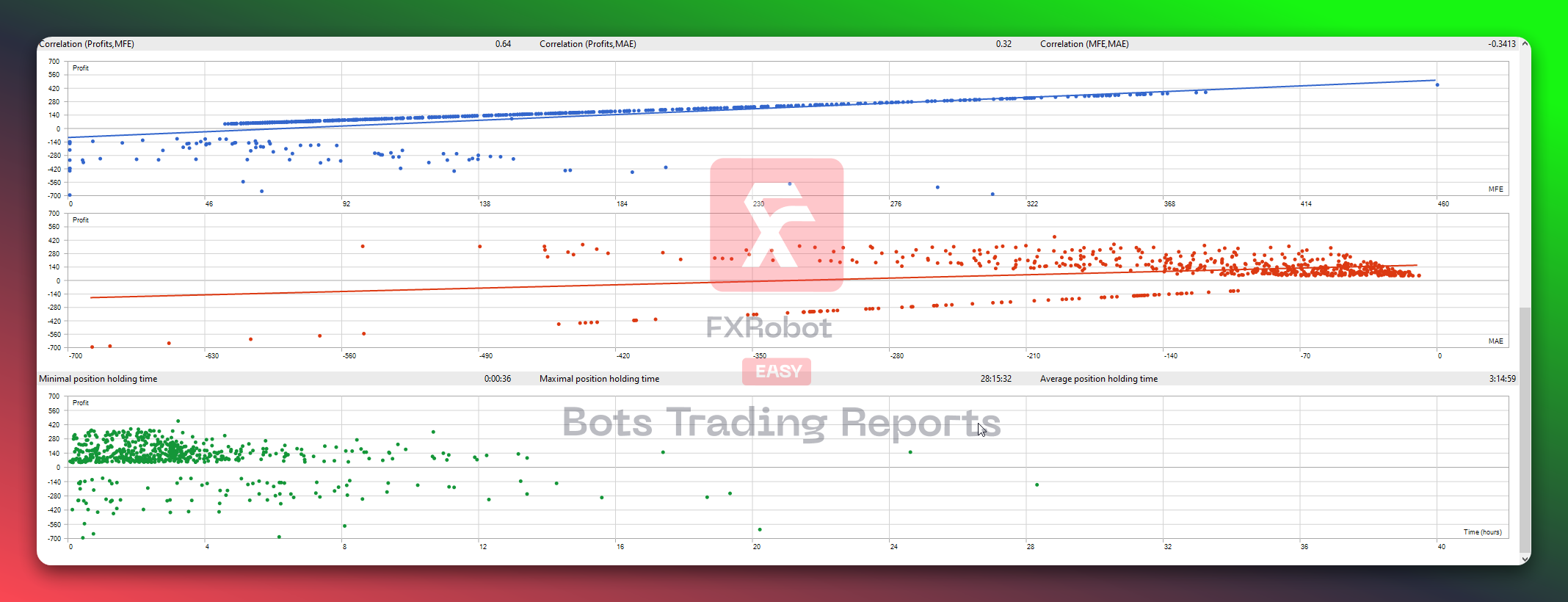

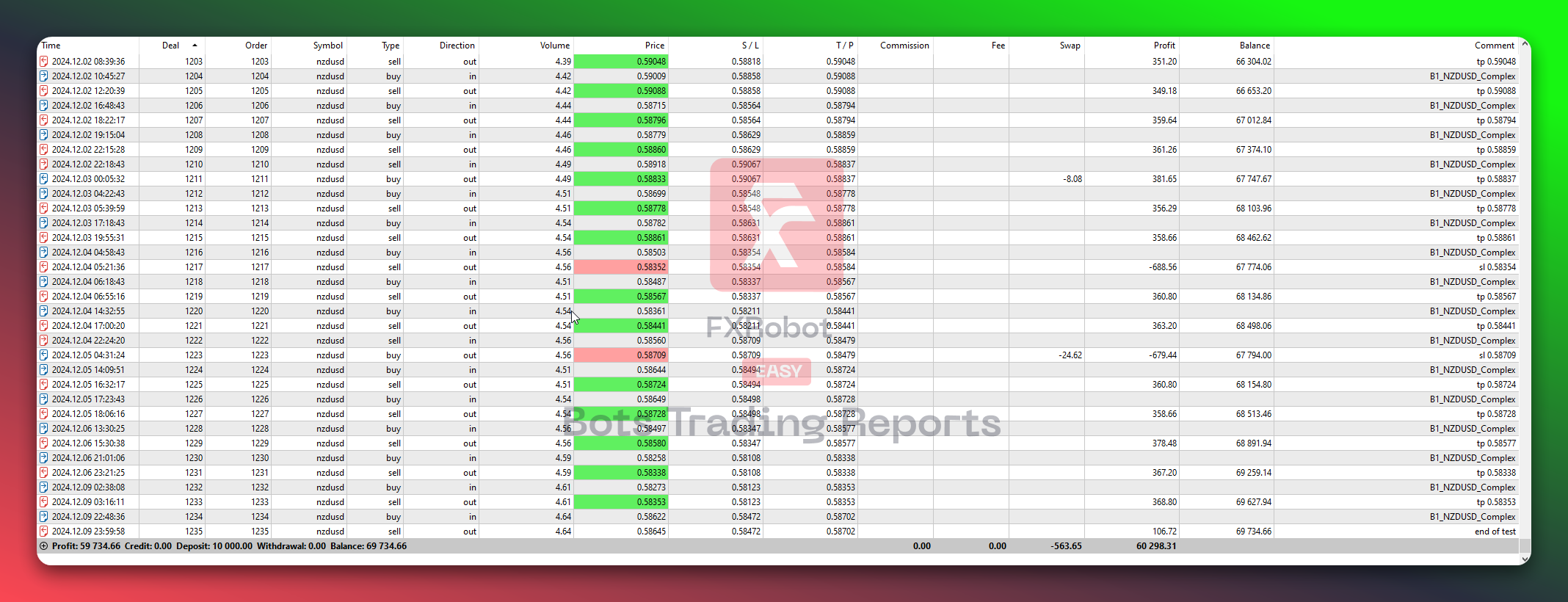

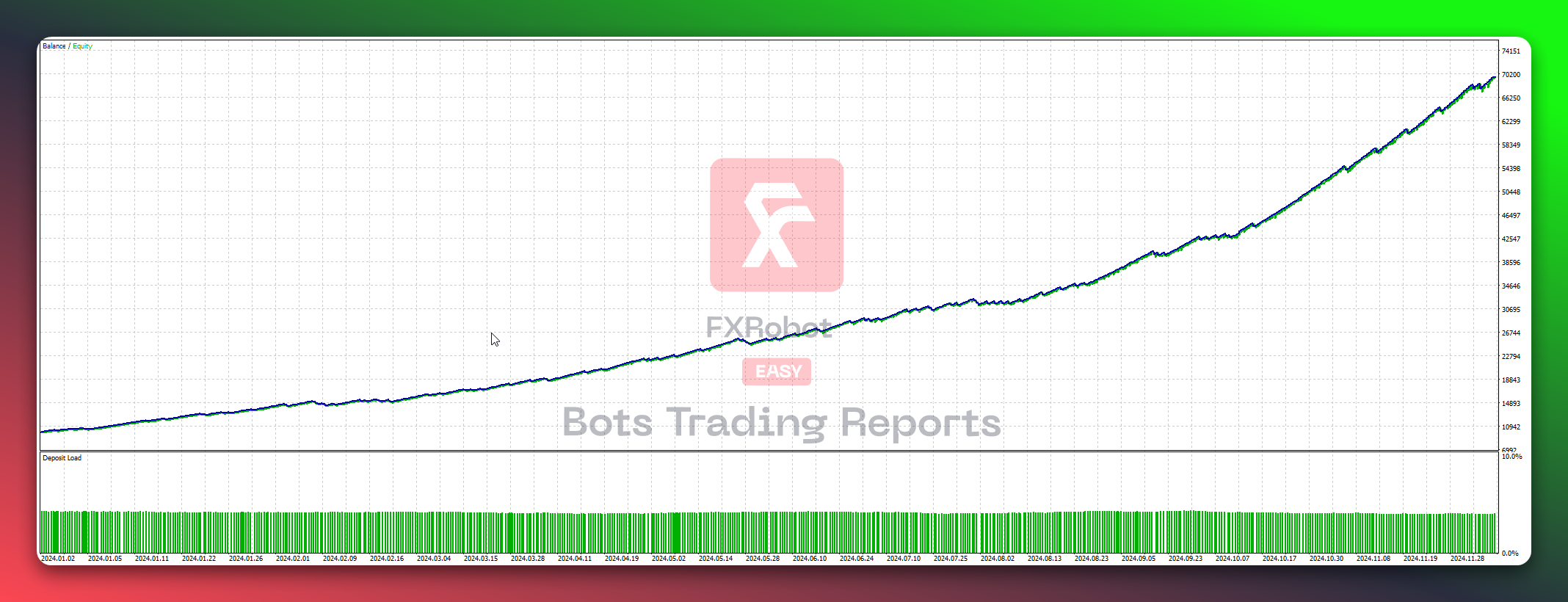

The B1_NZDUSD_Complex demonstrates a clear strength in profitability, achieving a net profit of 59,734.66 with its initial deposit of 10,000, and showing exceptional risk management with a drawdown of just 3.00%. The high profit factor of 3.52 signifies efficient profit-generation versus losses. With a formidable win rate of 85.90%, especially in long trades at 89.63%, the strategy aligns well with market trends. The expected payoff of 96.81 suggests lucrative returns per trade, while the balance between average profit and loss trades supports a reliable risk-reward profile. An AHPR and GHPR of 0.32% illustrate consistent growth potential, making this approach appealing for traders seeking stable and effective profit strategies.

Gross Profit

83 397.67

Balance DD Maximal

971.22 (3.00%)

Profit Traders(% of total)

530 (85.90%)

Loss Traders(% of total):

87 (14.10%)

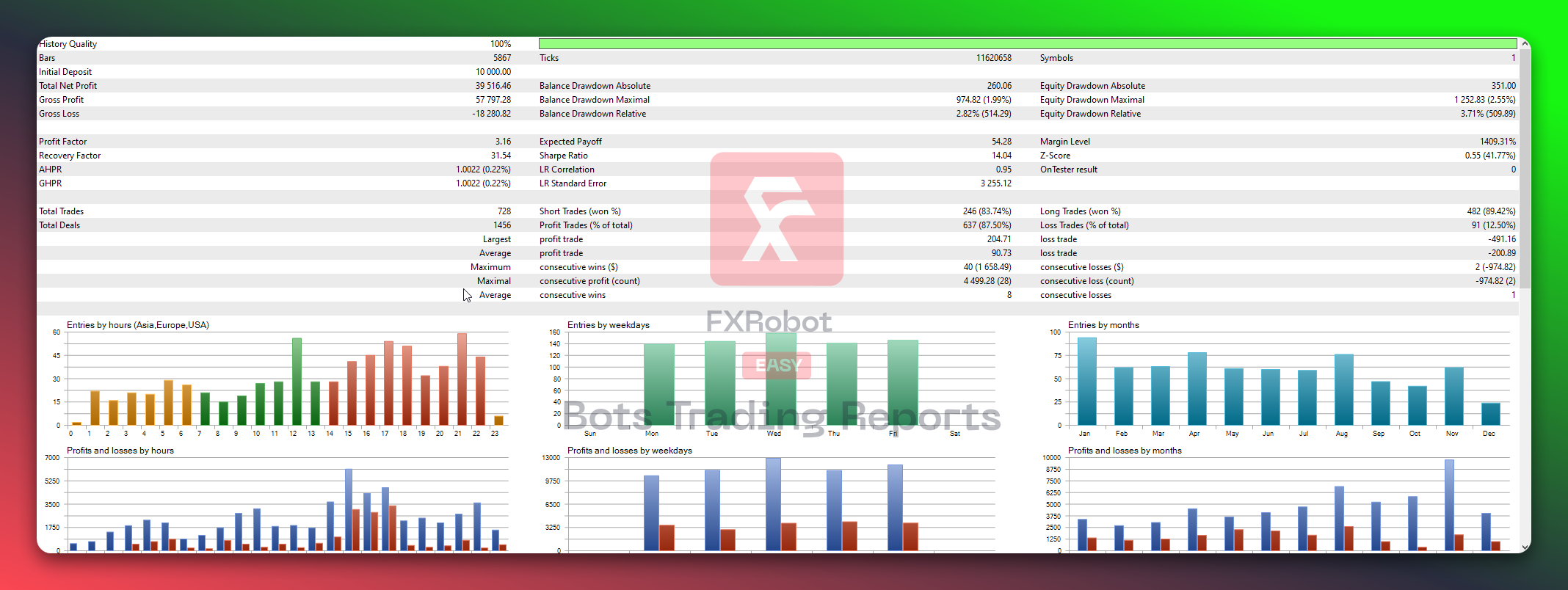

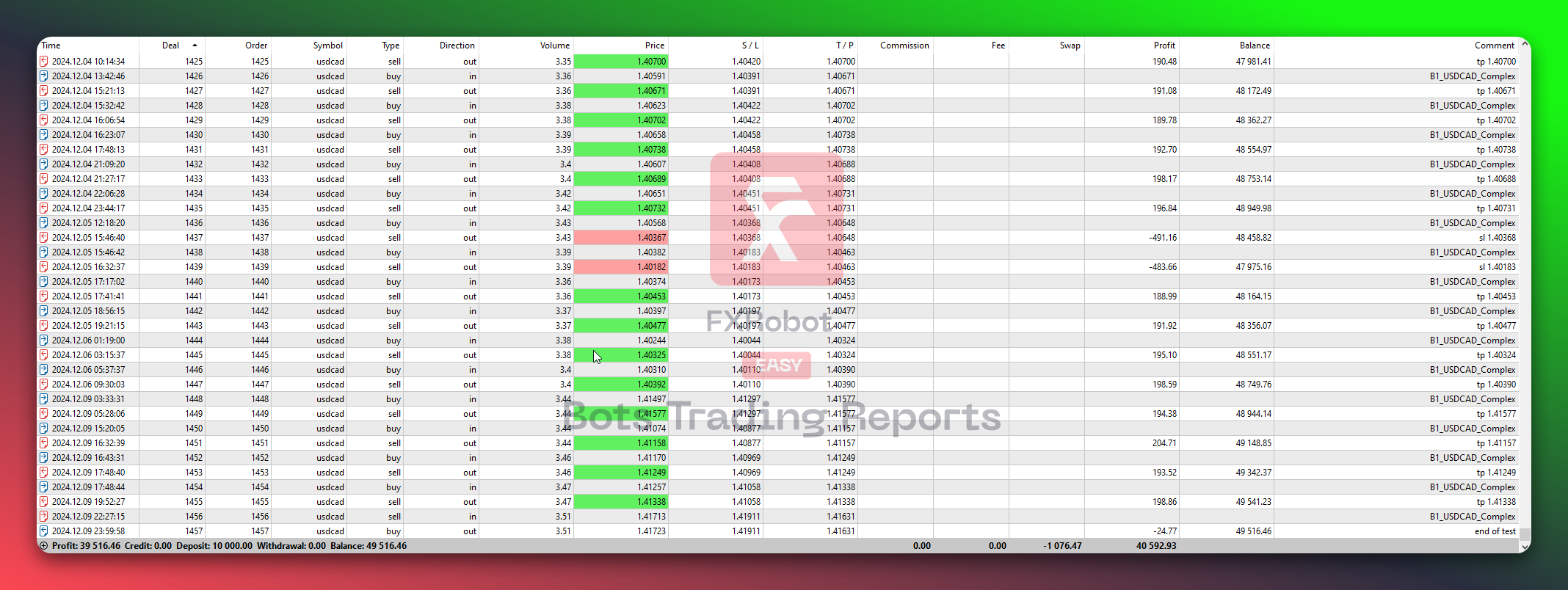

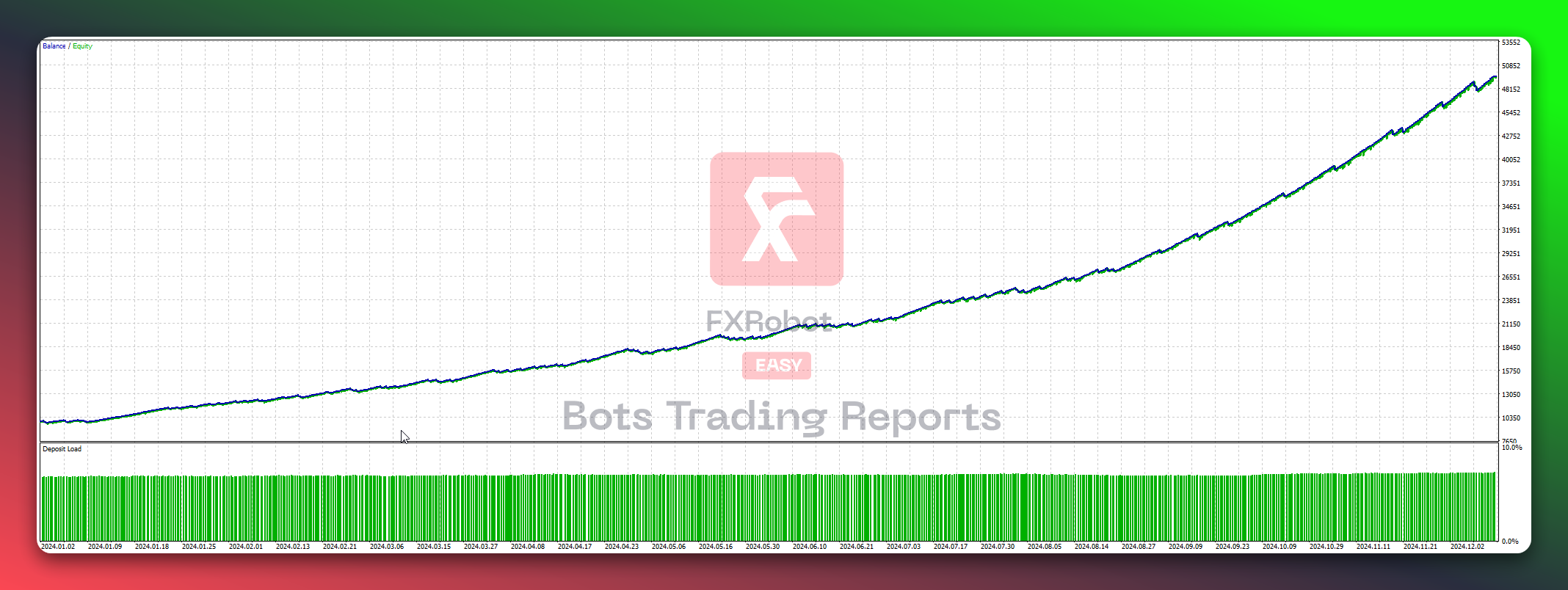

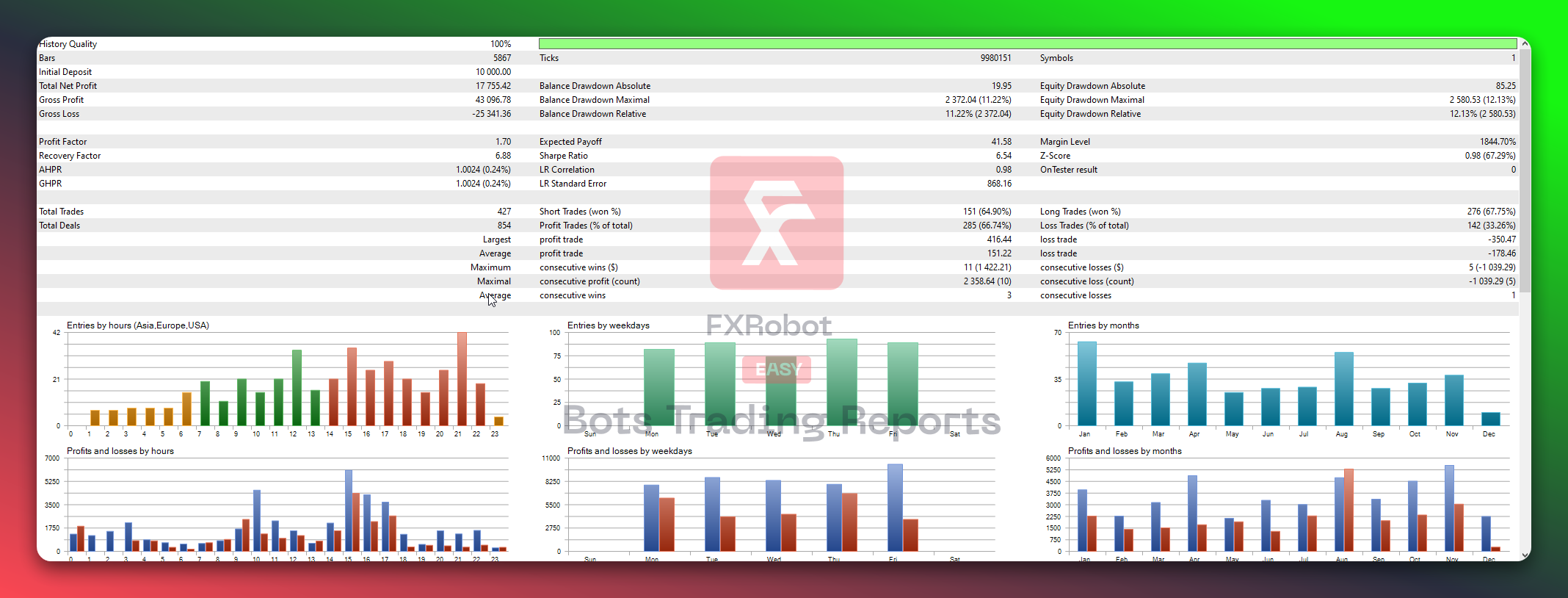

H1 (2024.01.01 - 2024.12.10)

10000.00$

39516.46$

Success in numbers!

The B1_USDCAD_Complex showcases an impressive net profit of 39,516.46 from a 10,000 initial deposit, reflecting strong earnings with minimal risk. Its profit factor of 3.16 indicates efficient profit management relative to losses and a low drawdown of 1.99% highlights superior risk control. With an outstanding win rate of 87.50%, particularly in long trades at 89.42%, the strategy aligns with favorable market moves. The expected payoff per trade of 54.28 signifies solid returns, supported by balanced average profit and loss metrics. Consistent AHPR and GHPR at 0.22% confirm a steady upward growth trajectory, making this an ideal strategy for conservative traders focused on stability and sustained profitability.

Gross Profit

57 797.28

Balance DD Maximal

974.82 (1.99%)

Profit Traders(% of total)

637 (87.50%)

Loss Traders(% of total):

91 (12.50%)

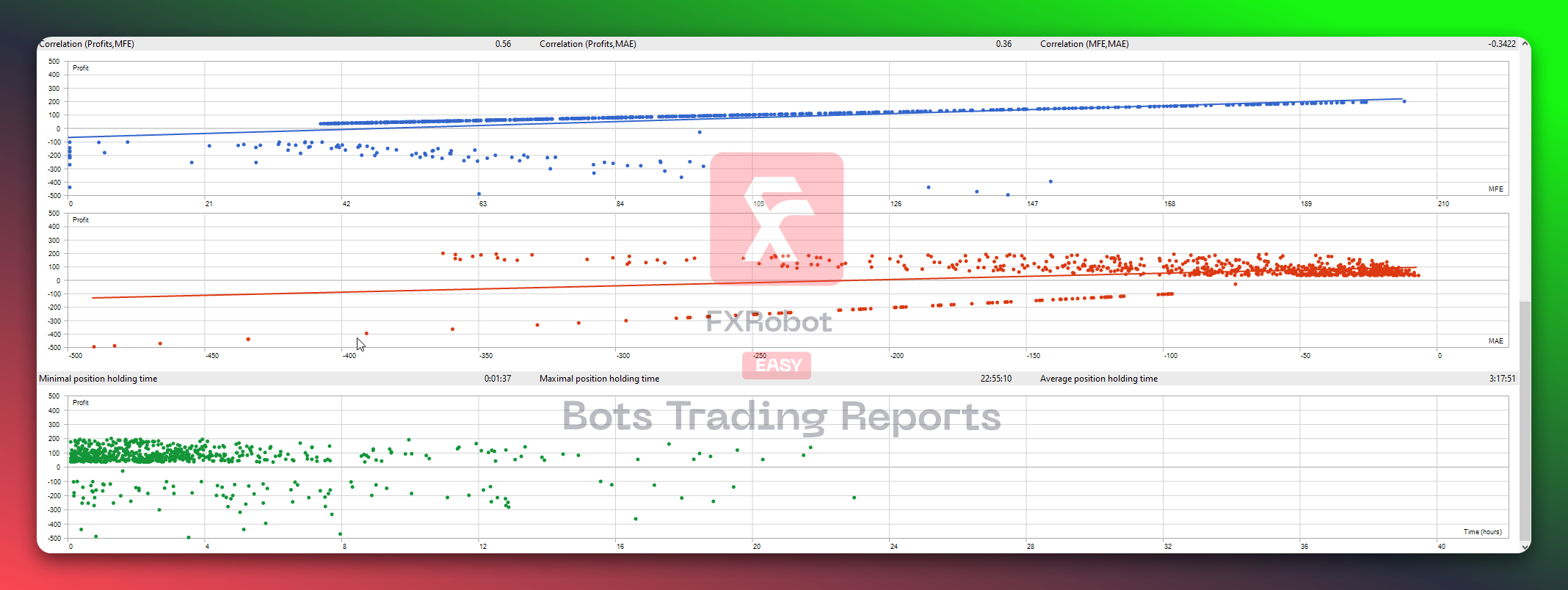

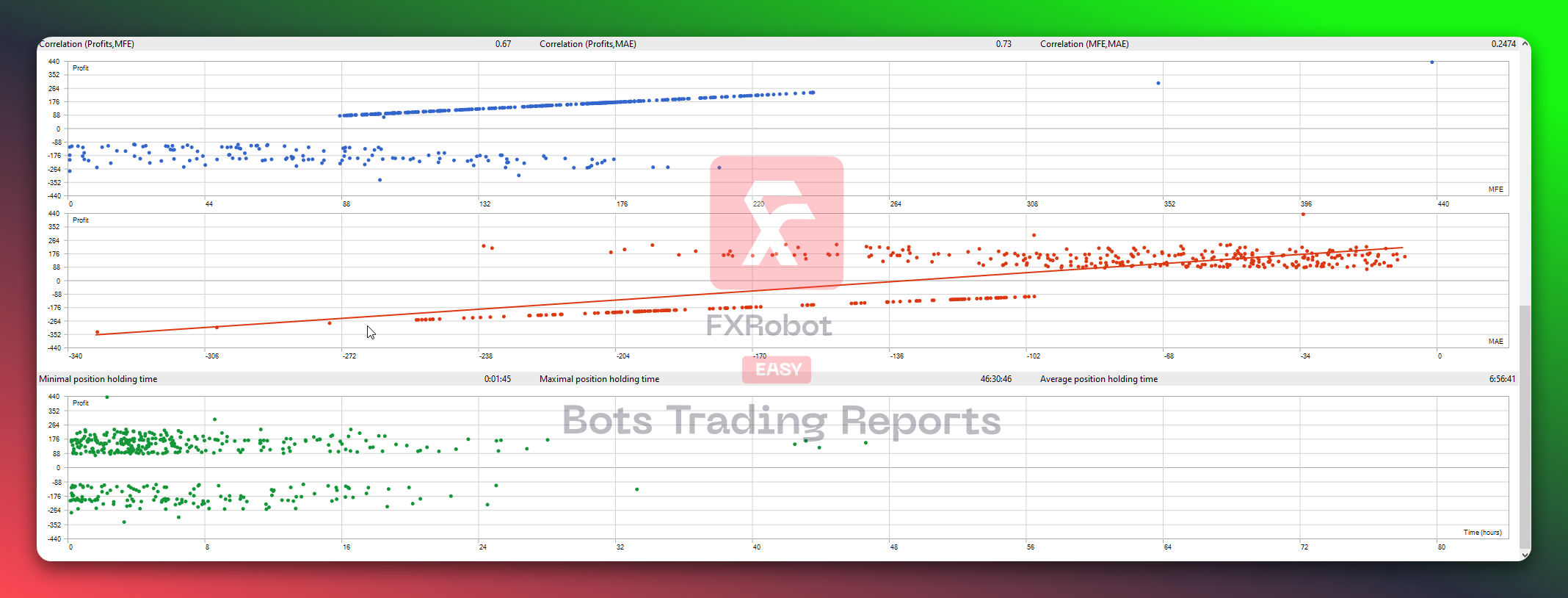

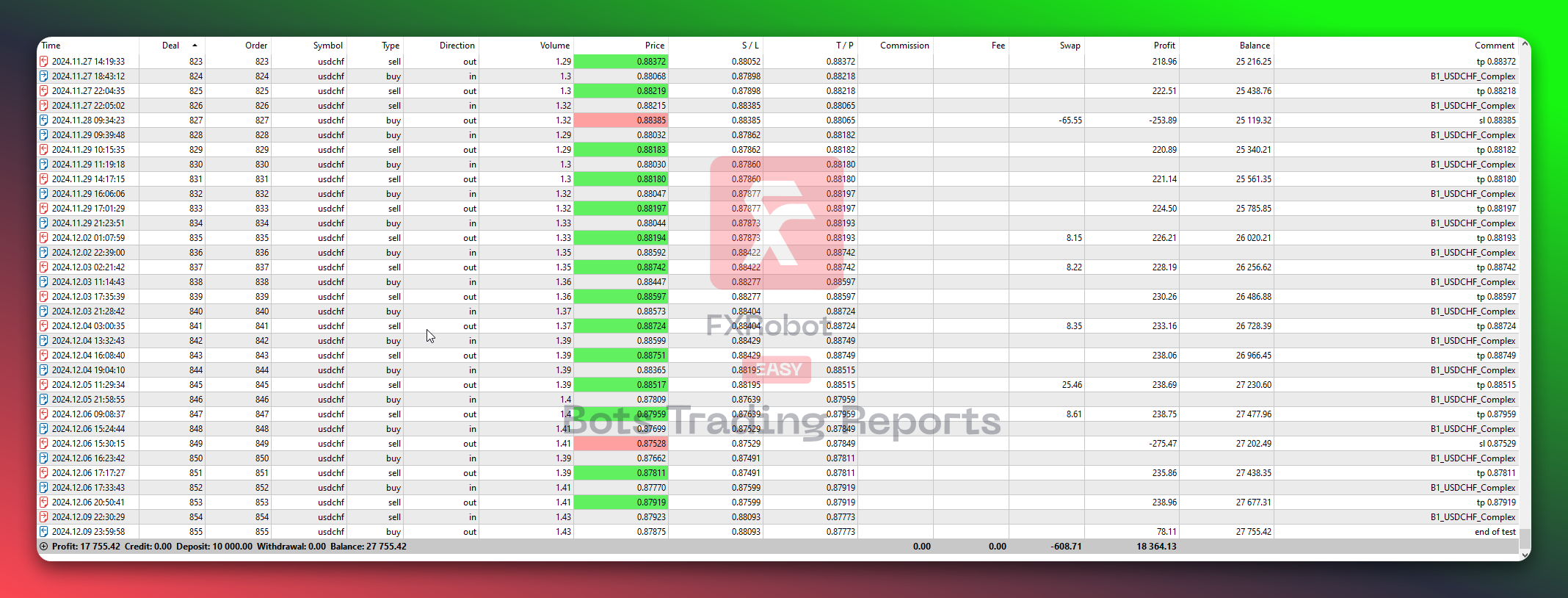

Period: H1 (2024.01.01 - 2024.12.10)

10000.00$

17755.42$

Success in numbers!

The B1_USDCHF_Complex reflects a cautious yet effective trading strategy, yielding a net profit of 17,755.42 from an initial 10,000 deposit. A profit factor of 1.70 denotes decent profitability with some room for enhancement, as seen in the moderate drawdown of 11.22%. The strategy benefits from a win rate of 66.74%, with long trades showing a marginally higher success rate at 67.75%. The expected payoff of 41.58 indicates steady incremental gains, with balanced average profit and loss figures reflecting sound trade management. The AHPR and GHPR of 0.24% suggest consistent performance over time. This setup is ideal for those seeking stable returns with manageable risk.

Gross Profit

43 096.78

Balance DD Maximal

2 372.04 (11.22%)

Profit Traders(% of total)

285 (66.74%)

Loss Traders(% of total):

142 (33.26%)

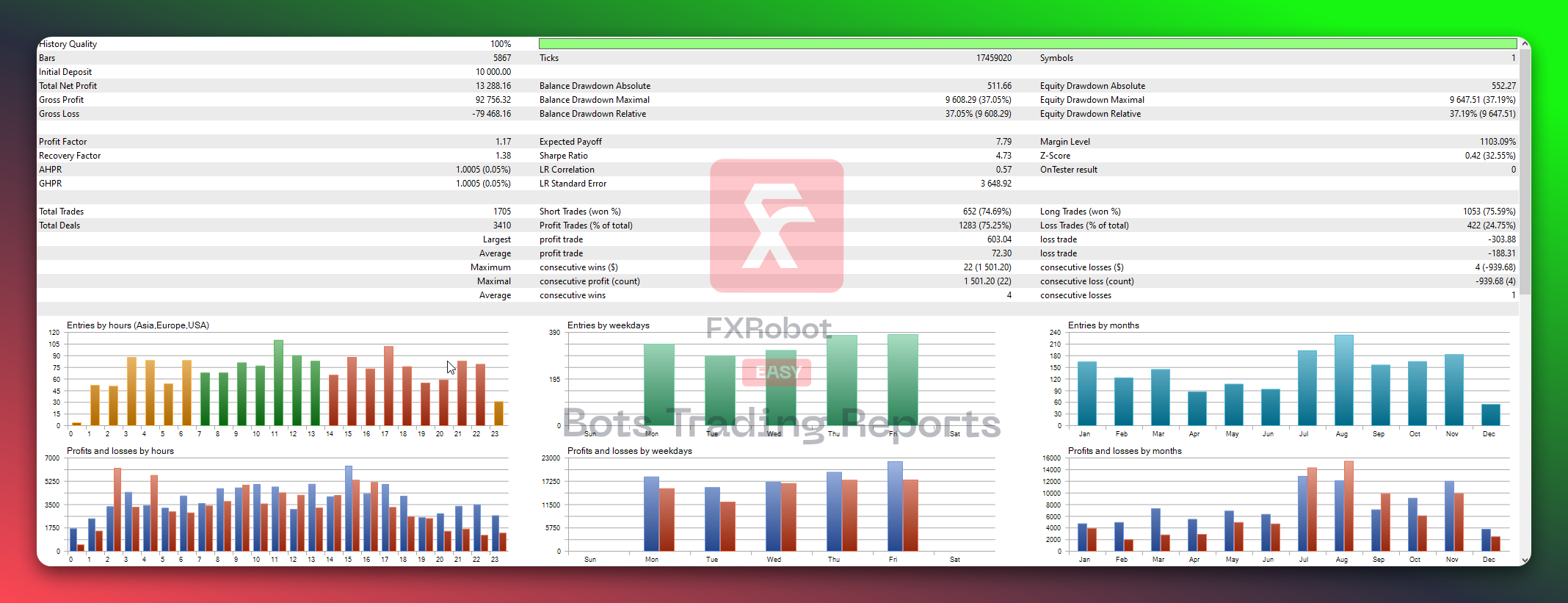

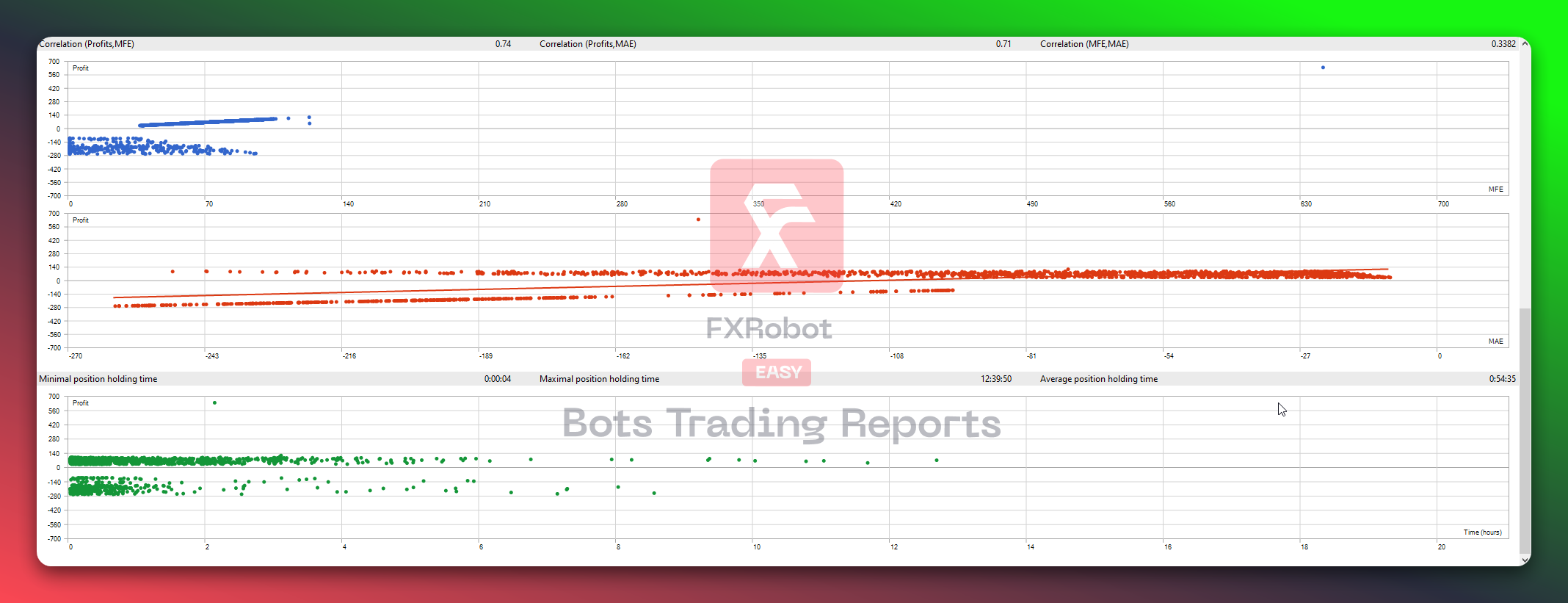

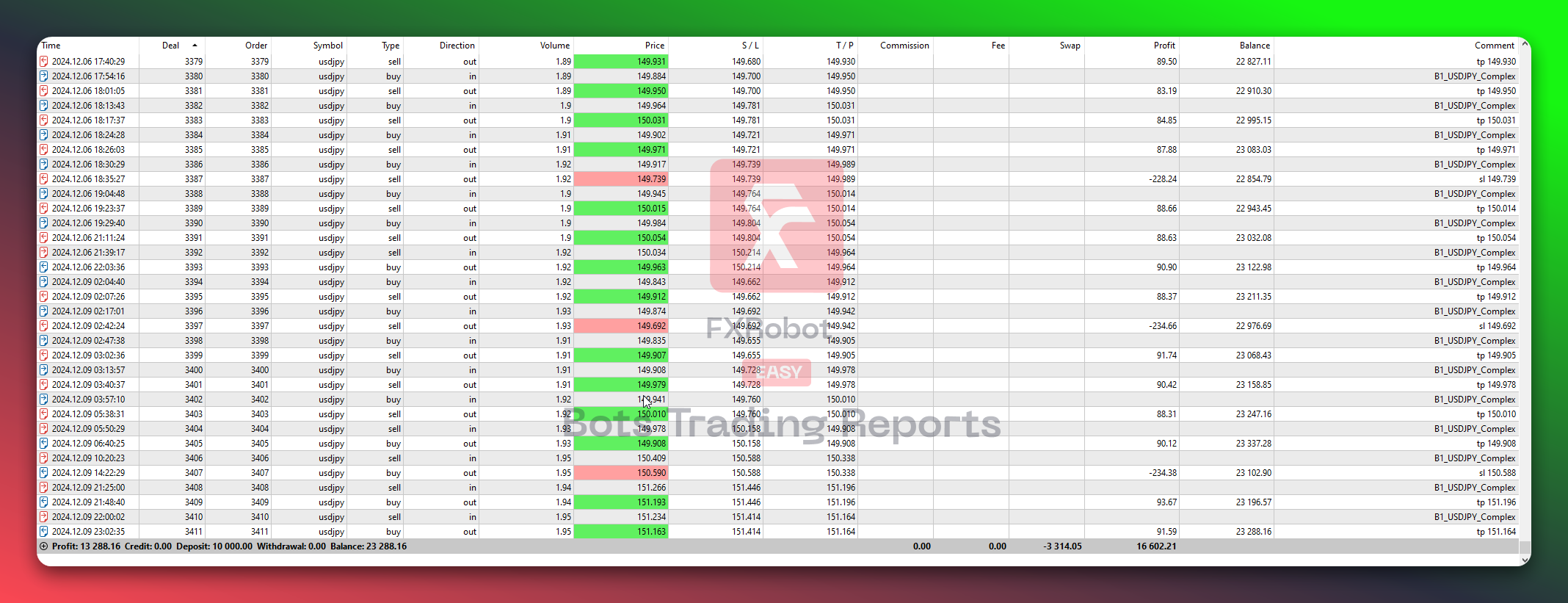

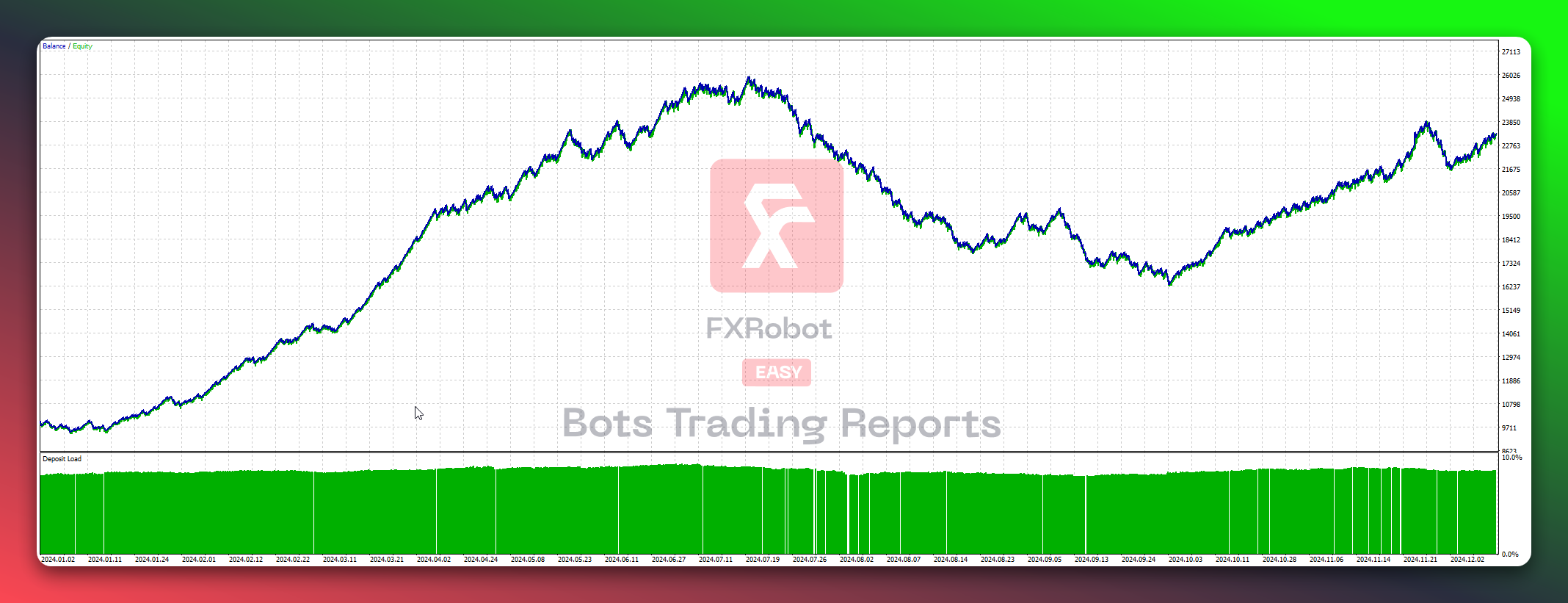

H1 (2024.01.01 - 2024.12.10)

10000.00$

13288.16$

Success in numbers!

The B1_USDJPY_Complex reveals a modest net profit of 13,288.16, highlighting a conservative approach with room for strategic improvements. Its low profit factor of 1.17 and high drawdown of 37.05% suggest a need for refined risk management. Achieving a win rate of 75.25%, the strategy is decently successful in executing trades, with long trades slightly outperforming. The expected payoff of 7.79 reflects small gains per trade, with average profit figures outweighed by losses, indicating potential tuning targets. Despite these challenges, the AHPR and GHPR of 0.05% suggest steady, albeit slow, growth over time. Adjustments to better harness its market alignment could enhance this strategy's efficacy.

Gross Profit

92 756.32

Balance DD Maximal

9 608.29 (37.05%)

Profit Traders(% of total)

1283 (75.25%)

Loss Traders(% of total):

422 (24.75%)

7 total

5 stars

71%

4 stars

14%

3 stars

0%

2 stars

0%

1 stars

0%

3 weeks ago

Volatility Threshold (VT) = 15 for EASY Breakopedia, , , , and (SRS) = 40, my custom configurations consistently produce above average returns, making them an invaluable tool in my trading arsenal. Unlike the configurations you offer after purchase!

3 weeks ago

EASY Breakopedia offers a robust strategy, at a reasonable price. And this strategy seems to really work. I mainly use the B1_Complex series sets!

3 weeks ago

Embracing EASY Breakopedia Bot has been a game-changer, especially in exploring the often volatile cross-currency trading pairs. Focused on EUR/JPY and AUD/JPY combinations, this bot meticulously capitalizes on breakout levels, which are crucial for turning market volatility into a profitable experience. By systematically applying the 'Best of the Best' settings and monitoring key market conditions, I've found the bot not only reliably secures the most promising trades but also significantly reduces the frequency of false signals. For traders interested in strategically penetrating less common currency pairs while maintaining disciplined risk management, EASY Breakopedia offers a sophisticated solution with a clear emphasis on precision and efficiency.

2 months ago

I have been using EASY Breakopedia for some time now, and I must say that EAASY TRADING AI + Pivot is very cool! I have been using EASY Scalperology for a very long time and for all my brokers I could not get consistent profitability. With Breakopedia I have succeeded! Thank you to the development team for a reliable and convenient trading assistant.

2 months ago

I've been using the EASY Breakopedia trading bot for a couple of months now, and I'm genuinely impressed by its effectiveness in detecting market breakouts. The bot’s advanced pattern recognition, combined with the breakout level indicator, provides an extra layer of security in my trades by minimizing false signals. This feature has significantly increased my profitability, especially during volatile market conditions. The setup was straightforward, and the support from the development team has been exceptional, ensuring I maximize this tool’s potential. For anyone serious about leveraging breakout strategies, the EASY Breakopedia is a game changer!

4 months ago

EASY Breakopedia is incredibly accurate and efficient in detecting market patterns, making trading almost effortless. Highly recommended for traders seeking precision with B1_USDJPY_Complex set.

EASY Breakopedia Bot is a modern trading bot for the Metatrader 5 platform, developed using the EASY Trading AI strategy. This bot not only analyzes market conditions in real-time but also verifies signals based on breakout levels, making it a reliable tool for well-considered trading decisions.

The bot analyzes market data in real-time, identifying patterns and signals with a high probability of successful movement. It uses a breakout level indicator to confirm signals and open trading positions, minimizing the chance of false entries and increasing the likelihood of successful trades.

Installation is carried out in a few simple steps: * After purchase, log in to your personal account at ForexRobotEasy.com and download the trading bot files. * Unpack the archive and copy the files into the MQL5/Experts folder of your Metatrader 5 terminal. * Restart the terminal so it can detect the new bot. * Drag EASY Breakopedia onto the desired currency pair chart. * In the bot settings, activate the "Allow automatic trading" option and enter your activation keys. * Customize the bot parameters according to your trading requirements and select an appropriate set file.

Yes, a VPS server is required for stable and profitable trades. We recommend choosing a server located as close as possible to your broker to minimize signal delays and improve order execution speed.

The bot offers features such as setting stop-loss and take-profit levels, automatic lot calculation, and advanced risk management settings. This allows traders to tailor the bot to their strategies and minimize risks.

We recommend selecting brokers with tight spreads and low commissions to reduce trading costs and increase profit potential. Ideally, the broker should have high order execution speed and low slippage.

To activate notifications, simply message our bot at t.me/Easydealsbot and enter the command /start. In response, you will receive your unique Telegram ID, which you need to enter in the EA settings.

The lower cost reflects the specific algorithm features that offer reliable signal verification but may show lower profitability compared to other bots. This makes Breakopedia an accessible choice for traders who value reliability.

You are using the same EA. Only the demo version is initialized with the key for demo accounts. The key for the demo account will not work on the real account.

To activate, enter the license key received after purchase. The file with the keys should be placed in the /MQL5/Experts/Files/scalperology.txt folder within your terminal.

By integrating advanced AI technologies and verifying signals through breakout levels, the bot offers high reliability and adaptability in trades, minimizing human factor influence and increasing trading discipline.

AUD/JPY

AUD/JPY

AUD/JPY

AUD/JPY

AUD/JPY

AUD/JPY

Trading instruments

Participants